Table of Contents

- About Guidewire Software, Inc

- What are the Benefits of Guidewire?

- Challenges in Testing Guidewire Suite

- Guidewire Test Automation Tips for Better ROI

- Conclusion

- Why Partner with TestingXperts for Guidewire Automation Testing?

The insurance industry is undergoing a rapid digital transformation, making it crucial for insurance companies to implement innovative technologies like Guidewire to remain competitive in the modern marketplace. In the fast-paced data and digital engagement areas, the latest release of the Guidewire Insurance Platform enables insurers to mine and deploy deep insight from the large volume of data available to the industry. According to reports, the global guidewire market is expected to hit US$2.6 billion by 2025. But, to successfully implement this platform, companies should invest in automating guidewire testing to prohibit the rising costs and delays of manual testing. It will enable insurance companies to focus on other key areas, such as their services and users, instead of wasting time on manual processes that could waste resources and slow workflow.

About Guidewire Software, Inc

Guidewire Software, Inc. is a US-based software company that offers tailored services to the insurance niche. Their Insurance Suite offers comprehensive applications to support multiple insurance operations such as policy administration, claim management, and billing. The company is also known for recurring revenue as it sells term licenses with software-as-a-service on a subscription basis. Their most popular products are BillingCenter, PolicyCenter, and ClaimCenter, and offer core back-end software services for property and casualty insurance carriers all across the world.

The Guidewire Insurance Platform is based on three elements: data management and analytics, transaction processing, and digital engagement. It also helps make the best business decisions based on data insights and supports digital sales, services, and claim experience for several stakeholders. Some well-known insurance carriers that use Guidewire are the Insurance Corporation of British Columbia, United Automobile Insurance Company (UAIC), Canadian Automobile Association Insurance Company (Ontario), and The Cincinnati Insurance Companies.

What are the Benefits of Guidewire?

Guidewire Suite is a software platform that focuses on upscaling insurance operations to deliver seamless services to an active global customer community. It is known for streamlining operations, managing insurance process complexities, and improving customer experience. Following are some key benefits of using Guidewire

• It allows insurance companies to implement solutions according to their requirements and upscale them as their business grows. This type of flexibility allows companies to easily adapt to changing customer demands and market structure.

• The software offers greater accessibility and flexibility with its cloud-based solution, enabling insurance companies to implement cloud computing into their existing business infrastructure. This, in turn, results in improved data security and reduced IT infrastructure costs.

• It offers advanced data management and analytics tools to analyze vast amounts of data, allowing insurers to gain insights into customer behavior, market trends, risk assessments, and operational efficiency, leading to informed decision-making.

• Its set of tools allows insurers to provide personalized services to the clients, improve response time, and efficiently manage claim processing, leading to overall customer satisfaction.

• Guidewire Suite can easily integrate with existing insurance operations such as claim management, billing, policy administration, and underwriting. This reduces error risk, minimizes manual tasks, and improves operational efficiency.

• It allows insurance companies to comply with changing regulatory requirements by adapting to new regulations, ensuring that the businesses remain compliant. The software also supports risk management through enhanced underwriting processes and risk assessment.

Challenges in Testing Guidewire Suite

Due to the complex and customizable nature of Guidewire Insurance Suite, testing it comes with a set of challenges. While the implementation process can be handled by IT experts, the testing and integration of the Insurance Suite within the business operations are very critical. Guidewire testing remains a major challenge, as manual testing is time-consuming and tedious task. Let us look into some of the challenges encountered by QA teams during Guidewire testing

• As Guidewire offers customizable solutions, testing each customization often involves complex business rules and configurations, which is time-consuming and challenging.

• Data migration is a critical process for companies transitioning to Guidewire software. Testing migrated data accuracy, and integrity becomes complex as it requires various validating techniques.

• The Guidewire Suite needs to be integrated with external systems, thus, ensuring seamless integration and data consistency presents a significant testing challenge.

• Testing Guidewire Suite for reliability, performance, and scalability during peak business hours is challenging.

• Insurance business owners should follow strict regulations and compliance, whether regional or global. So, conducting compliance testing for Guidewire implementation based on rules and policies becomes challenging and critical.

• Insurance businesses handle sensitive data, and ensuring security is necessary. Thus, doing vulnerability assessment to ensure data protection, especially for a complex and integrated system such as Guidewire, becomes tedious.

