Recommended Blogs

Is Quality Becoming the Achilles Heel for Insurance Companies? How Test Automation Can Help!

Insurers worldwide are motivated to make significant investments in the latest technologies to improve customer retention and reduce costs. By embracing new business strategies and outspreading their online existence to the web and mobile platforms, they are extremely focused on investing in modernization and streamlining their core and legacy systems so as to boost operational efficiencies.

Insurance domain testing

Due to this development, there has been an increase in the way the customers are accessing and utilizing the information that notifies and allows them to take the right business decisions. However, there are discernible quality challenges faced by insurers in meeting the evolving behavior of customers and their expectations in terms of products and service.

Significant losses and increasing operating costs due to disastrous events have made it challenging for them to sustain themselves in the market. In order to stay ahead of the competition and to provide the customers with a great application experience, the industry is going through several trials and tests to reconfirm that the applications are able to meet the objectives.

Therefore, to boost the growth of the insurance sector by ensuring better user experiences, the testing of applications/software has become a critical factor. Software testing applications before release is imperative for a successful launch of an application.

Software testing in the insurance sector ensures:

– Quality of product/application

– Hassle-free endorsement and cancellation process

– Accurate calculation of policy premium

– Real-time claim tracking

– Authorization and authentication for claim processing

– A quick and easy refund process

– Timely notifications around policy expiration or premium payments

Why Test Automation?

The insurance domain is vast and testing each and every feature/functionality manually is not possible, especially when a new product/feature is released frequently. With technology boosting the sector, testing has to be recurring with no scope for manual errors, and automation testing is the only way out. Automating the existing set of workflows can be a game-changer for organizations. Test Automation with a comprehensive framework of scripts boosts speed and also brings quality.

Benefits of Test Automation in the Insurance Sector

Every application needs to facilitate processes and resolve issues in order to bring about combined expertise. Test automation brings its essential benefits for the insurance sector in its own way.

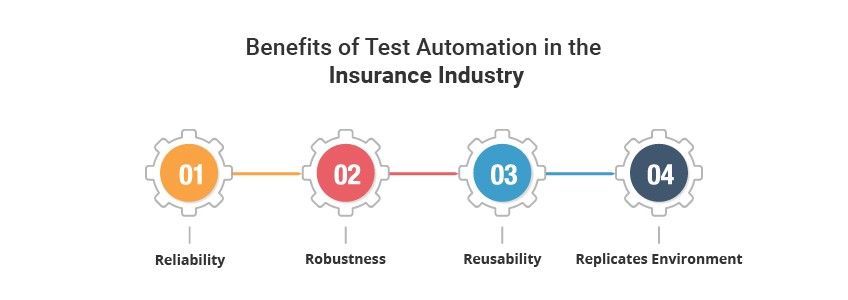

Here are the 4 Rs that Test Automation brings to the insurance sector

Reliability:

Continuous testing plays an important part in ensuring full coverage of business requirements by exercising various setups under varied stresses. This reliability is only possible with an test automation frameworks which will sustain the recurrence of the tests and be able to avoid the manual errors. Test Automation saves time and effort, accelerating the overall testing process.

Robustness:

As the framework improves with every test and bug, Test Automation effectively supports additional testing tasks too. Automated testing is designed to offer flexibility by complying with modern security and testing standards. This makes the whole process and framework innovative over a longer period, further boosting the profitability factor and optimizing the benefits of the testing tools.

Reusability:

Reusability is the best benefit of Test Automation, as it boosts effectiveness and productivity across the lifecycle of the product. The automation framework makes the tests reusable, as each test the directory gets more advanced and ready for upcoming market needs. It also minimizes costs and helps to explain investment in testing tools.

Replicates the environment:

Test Automation emulates a typical user environment for testing across scenarios and with various components. It also helps to simulate user-driven characteristics and circumstances to check real-time issues and pressures. Automated scripts can be made to run on different platforms and operating systems in parallel, thereby reducing overall execution time.

With insurance being a data-sensitive, life-sensitive, and time-sensitive industry, there is no time to turn back and evaluate – it has to be now or never. Test Automation is the perfect solution to bring about consistent results and continuous testing with minimal human intervention for the application.

Here at TestingXperts, we understand the prerequisite of the industry and support you via customized testing solutions to manage the entire testing lifecycle – new business and underwriting, policy administration, billing, rating verification, claims settlement, and statutory reporting. We have extensive domain expertise across various segments of the Insurance sector like Life, Property and Casualty, Auto, Travel, etc. Our proprietary IPs & tool-agnostic test automation framework ‘Tx-Automate’ help in reducing testing efforts by 30%-40%.

Want to schedule a call with our experts? Contact us here

FAQs

With insurance being a data-sensitive, life-sensitive, and time-sensitive industry, there is no time to turn back and evaluate – it has to be now or never. Test Automation is the perfect solution to bring about consistent results and continuous testing with minimal human intervention for the application.

1. Reliability

2. Robustness

3. Reusability

4. Replicates the environment

Discover more

Stay Updated

Subscribe for more info