Banking has come a long way from the traditional brick-and-mortar branches. Over the years, technological advancements have revolutionised the banking industry, making it more convenient and accessible for customers. The transition from manual processes to automated systems paved the way for the rise of digital banking.

In recent years, digital banking has emerged as a game-changer in the financial sector, revolutionising how customers interact with their banks. According to a recent study conducted in the UK, digital banking usage has seen a remarkable surge, with 82% of UK adults now using online banking services and 73% accessing their bank accounts through mobile apps.

Importance of Digital Banking in the UK

Digital Banking has gained significant traction in the UK, with many consumers adapting to its convenience and flexibility. The UK has been at the forefront of digital banking innovation, with a robust ecosystem that encourages collaboration between traditional banks and fintech startups. Its widespread adoption has reshaped the financial landscape, making it imperative for banks to adapt and provide seamless digital experiences to meet customer expectations.

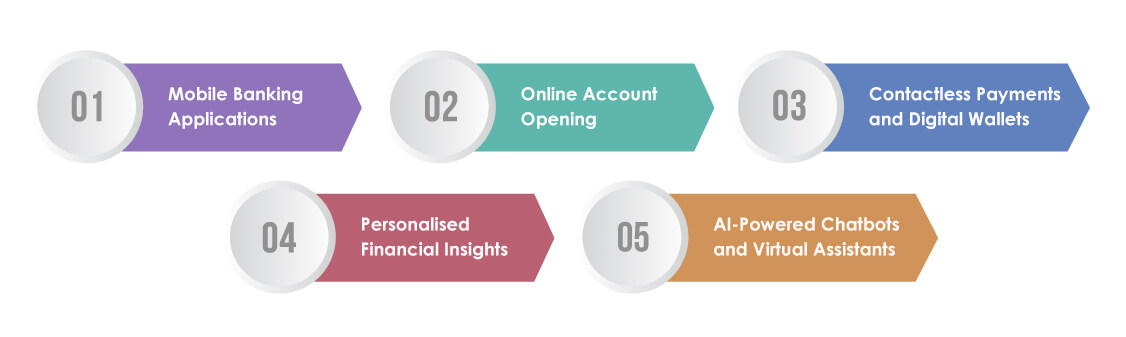

Key Features in Digital Banking

Following are the key features of digital banking that have reshaped the banking experience for customers in the UK:

Mobile Banking Applications

These apps provide many features, including account balance inquiries, fund transfers, bill payments, and mobile check deposits. Mobile banking apps also leverage the capabilities of smartphones, such as biometric authentication and location-based services, to enhance security and provide personalised experiences.This why, it is necessary to conduct mobile banking application testing also.

Online Account Opening

With online account opening, customers can complete the application process, submit required documents electronically, and receive instant approvals digitally. This convenience has made it easier for individuals to establish banking relationships, especially those who prefer digital-first experiences.

Contactless Payments and Digital Wallets

Digital wallets like Apple Pay, Google Pay, and Samsung Pay enable users to store their payment information securely and make seamless payments at supported merchants. Contactless payments provide a convenient and hygienic alternative to traditional payment methods.

Personalised Financial Insights

Banks can offer tailored recommendations, budgeting advice, and savings opportunities by analysing transaction history, spending patterns, and financial goals. This personalised approach empowers customers to make informed financial decisions and achieve their financial objectives.

AI-Powered Chatbots and Virtual Assistants

These intelligent systems can handle customer queries, provide account information, assist with transactions, and offer financial advice. Chatbots use natural language processing and machine learning algorithms to understand customer inquiries and deliver relevant and accurate responses, enhancing customer service and reducing response times.

