The insurance industry is on the rise, and so are digitalization measures. Today's scenario requires the industry to be digitally adept with an increased IT efficiency, reduced TCO, modernized and scalable core systems, design integrated test scenarios, compliant with industry regulations and to seamlessly integrate with third-party software's.

Tx has an extensive industry experience enabling next-gen specialist QA, QE and software testing services for global clients across various domains. With an in-depth insurance domain experience leveraging the Tx in-house developed AI accelerators and RPA-based automation frameworks, we ensure to deliver scalable and robust insurance products. Our focus is to keep pace with the evolving insurance markets across the agile and DevOps projects, ensure regulatory compliance, and provide high-quality solutions enabling seamless customer experience (CX).

Insurance Challenges and Solutions

- Outdated legacy insurance systems with fewer features and functionalities

- Multiple sources of discrete data affecting integration

- Data inconsistency across multiple systems

- Exposure to threats and vulnerabilities from hackers and cyber fraudsters

- Improper claim management which involves a lot of manual effort and time

- Improper customer lifecycle management

- Increasing costs due to post-production defects

- Leveraging AI in insurance systems to provide insightful recommendations

- Accelerated decision making, leading to better customer experience

- Modernized claim processing using the latest techniques

- Data-Driven Insurance Solutions

- Product recommendations based on customer data like buying pattern, service preferences, and more.

- Automated and Interconnected Insurance Systems

- Quick and faster claim processing without needing much human intervention

Business Benefits Delivered

Get In Touch- 30% Faster Time-To-Market

- 40% QA Cost Savings

- 40% Higher Operational Efficiency

- 90% Reduction In Man-Hours

Tx Insurance Offerings

Customer Experience

Enhance the customer experience with flawless service and tools across claims, endorsement requests and contact center interactions.

Core System Modernization

Modernize technology stack enabling insurance products to achieve optimum business benefits through cloud migration, blockchain, and personalized experience via agile and secure digital infrastructure.

Intelligent Automation in Insurance

Drive Intelligence, acceleration and cost efficiency through new-age technologies like RPA, AI/ML, especially in areas such as business processing, claims processing and finance.

Connected Insurance

Enable customer engagement transformation and new insurance revenue streams opportunities with innovative solutions around connected homes, cars and enterprises

Data Intelligence

Leveraging historical data for ML and analytics to redefine operations and reimagine customer journeys while reducing operational costs.

Risk Management

Enabling underwriters make quick and effective decisions using data analytics. Implementing cloud-based models for dynamic pricing, personalised rates and enabling real-time information

