The Property and Casualty (P&C) insurance market has seen considerable and rapid change in recent years. The established industry paradigms are evolving as a result of the convergence of data analytics, technological improvements, and increasing customer expectations. The challenge facing insurers today is to use digital technologies to build a more customer-centric and operationally efficient environment in addition to reacting to them. The emergence of new age Insurance firms, the incorporation of AI and ML, intelligent automation in P&C insurance, and the growing importance of data-driven decision-making are changing the way P&C insurance is conducted. This dynamic environment necessitates a forward-thinking strategy that values adaptability, innovation, and a thorough grasp of new risks. As a result, insurers must rethink their approaches, offerings, and interactions in a world that is changing quickly.

The Role of Claims Processing in Customer Satisfaction and Operational Efficiency

In the world of insurance, the delicate balance between client happiness and operational effectiveness is delicately balanced through claims processing experience. A smooth and clear claims process is frequently the deciding factor for policyholders’ commitment to an insurance provider. Customers’ perceptions of an insurer’s dedication to their financial security and well-being can be greatly influenced by how quickly and accurately claims are handled. A smooth claims procedure not only reassures customers in difficult circumstances, but also establishes a foundation of trust and loyalty, which may lead to repeat business and favourable word-of-mouth recommendations.

Effective claims processing is the key to simplifying internal processes and cost control from an operational standpoint. Manual, labour-intensive procedures can create bottlenecks, which can cause settlement delays, increased administrative costs, and potential mistakes. Intelligent automation and digitalization of claims workflows can speed up communication between departments engaged in the claim’s lifecycle, cut down on errors, and significantly reduce processing times. This not only expedites claim settlements but also optimizes resource use, freeing insurers to concentrate more on long-term goals.

Understanding Intelligent Automation in P&C

Intelligent automation is a ground-breaking method for streamlining procedures and improving client experiences in the context of Property and Casualty (P&C) insurance. It results from the fusion of three potent technical pillars: robotic process automation (RPA), machine learning, and artificial intelligence (AI).

This covers handling claims, underwriting, managing policies, interacting with customers, and more. The objective is to accelerate labor-intensive, complicated procedures while improving decision-making skills through cognitive analysis of data.

Challenges in Traditional Claims Processing

In the insurance sector, traditional claim processing techniques frequently face a number of serious difficulties that limit effectiveness and client satisfaction. These difficulties result from reliance on manual processes, which are prone to mistakes, holdups, and irate clients.

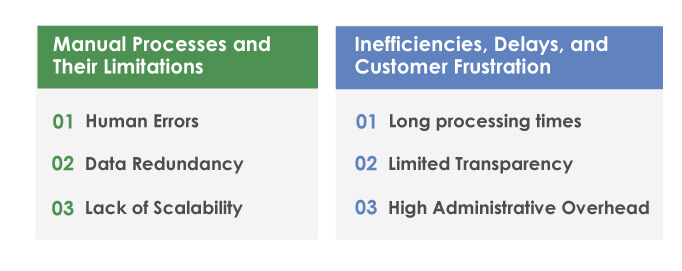

1. Manual Processes and Their Limitations:

Traditional claims processing has a number of drawbacks because it mainly relies on manual data entry, paperwork, and communication:

Human Errors:

When data is entered manually, there is a higher chance that it will contain typographical errors, inaccurate information, and inconsistent data, all of which might influence how claims are handled incorrectly.

Data Redundancy:

Repeated data entering into different systems leads to wasted effort and inconsistent data.

Lack of Scalability:

Manual processes struggle to keep up with rising claim volumes, resulting in bottlenecks and resource limitations.

2. Inefficiencies, Delays, and Customer Frustration:

For both customers and insurers, manual claims processing frequently creates inefficiencies that lead to frustrating experiences:

Long Processing Times:

Manual tasks take longer, which adds to the delays in claim approvals, verifications, and settlements. These delays might cause consumer annoyance.

Limited Transparency:

Customers are left in the dark about the progress of their claims in real time, which causes uncertainty and dissatisfaction.

High Administrative Overhead:

The labor-intensive nature of manual processes necessitates sizable personnel for data entry, verification, and communication, which raises the cost of operations.

Addressing these challenges through intelligent automation can not only improve operational efficiency but also enhance customer experiences by reducing delays, errors, and the associated frustrations of traditional claims processing methods.

How Intelligent Automation helps in P&C Insurance?

