- Why ISO 20022?

- Role of Testing in the ISO 20022 Migration Process

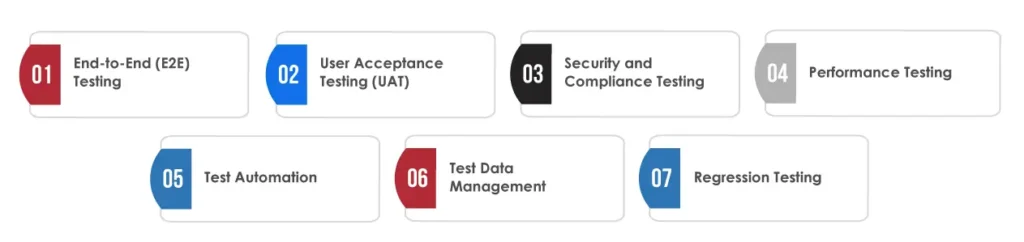

- Testing Types for ISO 20022 Transition

- How does Tx QA Services Ensure a Smooth Transition to ISO 20022?

- Summary

Seamless data exchange in the dynamic and fast-paced financial ecosystem is crucial for operational efficiency. For the last couple of decades, cross-border payments have been following multiple standards and formats. There’s no common format/standard, creating transaction fragmentations and causing interoperability issues. As a result, it is causing delays, errors, and inconsistencies in digital payment processing. To counter this issue, adopting ISO 20022 has become a global standard to cater to banking and finance messages.

According to statistics, more than 11000 global finance firms have successfully migrated to ISO 20022 standard since March 2023. As for banks, SWIFT has made it mandatory to implement this new standard by November 2025. This migration is not a simple tech upgrade: it’s a complete modernization from existing MT messages format to MX format to improve data quality and efficiency. However, as banks and other financial firms migrate to ISO 20022, there will be certain challenges, and project managers and QA engineers will play a critical role in ensuring a successful transition. This would require meticulous planning and rigorous QA processes.

Why ISO 20022?

With ISO 20022 implemented, banks can expect a more structured and richer data format than its predecessor MT messages. By transitioning to this standard, banks and other financial institutes can expect:

- Enhanced interoperability between institutions

- Better cross-border transaction monitoring

- Improved data quality and transparency

- Detailed financial message information

- Better encryption and regulatory compliance

- Increased automation capabilities

However, the ISO 20022 migration process is fraught with challenges, which is where quality assurance comes in.

Role of Testing in the ISO 20022 Migration Process

The global financial market is undergoing a significant change with the SWIFT 2025 initiative. It aims to modernize the payment messaging structure and support enhanced interoperability, innovation, and efficiency. In all of this, testing is a critical factor to ensure the reliability and quality of the processes, systems, and software involved in the transformation. The quality assurance process will affect the ISO 20022 migration in the following ways:

- QA teams will test every aspect of the new system by performing functional testing to ensure it meets business requirements. They will also conduct integrating testing to verify the seamless communication between multiple systems and performance testing to assess system behavior under varying loads.

- Data quality is one of the critical factors in ISO 20022 implementation. The QA process will involve validating data formats, verifying data integrity, and ensuring data consistency.

- By deploying automated testing tools, QA teams will run extensive data checks to identify and rectify issues before they escalate.

- Transitioning to a new standard might involve inherent risks. Quality assurance can help identify potential risks early, and with continuous monitoring and regular audits, banks can mitigate these risks and address any remaining issues proactively.

- ISO 20022 is not only about technical compatibility; it’s also about ensuring that banks and financial institutes meet regulatory requirements. QA teams, in collaboration with compliance departments, will ensure that the new system adheres to all domestic and international regulations and avoids potential legal complications.

Testing Types for ISO 20022 Transition

“ISO 20022 is an open global standard for banking and payment information that offers consistent, structured, and rich data that can be leveraged for various financial transactions.” – as per SWIFT.

As by the end of November 2024, the SWIFT MT messages will be a thing of the past, banks and payment service providers will have to pace up their transition process now. Taking countries into consideration, the US, Canada, and the UK are in the middle of the ISO 20022 transition, while India and China have already moved further. But to ensure a smooth transition, one must go through the following testing checks:

End-to-End (E2E) Testing:

Migration involves multiple interfaces and systems. A thorough E2E testing will validate seamless message flow across the involved elements. Testing message routing, integration points, and data transformation will ensure seamless interoperability between financial institutes. Also, closely monitor exception scenarios, reconciliation, and error-handling processes to mitigate underlying risks before migration.