Case Study

Gain Insights into our Services

Our Omnichannel Insurance Solutions

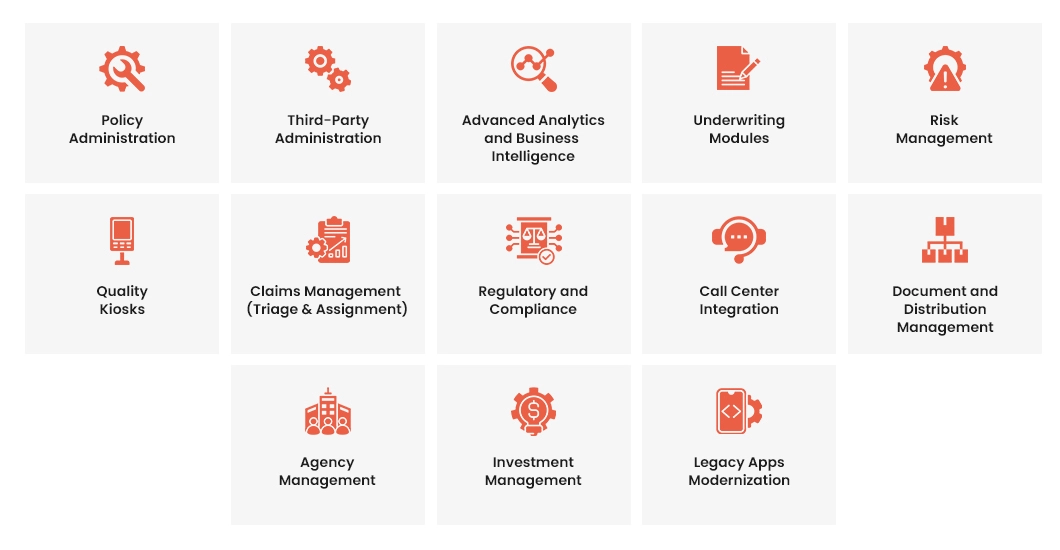

Other Key Insurance Areas We Cater To

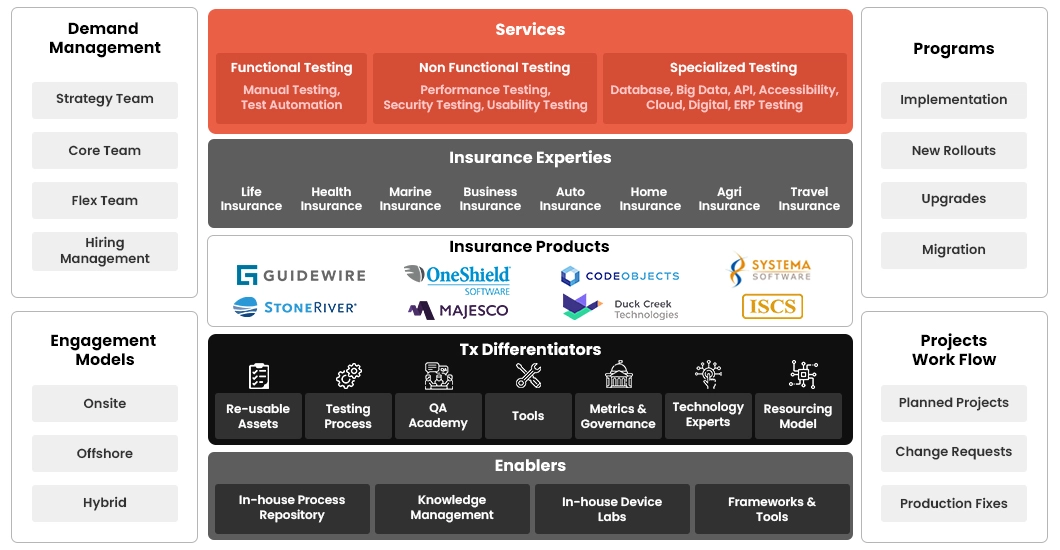

Test Center of Excellence (TCoE)

Our Insurance Test Center of Excellence (TCoE) has a well-defined tool-agnostic framework, test accelerators, a comprehensive testing approach, tools, metrics, and governance with many Insurance domain QA experts. We cater to the insurance regulations, and our QA engineers have experience in performing testing specific to state-wise insurance regulations and federal regulations such as the National Association of Insurance Commissioners (NAIC), Financial Services Authority (FSA UK), Association of British Insurers (ABI), Insurance Regulatory and Development Authority of India (IRDA), and Unclaimed Property ACT (UPA).

Our Accelerators

Tx-SmarTest

- Bot-led testing that ensures quicker and more robust testing outcomes

- Ensures greater code coverage and reduces test cycle time significantly

Tx-PEARS

- Ready-to-use framework for security and performance testing engagements

- 30% QA cost savings within the testing engagement

Tx-ReUseKit

- Ready-to-use templates help save time and chargeable effort while starting, managing, and reporting on software projects

Tx-TestMethods

- Improves overall IT life cycle management with test effectiveness and efficiency

- 30% savings in time and cost

Tx-DevOps

- Improves the code quality and delivery speed

- 25-30% time is saved with clear visibility of the entire DevOps project lifecycle

Tx-Botomate

- Supports NLP model test and real-time monitoring of chatbots

- Effective testing of conversational flows

Tx-UiPath

- Robot-led test automation framework

- 30% faster test creation

- 40% lesser maintenance efforts

Tx-Automate

- 90% reduction of efforts to run tests

- 80% reduction in regression testing cycle

Why Choose Us?

Successfully delivered insurance testing projects to Fortune 2000 clients with a team of 50+ insurance domain experts with over 1000+ QA experts in-house.

Our Insurance QA services leverage AI, ML, RPA, and No-code/low-code automation to deliver a great CX with superior insurance solutions.

Rich pool of expert resources having end-to-end functional knowledge of the insurance business processes.

Flexibility at our core, we provide tool, technology, and device-agnostic frameworks and accelerators ensure faster testing outcomes.

See What Clients Are Saying About Us!

4.7/5.0

Overall Rating

"TestingXperts has been our trusted QA partner for 10+ years—reliable, responsive, and the best team I've worked with in 20+ years."

See All Reviews(Manager of Quality Services, Insurance)

Get a Consultation