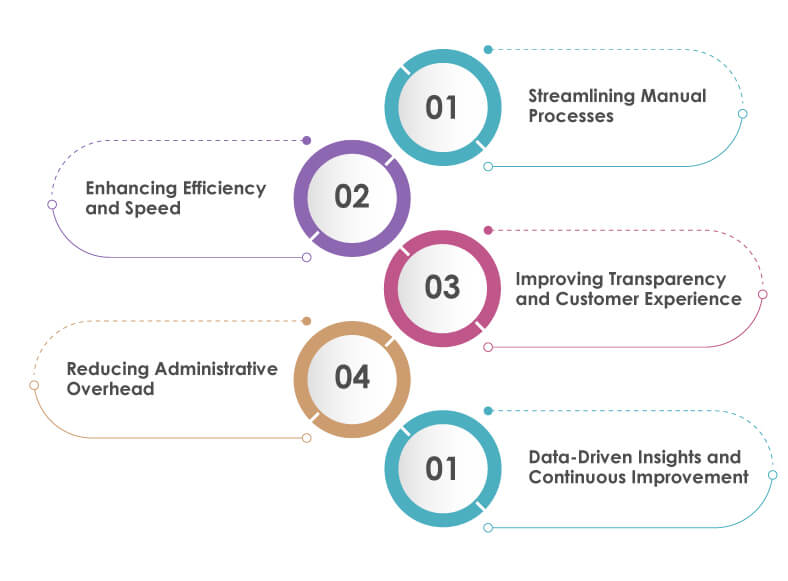

1. Streamlining Manual Processes:

Automated Data Entry:

Intelligent automation can automate data entry tasks, eliminating the risk of human errors and ensuring accurate and consistent information across systems.

Document Processing:

AI-powered systems can extract relevant information from documents and forms, significantly reducing manual effort and accelerating the claims validation process.

2. Enhancing Efficiency and Speed:

Automated Workflows:

RPA can orchestrate end-to-end claims processing workflows, seamlessly transitioning tasks from one stage to another without manual intervention, reducing processing times.

Decision Support:

AI and ML algorithms can analyze claim data and historical patterns to assist claims adjusters in making faster and more informed decisions.

3. Improving Transparency and Customer Experience:

Real-time Updates:

Intelligent automation enables real-time tracking of claims, offering customers and insurers immediate visibility into the status of each claim, enhancing transparency and reducing customer frustration.

Automated Communication:

Automated communication tools can provide timely updates to claimants, keeping them informed throughout the claims process and enhancing customer satisfaction.

4. Reducing Administrative Overhead:

Task Offloading:

RPA can handle routine and repetitive tasks, freeing up human resources to focus on more complex and strategic aspects of claims management.

Efficient Resource Allocation:

By automating manual tasks, insurers can optimize resource allocation, reducing the need for large administrative teams.

5. Data-Driven Insights and Continuous Improvement:

Predictive Analytics:

Machine learning algorithms can analyze historical claims data to identify patterns and trends, helping insurers identify fraud, assess risks, and optimize processes.

Continuous Learning:

Intelligent automation systems can learn from past interactions, improving their accuracy, decision-making capabilities, and overall efficiency over time.

By harnessing the capabilities of intelligent automation, insurers can mitigate the challenges associated with manual claims processing, leading to faster claims settlements, reduced errors, improved customer satisfaction, and a more agile and competitive operation.

Use Cases of Intelligent Automation in P&C Insurance

The P&C insurance sector has always been characterized by its vast data sets, intricate processes, and the need for accurate decision-making. Today, because of intelligent automation, there’s an opportunity to streamline operations, reduce costs, and enhance customer experiences. Let’s dive into some compelling use cases of IA in P&C insurance:

Claims Processing:

One of the most critical processes in insurance is claims processing. Insurers can automate data entry, validate claims with historical data, and quickly identify potential frauds by leveraging IA. This leads to faster claim resolutions, reduced human errors, and increased customer satisfaction.

Policy Administration and Underwriting:

By analyzing vast amounts of data, IA can assist underwriters in determining policy prices, endorsements, and renewals. Automated data extraction and processing facilitate a quicker and more accurate risk assessment, crucial for determining policy premiums.

Customer Service:

Intelligent chatbots and virtual assistants are now standard in P&C insurance. These bots can answer policy-related questions, guide customers through the claims process, and even assist in purchasing new policies. This 24/7 availability enhances the customer experience and reduces operational costs.

Fraud Detection:

IA can cross-reference claims against thousands of data points to pinpoint inconsistencies. Machine learning algorithms can detect patterns that might indicate fraudulent activities, saving the industry billions annually.

Regulatory Compliance:

With ever-changing regulations, insurers must remain compliant. IA can be programmed to understand these regulations and monitor transactions and operations to ensure they meet the necessary standards.

