Table of Contents

- The Evolving Landscape of Insurance Testing

- What is HyperAutomation Testing?

- The Role of HyperAutomation Testing in Insurance

- Testing Challenges in the Insurance Industrys

- HyperAutomation Testing Framework for Insurance

- The Future of HyperAutomation in Insurance Industry

- Overcoming Challenges and Maximizing the Value of HyperAutomation Testing

- Conclusion: Embracing HyperAutomation Testing for Insurance Excellence

- How Can TestingXperts Help you in HyperAutomation in the Insurance Industry?

In the ever-changing landscape of the insurance industry, testing plays a pivotal role in ensuring the quality, reliability, and security of insurance systems and processes. As the industry undergoes significant digital transformation and faces increasing customer demands, the need for effective and comprehensive testing has become paramount.

The Evolving Landscape of Insurance Testing

The evolving landscape of insurance testing is marked by emerging technologies, shifting customer expectations, and evolving regulatory requirements. Insurance companies are leveraging advanced analytics, artificial intelligence, machine learning, and automation to streamline operations, enhance customer experiences, and stay competitive. This dynamic environment calls for agile and adaptive testing approaches that can keep pace with the industry’s rapid changes. In this blog, we will explore the challenges, trends, and strategies shaping the evolving landscape of insurance testing, and the crucial role it plays in ensuring the success of insurance operations in the digital era.

What is Hyperautomation Testing?

Hyperautomation testing refers to the comprehensive testing approach that combines automation, artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA) to streamline and optimize various testing activities across an organization. It involves automating repetitive and manual tasks, integrating disparate systems, leveraging AI and ML algorithms for intelligent testing, and utilizing RPA for process automation.

Hyperautomation testing aims to enhance testing efficiency, accelerate test cycles, improve test coverage, and enable faster time-to-market for software applications. By harnessing the power of automation and advanced technologies, hyperautomation testing empowers organizations to achieve higher levels of quality, scalability, and reliability in their products and services.

It revolutionizes the traditional testing approach by enabling faster feedback loops, enhanced test case generation, smarter test execution, and deeper insights into the quality of software systems. Overall, hyperautomation testing is a game-changer in the testing domain, enabling organizations to meet the demands of today’s rapidly evolving digital landscape.

The Role of Hyperautomation Testing in Insurance

Hyperautomation testing plays a crucial role in the insurance industry, where efficient and reliable systems are essential for delivering exceptional customer experiences and ensuring regulatory compliance. The insurance sector involves complex processes, vast amounts of data, and a need for accuracy and precision. Hyperautomation testing helps insurance companies streamline their operations, enhance efficiency, and mitigate risks.

One of the key roles of hyperautomation testing in insurance is to accelerate the testing process. By automating repetitive and time-consuming tasks, such as test case generation, data setup, and test execution, insurance organizations can significantly reduce the time and effort required for testing. This allows for faster time-to-market for new insurance products, system updates, and regulatory changes.

Another crucial role of hyperautomation testing in insurance is to improve test coverage. With the help of intelligent algorithms and AI-powered techniques, hyperautomation testing can identify patterns, predict potential issues, and generate test cases that cover a wide range of scenarios. This ensures comprehensive testing of insurance systems, reducing the likelihood of errors and improving the overall quality of software applications.

Hyperautomation testing also helps in enhancing the scalability of insurance systems. By automating the testing process, insurance companies can easily scale up their testing efforts to handle large volumes of data, complex business rules, and diverse integration scenarios. This scalability ensures that insurance systems can handle increasing demands and provide a seamless experience to policyholders and other stakeholders.

Additionally, hyperautomation testing aids in ensuring regulatory compliance. The insurance industry is heavily regulated, and compliance with laws and regulations is of utmost importance. Hyperautomation testing enables insurance organizations to validate compliance requirements by automating the testing of specific rules, calculations, and data accuracy. This helps in mitigating compliance risks and avoiding costly penalties.

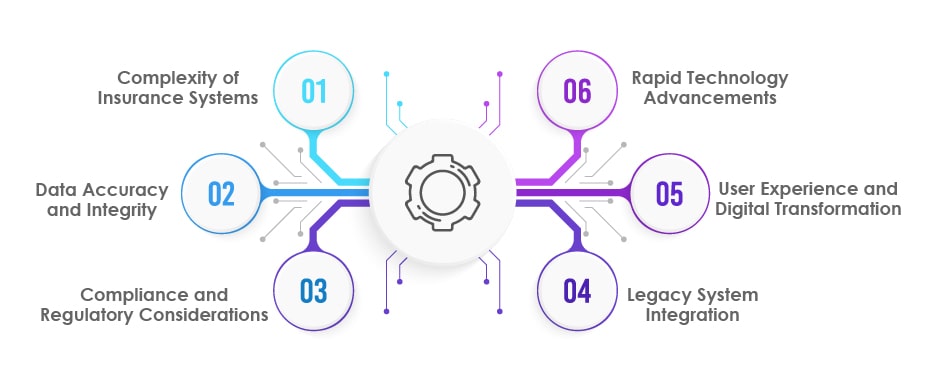

Testing Challenges in the Insurance Industry

The insurance industry faces unique testing challenges due to its complex systems, regulatory requirements, and evolving customer expectations. Understanding and addressing these challenges are essential to ensure the reliability, security, and efficiency of insurance operations. Let’s explore some of the key testing challenges in the insurance industry:

Complexity of Insurance Systems:

Insurance systems involve intricate business processes, numerous integration points, and a vast amount of data. Testing such complex systems requires comprehensive test coverage, including various policy types, product configurations, and business rules. Managing the complexity of these systems while ensuring accurate and reliable testing can be a significant challenge.

Data Accuracy and Integrity:

Insurance relies heavily on accurate and reliable data. Testing data accuracy and integrity across various systems and databases is crucial to prevent errors, ensure consistent policy information, and support accurate risk assessment and underwriting. However, maintaining data quality, data consistency, and data privacy can be challenging, particularly when dealing with legacy systems and data migration.

Compliance and Regulatory Considerations:

The insurance industry is subject to stringent regulations and compliance requirements. Testing must validate that insurance systems adhere to regulatory standards, industry guidelines, and legal obligations. Ensuring compliance with data protection laws, consumer privacy regulations, and policy guidelines requires thorough and meticulous testing, including validating calculations, ensuring accurate reporting, and verifying compliance with specific mandates.

Legacy System Integration:

Many insurance companies operate on legacy systems that have been in place for years. Integrating these legacy systems with modern technologies, third-party platforms, and new digital channels can pose integration challenges. Testing the compatibility, interoperability, and data synchronization between legacy systems and new components is essential to ensure seamless functionality and a consistent user experience.

User Experience and Digital Transformation:

With the rise of digital channels and self-service options, insurance companies are focusing on improving the user experience. Testing the usability, responsiveness, and performance of digital interfaces and mobile applications is crucial to meet customer expectations. Additionally, as insurance companies undergo digital transformation, testing the end-to-end digital processes, including online policy issuance, claims filing, and customer service, becomes critical for a seamless and satisfying user experience.

Rapid Technology Advancements:

Insurance technology is rapidly evolving, with the adoption of artificial intelligence, machine learning, robotic process automation, and data analytics. Keeping pace with these advancements and effectively testing new technologies is a challenge. Testing AI models, algorithmic underwriting, chatbots, and automated claims processing requires specialized expertise, data validation techniques, and comprehensive test strategies.

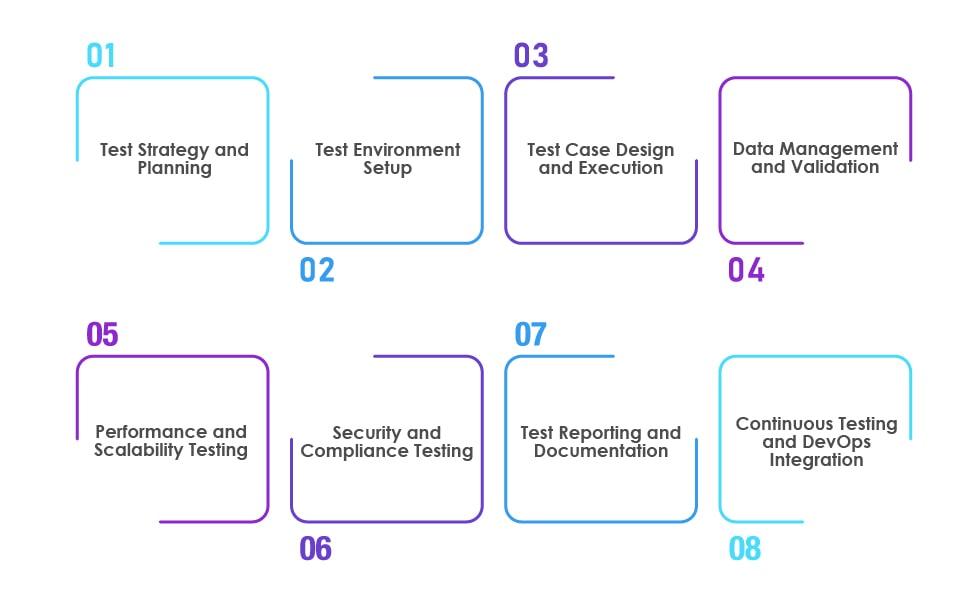

Hyperautomation Testing Framework for Insurance

A hyperautomation testing framework for the insurance industry provides a structured approach to effectively implement and execute hyperautomation testing. Such a framework involves a combination of methodologies, tools, and best practices tailored specifically for insurance systems and processes. Here are the key components of a hyperautomation testing framework for insurance:

Test Strategy and Planning:

Define the testing objectives, scope, and strategies specific to insurance systems. Identify the critical areas to be tested, including policy administration, claims processing, underwriting, and regulatory compliance. Develop a comprehensive test plan that outlines the testing approach, timelines, resources, and dependencies.