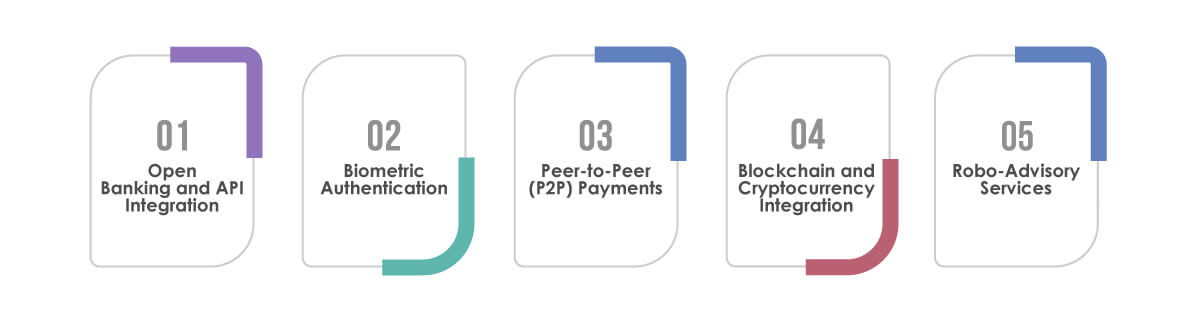

Digital Banking Innovations in the UK

The following innovations have revolutionised customer experiences and can drive greater efficiency, security, and accessibility in the financial industry:

Open Banking and API Integration

Open Banking is a regulatory initiative in the UK that promotes the secure sharing of financial data between banks and authorised third-party providers. It lets customers share their banking information with official apps and services, enabling personalised financial management and innovative products. Open Banking has facilitated the integration of various financial services through APIs, fostering collaboration and innovation within the industry.

Biometric Authentication

Biometric authentication methods like fingerprint, facial, and voice recognition provide an added layer of security by utilising individuals’ unique physiological or behavioural characteristics. Biometric authentication ensures that only authorised individuals can access their accounts and perform transactions, enhancing safety and reducing the reliance on passwords or PINs.

Peer-to-Peer (P2P) Payments

P2P payment services enable individuals to send and receive money directly from their bank accounts or digital wallets. Services like PayPal, Venmo, and Paym allow users to seamlessly split bills, pay friends, or make payments to small businesses. P2P payments offer a convenient and fast alternative to traditional payment methods, making individual transactions hassle-free.

Blockchain and Cryptocurrency Integration

Blockchain, a decentralised ledger technology, ensures transparency, security, and immutability in financial transactions. Cryptocurrencies, such as Bitcoin and Ethereum, have gained traction as alternative digital assets. Banks are exploring the potential of blockchain for cross-border payments, smart contracts, and other financial services.

Robo-Advisory Services

Robo-advisory services combine automation and AI algorithms to provide investment advice and portfolio management. These services leverage customer preferences, risk tolerance, and financial goals to offer personalised investment recommendations. Robo-advisors have democratised access to investment advice, making it more affordable and accessible for individuals, especially those with lower investment thresholds.

Addressing Security and Privacy Concerns

Ensuring customer data security and privacy is paramount in digital banking. Following are the steps taken to address security and privacy concerns, including data protection regulations, secure authentication practices, fraud detection measures, and user education initiatives:

Data Protection Regulations in the UK

The UK has stringent data protection regulations, including the General Data Protection Regulation (GDPR). These regulations govern the collection, storage, and processing of personal data by banks and other financial institutions. Compliance with these regulations is crucial for digital banking providers, ensuring the protection of customer data and privacy rights.

Secure Authentication Practices

These practices include multi-factor authentication, biometric authentication, and secure login procedures. By combining multiple authentication factors, such as passwords, PINs, fingerprint scans, or facial recognition, banks ensure that only authorised individuals can access their accounts, mitigating the risk of unauthorised access.

Fraud Detection and Prevention Measures

Advanced analytics, machine learning, and AI algorithms are employed to detect suspicious activities, unusual transaction patterns, and potential fraud attempts. Banks implement real-time monitoring systems and use stringent fraud prevention measures to protect customers from financial fraud and unauthorised transactions.

User Education and Awareness

Banks provide educational resources, security tips, and alerts to raise customer awareness. By fostering a culture of cybersecurity and promoting user education, banks empower customers to protect themselves from phishing attacks, identity theft, and other online threats.