User Acceptance Testing (UAT):

Engage end-users (employees, customers, and other stakeholders) in the testing process to ensure the new standard upgrades within the system are acceptable to them. UAT involves running real-world simulations to validate the system’s performance per end-user needs in a practical environment. By analyzing the valuable feedback, banks can improve the transaction and financial messaging processes for final adjustments.

Security and Compliance Testing:

Security testing involves assessing security controls and encryption methods for ISO 20022 messaging. This testing type evaluates the security protocols like authorization, encryption, and authentication. Banks can validate sensitive data elements like transaction amounts and account numbers so that they are protected and encrypted during storage and transmission. Conducting pen testing and vulnerability scanning can identify security loopholes and misconfigurations in the payment infrastructure. It is also important to validate compliance per industry standards and regulatory requirements such as AML/CFT, PCI-DSS, and ISO 27001.

Performance Testing:

Define performance test scenarios for expected transaction volumes, concurrency level, and message sizes for ISO 20022. Factors include future growth projections, peak processing timeframe, and seasonal variations. Banks should also perform load and stress testing to check the system’s ability to handle the rise in transaction volumes and determine its breaking point, scalability limitations, and performance bottlenecks. After doing so, they need to work with development teams to optimize performance by refactoring code for better efficiency, optimizing database queries, and inserting caching mechanisms.

Test Automation:

This testing type involves evaluating and selecting the right test automation frameworks and tools to validate MT message formats and protocols, such as API testing, XML parsing, and schema validation. The QA teams design and develop reusable test scripts that adapt to different ISO 20022 transaction scenarios and payment flow.

Test Data Management:

QA teams generate diverse test data for ISO 20022 payment messages, consisting of varying payment types, region/country-specific requirements, and currencies. The process involves leveraging data masking techniques and synthetic data generation tactics. All the work is done under the condition that test data management adheres to data privacy and security guidelines like PCI DSS and GDPR. The QA teams ensure that all the sensitive PII and financial information remains protected in test environments by deploying data obfuscation and anonymization techniques. This also ensures that up-to-date and consistent test data remains available across different testing phases.

Regression Testing:

This testing type ensures new code changes/updates do not affect the existing functionalities. It involves re-running completed test scripts to verify the optimal system’s performance even after modifications. As ISO 20022 implementation is a big update, regression testing is a must to ensure that new changes do not negatively impact payment processing.

How does Tx QA Services Ensure a Smooth Transition to ISO 20022?

In the banking and payment industry, transitioning to ISO 20022 represents a comprehensive transformation of data quality and operational efficiency. However, it is a complex process with many implementation challenges. That’s where TestingXperts (Tx) steps in to offer you robust QA solutions for a seamless ISO 20022 transition. We at Tx employ a holistic testing strategy to meet the unique requirements of ISO 20022. Our functional and performance testing experts ensure that all your system’s functionalities meet business requirements and can handle various loads during transition processing and messaging.

We leverage our in-house accelerator Tx-Secure and security testing expertise to identify and mitigate vulnerabilities and protect sensitive financial data. By conducting a compliance audit, we ensure your new systems adhere to ISO 20022 standards and regulatory requirements. Our QA processes also involve data validation and integrity testing to ensure all data formats are accurate and consistent during pre- and post-migration. We leverage our in-house automation framework, Tx-Automate, to run extensive data checks and identify and remediate issues simultaneously.

Our risk assessment techniques help identify potential risks early in the transition cycle so that we can conduct continuous monitoring to address issues before they escalate. With our expert QA advisory, you get deep insights into industry best practices for ISO 20022 adoption and the necessary tools/methodologies to enhance the QA process.

Summary

The transition to ISO 20022 is a massive step for banking and financial institutions, encouraging improved data quality, better message formatting, optimized cross-border payment processing, and operational efficiency. In your migration process, Tx robust QA services can help you ensure the transition is smooth, compliant, and secure. By leveraging our comprehensive test advisory, QA strategies, risk management, data validation, and continuous monitoring, you can easily overcome the complexities of the ISO 20022 migration process. To know how Tx can assist, contact our experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info