Test Environment Setup:

Establish a dedicated test environment that mirrors the production environment. This includes configuring and provisioning the necessary hardware, software, databases, and network infrastructure required for testing. Ensure data privacy and security considerations are addressed and create a representative test dataset that covers various insurance scenarios.

Test Case Design and Execution:

Develop test cases that cover the functional and non-functional aspects of insurance systems. This includes validating policy creation, premium calculations, claims processing, data validation, security controls, and integration scenarios. Leverage automation tools to generate test scripts, automate test execution, and capture test results. Execute the test cases systematically, record any deviations, and analyze the test outcomes.

Data Management and Validation:

Implement data management strategies to ensure data accuracy, consistency, and integrity during testing. Develop techniques to generate synthetic test data or anonymize production data while preserving the characteristics and complexity of real-world insurance scenarios. Verify the accuracy of data transfers, calculations, and transformations across different insurance systems.

Performance and Scalability Testing:

Perform performance testing to assess the responsiveness, scalability, and reliability of insurance systems under varying workloads. Simulate peak usage scenarios, measure response times, and evaluate the system’s ability to handle concurrent users and high-volume transactions. Monitor system performance metrics, identify bottlenecks, and optimize system resources for optimal performance.

Security and Compliance Testing:

Incorporate security and compliance testing into the framework to ensure insurance systems adhere to industry regulations, data protection standards, and privacy requirements. Validate access controls, authentication mechanisms, encryption protocols, and compliance with applicable regulations such as GDPR or HIPAA. Conduct vulnerability assessments and penetration testing to identify and address potential security risks.

Test Reporting and Documentation:

Document test plans, test cases, test results, and any issues encountered during testing. Generate comprehensive test reports that provide insights into the test coverage, test outcomes, and identified defects. Capture and prioritize defects, track their resolution, and communicate the findings to relevant stakeholders.

Continuous Testing and DevOps Integration:

Integrate hyperautomation testing into the DevOps pipeline to enable continuous testing throughout the software development lifecycle. Incorporate test automation into the CI/CD process, leverage tools for continuous integration, and adopt agile testing practices. Implement test automation frameworks, version control systems, and collaboration tools to streamline testing activities and foster efficient communication between teams.

The Future of Hyperautomation in Insurance Industry

The future of hyperautomation testing in the insurance industry is poised for significant advancements and transformative impact. As technology continues to evolve and disrupt the insurance landscape, hyperautomation testing will play a crucial role in ensuring the reliability, efficiency, and security of insurance systems and processes. Here are some key aspects that will shape the future of hyperautomation testing in insurance:

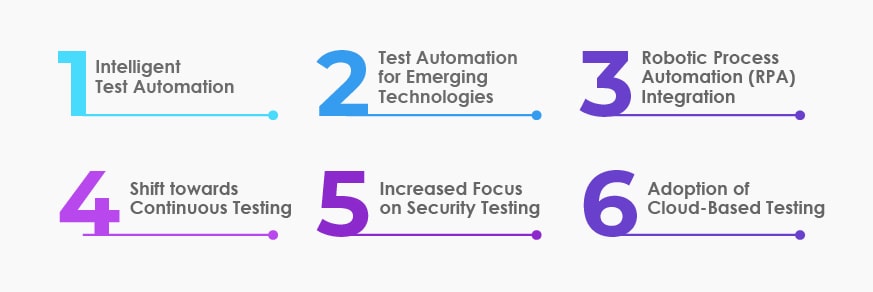

Intelligent Test Automation:

Artificial intelligence (AI) and machine learning (ML) algorithms will be increasingly integrated into

hyper automation testing. AI-powered testing tools will enable self-learning systems that can automatically adapt and optimize test cases, generate intelligent test data, and identify patterns and anomalies in testing results. ML algorithms will help in predicting potential defects and optimizing test coverage, allowing insurance companies to achieve higher levels of efficiency and accuracy in testing.

Test Automation for Emerging Technologies:

As insurance companies adopt emerging technologies such as blockchain, Internet of Things (IoT), and augmented reality (AR), hyperautomation testing will expand to encompass these new domains. Test automation frameworks will be developed to validate the interoperability, security, and performance of blockchain-based insurance smart contracts, IoT-enabled insurance devices, and AR-based claims processing systems.

