- Importance of RPA in Banking Industry

- Top 10 RPA Use Cases in Banking

- Business Benefits of RPA Implementation in Banking

- Why Partner with Tx for RPA Testing?

- Summary

Over the past few years, the banking and financial industry has witnessed exponential growth with the implementation of tech innovations. The result? Much faster, more secure, and highly reliable services. Banking firms always look for more sophisticated ways to deliver the best UX to their customers and remain competitive, especially in the virtual banking market. According to Gartner, the pandemic greatly affected business initiatives as they began adopting digital options to meet the changing demands of customers and employees. Employees are often overwhelmed by manual tasks like data entry, documentation, scanning, etc. But now, in the era of automation, these tasks can be easily automated, and robotic process automation is at the core of all this. RPA in banking leverages scripts, bots, and programs to perform repetitive tasks while adhering to the code or script rules. But what is RPA in terms of banking?

Robotic Process Automation in Banking

RPA in banking is about automating multiple time-consuming, repetitive, and resource-consuming processes like KYC, customer support, account opening, etc. It allows the team to streamline banking processes efficiently and ensures that the solution is cost-effective and processes are executed on time. According to a report, robotic process automation in the banking industry will reach around $1.2 billion by 2025. Using AI and RPA simultaneously would allow banking organizations to implement automation and support complex decision-making processes like anti-money laundering, cyber fraud detection, etc.

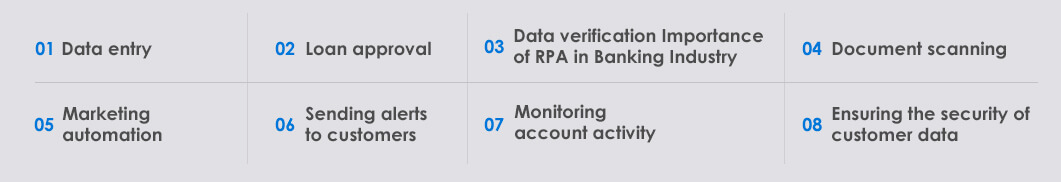

Importance of RPA in Banking Industry

Compared with other industries, employees in the banking and finance industry spend most of their time on manual processes. In addition to document-related processes, many aspects of loan processing, customer support, account opening, etc., are also rules—or manual-based. By automating such rules-based processes, banking organizations can save significant time, resources, and costs. According to Research and Markets, the estimated global market size of RPA and Hyperautomation would be $26 billion by 2027. Following is some of the rules-based or manual processes in banks that RPA can automate:

• Data entry

• Loan approval

• Data verification Importance of RPA in Banking Industry

• Document scanning

• Marketing automation

• Sending alerts to customers

• Monitoring account activity

• Ensuring the security of customer data

Introducing RPA to handle such processes can reduce processing costs by up to 70%, and banks can free up their manpower to work on business-critical tasks.

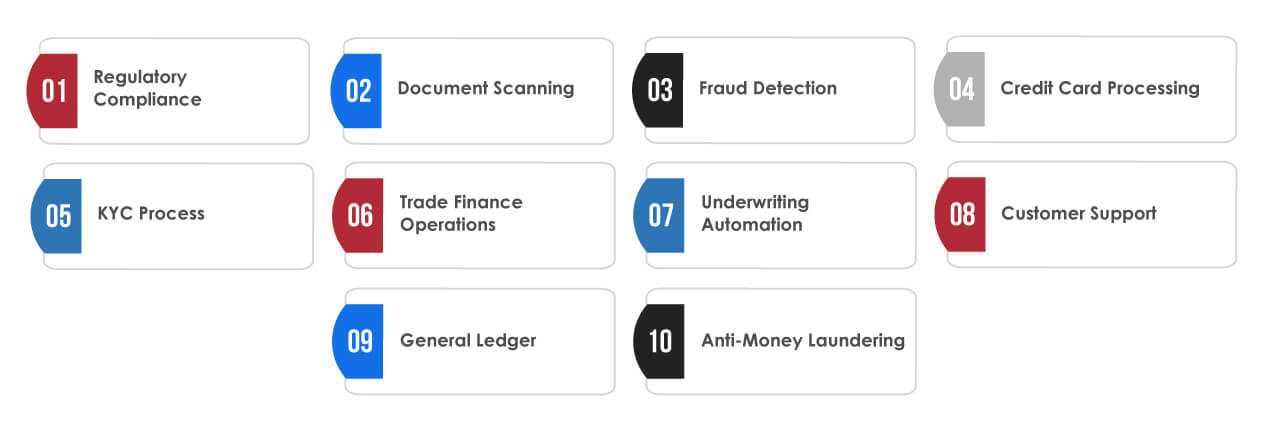

Top 10 RPA Use Cases in Banking

Banking and financial organizations have been using RPA for the last couple of years to automate various processes. Let’s take a look at some of the most significant RPA in banking use cases:

Regulatory Compliance

The banking industry is the center of every country’s economy, which requires close governance and adhering to various regulatory compliances. Although banks must work on various reports, they must regularly perform compliance checks after every trade and calculate expected credit loss (ECL). RPA bots automatically gather data from disparate sources, such as government websites, news outlets, federal bodies, etc. The collected data is sent to the bank’s internal system after confirming that it adheres to data structure guidelines. This increases the processing speed and reduces costs.