Predictive Analysis:

IA’s ability to sift through and analyze vast amounts of data means it can forecast future trends. This can help P&C insurers anticipate market shifts, understand emerging risks, and tailor their products accordingly.

Key Applications of Intelligent Automation in Claims Processing

The incorporation of intelligent automation is ushering in a new era of efficiency and precision within claims processing in the constantly changing insurance industry. Insurers are gaining access to a variety of game-changing solutions that expedite processes, improve client interactions, and support fraud detection by leveraging the capabilities of artificial intelligence, machine learning, and robotic process automation.

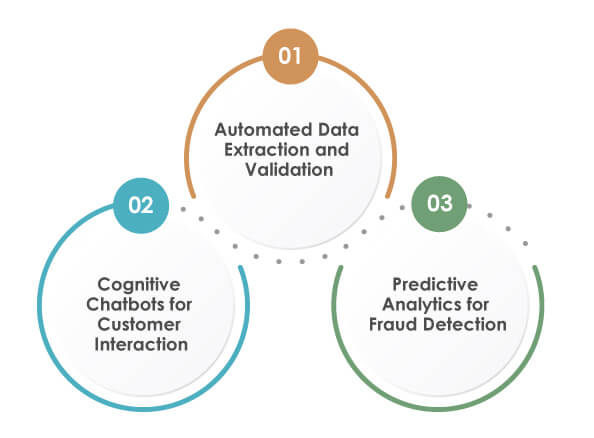

Automated Data Extraction and Validation:

Intelligent automation is excellent at automating claims processing’s data-intensive processes. Relevant data is accurately extracted and digitized from documents, forms, and other sources via automated data extraction. This data is checked against established criteria by machine learning algorithms, which saves time and guarantees data accuracy. This tool streamlines the claims intake process, reduces errors, and creates a more rational decision-making environment.

Cognitive Chatbots for Customer Interaction:

A significant improvement in consumer involvement during claims processing is provided by cognitive chatbots. These AI-powered bots provide policyholders with round-the-clock support, assisting them with the claims reporting process, responding to their questions, and giving them real-time updates. Insurance companies can improve customer satisfaction by automating common interactions. This improves client experiences, decreases wait times, and frees up human agents to handle more difficult situations.

Predictive Analytics for Fraud Detection:

The ability of intelligent automation’s predictive analytics to combat insurance fraud is crucial. Machine learning algorithms can find patterns in past claim data to indicate possibly fraudulent claims for additional investigation. By concentrating resources on legitimate cases, this proactive approach to fraud detection not only protects insurers from financial losses but also speeds up the processing of legitimate claims.

The deployment of these intelligent automation applications showcases how insurers can leverage technology to streamline claims processes, engage customers effectively, and ensure the integrity of their operations. By embracing these innovations, the insurance industry is poised to create a future where claims processing is faster, more accurate, and aligned with evolving customer expectations.

Conclusion

The integration of intelligent automation within the realm of insurance claims processing heralds a transformative shift in operational efficiency, customer engagement, and fraud prevention. This dynamic fusion of artificial intelligence, machine learning, and robotic process automation is reshaping how insurers approach claims management, addressing long-standing challenges and capitalizing on new opportunities.

By automating data extraction and validation, insurers are streamlining processes and reducing errors, leading to faster and more accurate claims assessments. The advent of cognitive chatbots introduces a new level of customer-centric interaction, ensuring round-the-clock support and enhancing overall satisfaction. Furthermore, predictive analytics empower insurers to proactively identify potential instances of fraud, safeguarding financial resources and maintaining the integrity of the claim’s ecosystem.

How Can TestingXperts help you with the Power of Intelligent Automation in P&C Insurance?

TestingXperts stands as a strategic partner poised to unlock the full potential of intelligent automation within the dynamic landscape of Property and Casualty (P&C) insurance. With a proven track record in software testing and quality assurance, TestingXperts offers comprehensive support in harnessing the power of intelligent automation.

From formulating tailored test strategies that leverage AI, machine learning, and robotic process automation, to designing and implementing cutting-edge frameworks, our expert team ensures seamless integration of automation into P&C insurance workflows. Through meticulous automated testing execution, including predictive analytics and cognitive chatbot evaluation, we accelerate testing cycles while maintaining precision. Moreover, our proficiency extends to performance testing, security validation, and ongoing maintenance, ensuring that your intelligent automation systems function optimally.

With TestingXperts as your guide, you can confidently embrace the transformative potential of intelligent automation, enhancing claims processing efficiency, customer experiences, and the overall success of your P&C insurance endeavors.

Discover more

Get in Touch

Stay Updated

Subscribe for more info