- P&C Insurance Underwriting

- Underwriting Shift from Traditional to AI

- 5 Benefits of Leveraging AI in P&C Insurance Underwriting

- How can Tx Assist with AI Testing for the P&C Insurance Sector?

- Summary

Insurance policy underwriting and claim underwriting are the two pillars of insurance operations. Usually, these processes are handled manually, causing inefficiencies or other issues in their functionalities. Other factors, like regulatory compliance pressure, complex risk assessment, and insufficient access to quality data, affect the performance of P&C insurance businesses. Insurers usually ignore labor-intensive data collection, lengthy paperwork, and the complex algorithm of insurance procedures, which usually prolongs turnaround times and leaves customers unhappy with the services.

Now, the question is, “How do P&C insurance businesses overcome these challenges and remain competitive in today’s digital insurance ecosystem?” The answer to this question is “leveraging AI in P&C insurance underwriting.” From enhancing claim processing and underwriting to optimizing operations and CX, AI is reshaping the P&C industry to a great extent.

P&C Insurance Underwriting

The process involves evaluating property and casualty insurance policy risks. The underwriters assess various factors to determine the losses caused, which include damages to business or personal property, past climate history, policyholders’ financial details, and location. The P&C insurance software uses data analytics, AI, and ML algorithms to evaluate risks and suggest suitable premiums. This helps in improving underwriting accuracy and speed. The P&C underwriting software improves the following function:

- The software utilizes advanced technologies like AI and data analytics to measure risks more accurately and quickly.

- Underwriting software replaces manual involvement to minimize errors and accurately ensure premiums match the risk level.

- It allows insurers to offer customized policies to individual customers by offering data-driven insights.

- Underwriters make informed decisions and set premiums based on data and analytics, delivering better results for the insurer and the policyholder.

- The software enables insurers to remain compliant with old and new regulations, which reduces legal risks.

Underwriting Shift from Traditional to AI

The traditional P&C insurance underwriting process heavily depends on manual data input, which causes inefficiencies and human errors. Insurers usually have limited access to quality data, restricting them from making profitable underwriting decisions. They face delays in product launches because of outdated legacy systems with limited functionality. This causes delays in meeting the expectations of policyholders, brokers, and new customers. Also, the lack of transparency among business and tech teams leads to the development of buggy solutions that do not address customer or business needs. Also, the traditional underwriting mechanisms are time-consuming, surrounded by a load of paper forms, complex steps, and manually-intensive tasks, causing client dissatisfaction.

AI-enabled underwriting, on the other hand, can address the limitations of traditional processes. It utilizes advanced tech and huge datasets for automation and offers valuable insights to insurers to generate customer-focused quotations, reduce operational costs, and create accurate policy pricing. Insurers can use AI-driven inputs to improve customer relationships and experiences, reduce turnaround time, and mitigate risks.

Access to actionable insights and data will make it easy to justify premium rates, and they can suggest measures to improve customers’ risk profiles. AI-driven solutions can completely transform P&C insurance underwriting by paving the roadmap for improved accuracy and efficiency.

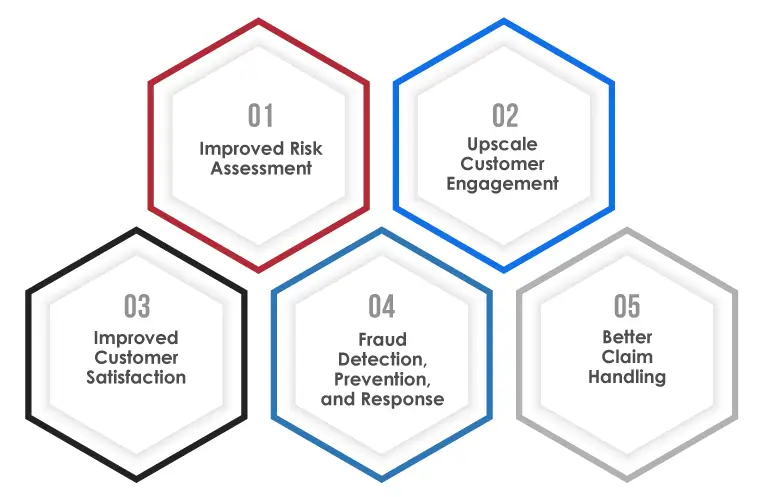

5 Benefits of Leveraging AI in P&C Insurance Underwriting

AI can be used in insurance underwriting in multiple ways. It can analyze and identify the loss numbers for multiple threat possibilities and calculate the median risk score. Although AI optimizes the way the P&C insurance sector operates, let’s take a close look at the areas in which it has a positive effect:

Improved Risk Assessment

AI’s functionality to analyze extensive past data enables P&C insurance businesses to analyze risks swiftly and mitigate possible errors or risks due to manual processes. They can utilize insurance software to analyze a policyholder’s data, including their location and personal details. This way, insurers can customize policies according to individual requirements.

Upscale Customer Engagement

AI-enabled chatbots handle policyholders’ inquiries 24/7, thus upscaling customer service. There are various chatbots with different functionalities that can address a wide range of questions (from policy details to payment methods and much more). Automating chatbots will upscale customer engagement rates and could become a core aspect of underwriting operations.

Improved Customer Satisfaction

AI integration with the underwriting software can minimize human involvement in premium coverage and price estimation. It can analyze applicants’ details, and insurers can better interact with them, generate responses, and recommend tailored services to improve overall satisfaction.

Fraud Detection, Prevention, and Response

AI-based systems can pinpoint fraudulent claims by analyzing data from multiple sources and channels. It would assist insurers in spotting fraud activities, gaining valuable insights, and crafting strategies to mitigate them. The result would be improved risk mitigation, optimized security, and facilitating trust between policyholders and insurers.

Better Claim Handling

Insurers can streamline claim processing and handling by leveraging AI-automated algorithms that eliminate the chances of delays and problems related to manual assessments. The real-time processing verifies details faster and evaluates claims seamlessly. This enables P&C insurers to speed up the claim-handling process for themselves and policyholders.

How can Tx Assist with AI Testing for the P&C Insurance Sector?

As a P&C insurance business owner, integrating AI with insurance underwriting software and implementing data-driven decision-making can help you deliver superior CX. However, one needs a reliable quality check to ensure secure and proper integration. It would help ensure no faults were logged into your AI systems while ensuring unbiased outputs. Leveraging Tx’s QA testing services for your AI systems can help you mitigate risks, enhance product quality, and instill confidence in your AI-driven initiatives. It would help you foster customer trust and achieve strategic business objectives with unparalleled precision and effectiveness.

- Our team has the expertise to perform AI systems QA and implementation tasks proficiently. We identify the root causes behind AI issues and implement test data management to refine model behavior for sustainable and effective solutions.

- P&C insurance underwriting is heavily dependent on data. We analyze datasets by bytes, ensuring your data is complete, accurate, and fully tested with the right methods before rollout.

- We detect the human factors that may cause your AI systems to reach inappropriate or biased conclusions.

- Our AI and insurance testing experts can assist you in mitigating challenges such as drifting precision, ensuring your AI maintains a higher level of stability despite the dynamic nature of the P&C insurance sector.

- Our exclusive AI-based accelerators, Tx-Automate and Tx-SmarTest, support our method, which diligently examines and validates QA parameters while safeguarding your product’s robustness and stability.

Summary

AI is transforming P&C insurance underwriting by addressing inefficiencies inherent in traditional methods. Manual processes in underwriting are prone to errors, delayed product launches, and customer dissatisfaction due to lengthy paperwork and complex steps. AI-powered solutions offer a transformative shift, enabling insurers to automate data collection, enhance risk assessment accuracy, and customize policies based on comprehensive data analytics. Tx offers expert QA testing services to ensure the seamless integration of AI in insurance underwriting systems, helping businesses mitigate risks, enhance product quality, and maintain stability. By leveraging Tx’s AI-based accelerators like Tx-Automate and Tx-SmarTest, P&C insurers can ensure their AI systems are robust, unbiased, and capable of delivering superior customer experiences while meeting regulatory compliance and operational goals. To know more, contact our AI testing experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info