The Future of Digital Banking

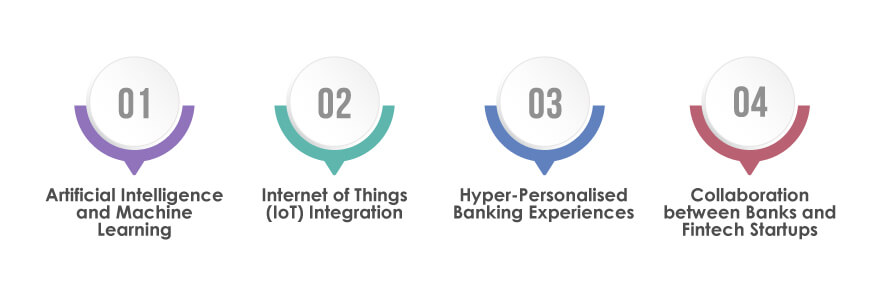

The key trends and innovations shaping the future of digital banking in the UK and how they are revolutionising the way customers bank and interact with financial institutions are as follows:

Artificial Intelligence and Machine Learning

These technologies will enable banks to automate processes, personalise customer experiences, and provide predictive insights. AI-powered chatbots and virtual assistants will become more sophisticated, offering conversational and context-aware customer interactions.

Internet of Things (IoT) Integration

IoT devices, such as smartwatches or home devices, can provide real-time banking notifications, balance updates, and transaction alerts. Connected devices will facilitate frictionless transactions, such as voice-activated payments, further enhancing the convenience and accessibility of digital banking.

Hyper-Personalised Banking Experiences

Digital banking will become increasingly hyper-personalised, tailoring financial products and services to individual customers. By leveraging customer data and analytics, banks will offer customised product recommendations, personalised pricing, and targeted offers. Hyper-personalisation will enhance customer engagement, loyalty, and satisfaction.

Collaboration between Banks and Fintech Startups

Banks will partner with fintech companies to leverage their expertise in payment technologies, blockchain, AI, and data analytics. This collaboration will foster a culture of innovation, enabling banks to deliver cutting-edge digital banking solutions to their customers.

How Can TestingXperts Help with Digital Banking Software Testing?

Whether it’s the mobile compatibility, compliance with data protection regulations, or a comprehensive testing approach, TestingXperts, a renowed digital banking testing service provider is equipped to meet the unique testing challenges of digital banking in the UK, providing reliable and efficient software testing services.

Domain Expertise

At TestingXperts, we possess extensive domain expertise in digital banking testing. Our team understands the complexities of digital banking systems, regulatory requirements, and security standards specific to the UK. We bring banking domain testing expertise to ensure comprehensive testing that aligns with industry best practices.

Reliability and Functionality

We focus on testing the reliability and functionality of digital banking systems by utilizing banking software loading testing approach. Through rigorous testing methodologies, we identify and rectify any bugs, errors, or glitches that may impact system performance, ensuring a seamless and reliable user experience for customers.

Mobile Compatibility

We specialise in digital banking application testing across various mobile devices, operating systems, and screen sizes. Our testing ensures that your banking app functions flawlessly, providing a consistent user experience regardless of the device used by your customers.

Comprehensive Testing Approach

We adopt a comprehensive testing approach that covers all aspects of digital banking, including functionality, security, performance, and usability. Our thorough testing ensures that your digital banking systems meet the highest quality standards and comply with industry regulations.

Security and Compliance Focus

We prioritise security and compliance in our testing approach. By conducting security testing, vulnerability assessments, and compliance checks, we help identify and mitigate potential risks, safeguarding customer data and ensuring adherence to data protection regulations.

Customer-Centric Approach

We understand the importance of providing a customer-centric digital banking experience. Our testing ensures that your digital banking platforms are user-friendly and intuitive and meet your customers’ evolving needs and expectations.

Tailored Solutions

We recognise that each platform is unique and tailor our testing solutions to your requirements. Our team collaborates closely with you to understand your testing goals and design customised strategies that address your challenges effectively.

Conclusion

Digital banking has revolutionised how customers interact with financial institutions in the UK. It offers unparalleled convenience, enhanced security, and personalised experiences. As this landscape evolves, banks must stay at the forefront of innovation and ensure their digital platforms deliver exceptional performance, security, and reliability

At TestingXperts, we understand the complexities and challenges of testing digital banking systems. With our domain expertise, comprehensive testing methodologies, BFSI domain testing services, and customer-centric approach, we can help you deliver robust and flawless banking solutions to your customers. Partner with us to ensure that your digital banking platforms redefine banking on the go in the UK and beyond.

Discover more

Get in Touch

Stay Updated

Subscribe for more info