• It requires effective and frequent regression strategies to check the regular patches and updates Guidewire releases to ensure new changes do not negatively affect existing features.

• Testing Guidewire software requires a deep understanding of end-user requirements to ensure a seamless user interface and streamlined workflows for usability.

Guidewire Test Automation Tips for Better ROI

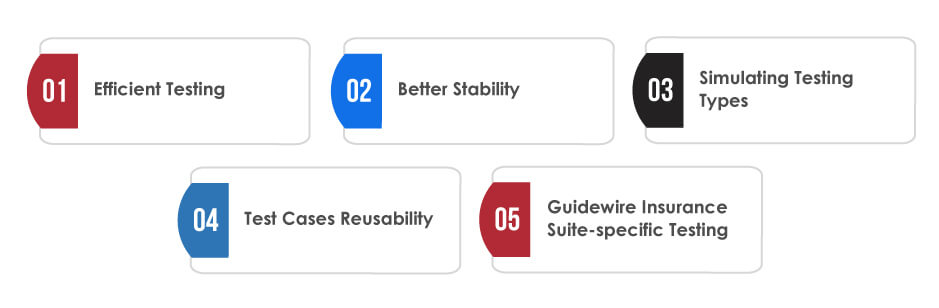

By automating test cases for Guidewire testing, businesses can reduce operational costs by 70% and improve their team’s efficiency. Automation will help improve product quality as the test can run repeatedly without human help and errors. Following are some of the benefits of test automation to make Guidewire testing more feasible such that it can offer better ROI.

Efficient Testing

The two main significant benefits of test automation are efficiency and consistency in test cases. With manual testing being time-consuming, businesses should implement automation to make the process faster, consistent, and cost-saving, leading to an efficient testing process and a higher return on investment.

Better Stability

It offers a stable platform for Guidewire testing requirements by reducing the monotony due to repetitive tasks. Test automation also reduces the error rate by following pre-determined instructions. Automating regressing tests allows testers to analyze whether the existing functionalities are compatible with the latest Guidewire updates.

Simulating Testing Types

Test automation helps in simulating different testing environments. For example, GUI testing is one of the most complex and time-consuming software testing processes. Test automation simulates the user-driven environments to check the real-time issues in the application.

Test Cases Reusability

Automation facilitates the test case reusability feature to help businesses increase their profitability across the product lifecycle. It enables better test management, seamless updation of the test directory, and efficient bug discovery. Test automation also minimizes costs, which is impossible with manual testing, leading to better ROI.

Guidewire Insurance Suite-specific Testing

Guidewire software testing is designed for the insurance industry-specific needs, which include system-integrated testing, functional testing, user acceptance testing, performance testing, test automation, etc. The in-house accelerators Tx-HyperAutomate and Tx-Automate will not only accelerate the test automation process but will also allow seamless integration of open-source tools. These tools significantly offer higher ROI for insurance software testing needs.

Conclusion

Guidewire Insurance Suite is a crucial tool for insurance businesses to facilitate successful digital transformation. For insurance companies seeking to improve customer experience, enhance operational efficiency, and remain competitive in the digital market, Guidewire’s robust features and customization make it an indispensable tool. However, one must implement robust testing steps to integrate Guidewire Suite into the existing business operations successfully. Test automation is necessary to counter the testing challenges that arise in Guidewire Suite implementation. It not only streamlines the testing process but also ensures cost-effectiveness, efficiency, and accuracy.

Why Partner with TestingXperts for Guidewire Automation Testing?

At TestingXperts, we understand the importance of investment that insurance companies make in Guidewire Insurance software products and the ROI they expect from it. Various insurance companies have partnered with TestingXperts for software testing services and Guidewire’s pre-built testing suite. Our QA services cater to key insurance areas such as third-party administration, underwriting modules, risk management, regulatory and compliance, risk management, advanced analytics and business intelligence, and more. You get assured of a 30% faster time-to-market, a 90% reduction in man-hours, 40% cost savings, and higher operational efficiency. We address the following insurance industry challenges with our next-gen QA services:

• Modernize core insurance systems to make them future-proof for Guidewire implementation.

• Help businesses comply with industry rules and regulations.

• Improve IT efficiency with seamless QA services and reduce total cost of ownership.

• Our in-house accelerators Tx-Automate and Tx-HyperAutomate, address the Guidewire automation testing process.

• Ensure seamless integration of third-party vendor systems.

To know more, contact our QA experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info