Document Scanning

Almost every bank in the world offers an online account opening option, but some people still prefer offline account opening, which involves a lot of paperwork. The issue is that banks have to digitize and store the documents customers fill out manually on backend servers. This is where RPA comes in. Bank documents are structured, and the RPA bot reads that data off it to store it in the defined digital format without needing manual assistance.

Fraud Detection

One of the major concerns for banks in digital systems integration is being targeted by fraudsters. As banks have to deal with thousands of daily transactions, keeping track of all transactions and flagging fraudulent ones becomes very difficult. RPA can keep track of all the transactions and automatically flag possible fraud patterns in real-time while maintaining response time. It can also assist banks in preventing fraud by blocking accounts and restricting transactions.

Credit Card Processing

Digitization of banking services accelerated credit card processing and issuance but still requires manual intervention. RPA bots can automate credit card application approval, accelerating the process and improving customer satisfaction. They can access multiple systems for applicant ID verification, automate background verification, approve/disapprove, or direct customers to human support.

KYC Process

KYC is a mandatory process that involves 500 to 1000+ FTEs, in which banks perform necessary checks on every customer. According to a report, banks spend around $384+ million yearly to comply with the KYC process. Considering the cost associated with the manual process, using RPA is the best option for banks to validate customer data. Considering the accuracy rate, banks can easily work without worrying about FTEs and complete the processes on time with minimal staff and errors.

Trade Finance Operations

RPA assists banks in streamlining complex and document-intensive trade finance operations. Automating data collection, verification, and processing tasks reduces turnaround times and improves operational efficiency.

Underwriting Automation

Underwriting involves assessing the risks associated with financial transactions such as bank loans, insurance policies, and bond issues. Collecting data from multiple sources and analyzing it before inputting it into the system requires much manual effort and accuracy. The process itself is time-consuming and laborious. RPA facilitates underwriting process automation by utilizing algorithms to make loan-related decisions rather than involving manual intervention. It removes the manual error and loan misinterpretation risks and ensures no biases are entertained during decision-making.

Customer Support

Delivering better CX is one of the top priorities for any business, and banks are no exception. In this industry, most requests require simple data retrieval, and RPA can considerably reduce the time to process low-priority requests. This eliminates the requirement for manual intervention in most cases.

General Ledger

RPA-enabled digitization of banking operations is perfect for supporting tedious and repetitive accounts management tasks. It includes updating data like revenue, expenses, assets, and liabilities, needed to prepare financial statements. Managing such data manually from diverse systems is highly prone to errors. RPA integrates data from legacy systems into a required format and reduces the time and effort needed for data handling.

Anti-Money Laundering

One of the most data-driven processes is anti-money laundering or AML, which banks can simplify with RPA. Integrating RPA with the backend processes would allow banks to swiftly catch suspicious banking transactions and automate manual processes. This would save both time and cost compared to labor-dependent traditional banking solutions.

Business Benefits of RPA Implementation in Banking

Let’s take a look at some of the benefits of implementing robotic process automation in banking operations

• RPA systems can easily and quickly complete tasks with simple instructions without any ambiguity. Compared to manual procedures, robotic accounting procedures do not have any drawbacks.

• Its high scalability allows banking institutes to manage a large volume of requests during peak business hours.

• RPA can readily store data to address any banking query by leveraging AI and ML technologies. It also assists in streamlining accounts payable and accounts receivable procedures.

• It helps automate repeated tasks like manual data processing and data updating, which, in turn, boost efficiency, consume fewer resources, and cut expenses by 25-50%.

• Humans make mistakes, and that’s a fact. However, sometimes, the smallest mistake can result in a significant loss to the company. With RPA systems, banks can effectively and efficiently conduct procedures as they are accessible 24/7 and are not affected by data failures.

• Manual data entry is one of the biggest challenges in loan origination. RPA can reduce the time and workload of loan application processing by leveraging intelligent document processing to extract, visualize, and process the data.

Why Partner with Tx for RPA Testing?

Robotic process automation is an innovative technology that allows banking and financial institutes to configure software robots to execute redundant tasks. It can effectively integrate into human actions and automate routine business processes. However, effective testing is crucial to ensure the seamless performance of RPA bots. Tx’s expertise in RPA testing services backed by in-house RPA-certified testing specialists employs a robust automation testing strategy. It includes test data creation, bot triggering, and validation against business processes for which the bots must be deployed. We leverage the latest and advanced open-source and commercial automation testing tools to ensure the effective performance of RPA bots.

Summary

With the intervention of RPA technology, the banking industry has witnessed significant improvement in daily operations. From enhancing operation efficiency to optimizing customer experience, RPA is upscaling the banking industry in many areas. This technology assists the banking industry in various areas like KYC processes, compliance reporting, fraud detection, and reducing costs and human errors. It also helps in supporting complex decision-making tasks like improving the speed of loan processing, customer support services, and AML services. However, to ensure the successful implementation of this technology, partnering with Tx would be a great assistance. To know how we can help, contact our experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info