Robotic Process Automation (RPA) Integration:

RPA will be tightly integrated with hyperautomation testing to automate end-to-end business processes, including data entry, claims verification, and policy administration. RPA bots will not only perform repetitive tasks but also assist in executing test scripts, generating test reports, and managing test environments. This integration will enhance efficiency, reduce human errors, and free up resources to focus on more complex testing activities.

Shift towards Continuous Testing:

Hyperautomation testing will align with the industry trend of continuous testing, where testing is seamlessly integrated throughout the software development lifecycle. Continuous integration and continuous delivery (CI/CD) pipelines will be enhanced to include automated testing at each stage, allowing for faster feedback loops and quicker identification of defects. Continuous testing will enable insurance companies to deliver high-quality software products and services with reduced time-to-market.

Increased Focus on Security Testing:

With the rising frequency and sophistication of cyber threats, security testing will become even more critical for insurance systems. Hyperautomation testing will include robust security testing practices, such as vulnerability assessments, penetration testing, and threat modeling. Advanced security testing tools will be leveraged to identify and address vulnerabilities in insurance applications, safeguarding sensitive customer data and ensuring compliance with industry regulations.

Adoption of Cloud-Based Testing:

The insurance industry will increasingly leverage cloud-based testing platforms to enhance scalability, flexibility, and cost-effectiveness. Cloud-based testing environments will enable insurance companies to rapidly provision and scale test resources as needed, reducing the dependency on on-premises infrastructure. Additionally, cloud-based testing platforms will provide advanced analytics and reporting capabilities, allowing for real-time monitoring of test execution and insights into testing metrics.

Overcoming Challenges and Maximizing the Value of Hyperautomation Testing

Implementing hyperautomation testing in an organization comes with its fair share of challenges. However, by addressing these challenges head-on, organizations can overcome them and maximize the value of hyperautomation testing. One of the key challenges is the need for skilled resources who possess expertise in automation tools, AI, and ML. Investing in training and upskilling programs can help bridge this gap. Another challenge is the complexity of insurance systems and processes, which require thorough understanding and meticulous test case design. By collaborating closely with domain experts and leveraging industry-specific frameworks, organizations can develop comprehensive test scenarios. Additionally, ensuring seamless integration with existing workflows and technologies can be a challenge. By adopting a well-defined integration strategy and leveraging tools that support interoperability, organizations can streamline the testing process.

Lastly, security and compliance are paramount in the insurance industry. Robust security testing measures and adherence to regulatory guidelines should be an integral part of hyperautomation testing. By addressing these challenges and leveraging the full potential of hyperautomation testing, organizations can achieve higher efficiency, quality, and agility in their testing processes, ultimately maximizing the value delivered to the business and its stakeholders.

Conclusion: Embracing Hyperautomation Testing for Insurance Excellence

In conclusion, hyperautomation testing has emerged as a game-changer in the insurance industry, offering immense opportunities for excellence and innovation. By harnessing the power of automation, artificial intelligence, and advanced testing methodologies, insurance organizations can achieve higher levels of efficiency, accuracy, and reliability in their testing processes.

Hyperautomation testing addresses the unique challenges faced by the insurance industry, such as complex systems, regulatory compliance, and evolving customer expectations. It enables seamless integration, continuous testing, and enhanced security measures to safeguard sensitive data and ensure compliance with industry regulations.

By embracing hyperautomation testing, insurance companies can optimize their testing efforts, accelerate time-to-market, and deliver high-quality software solutions that meet the evolving needs of policyholders. It is not just a means to ensure system stability, but a pathway to drive digital transformation and achieve excellence in the insurance landscape.

As the industry continues to evolve, embracing hyperautomation testing becomes imperative to stay competitive, enhance customer experiences, and pave the way for future success. By recognizing the value of hyperautomation testing and investing in the necessary resources, technologies, and expertise, insurance organizations can unlock new possibilities, mitigate risks, and thrive in the ever-changing insurance landscape.

How Can TestingXperts Help you in Hyperautomation in the Insurance Industry?

Our quality engineering team has successfully built Tx-HyperAutomate (a ready-to-deploy test automation framework) offers numerous advantages to software development teams seeking efficient and reliable testing processes. By providing a pre-built foundation for automation, it accelerates test creation and execution while ensuring scalability and maintainability. In addition to this, with the ability to save costs and foster collaboration, a robust automation framework becomes an indispensable asset in achieving high-quality software releases and meeting customer expectations.

We provide a pre-configured environment with essential components such as test libraries, APIs, and predefined functions, allowing testers to focus on creating test scenarios and test cases promptly. Drop us a line to get in touch and discuss your QA/QE challenges and how TestingXperts can help you achieve your goals.

Discover more

Get in Touch

Stay Updated

Subscribe for more info