Table of Contents

- The Rise of the Digital Insurance Industry

- Common Cyber Threats in the Digital Insurance Industry

- Implementing Robust Cybersecurity Measures

- Conclusion

- Why Partner with TestingXperts for Cybersecurity Testing Services?

As the digital insurance industry is transforming, the importance of cybersecurity cannot be ignored. The global cyber insurance market, which reached $11.9 billion in 2023, is anticipated to grow to $58.9 billion by 2032, showing the growing concern of cybersecurity in this industry. There are several factors involved in this growth, such as increasing dependence on cloud computing, the growing rate of data breaches, and specialised insurance policies. Due to this, integrating Artificial Intelligence in cybersecurity has now become crucial, as it speed up the analysis of vast data sets to detect threats and offers predictive insights. However, there are certain risks associated with implementing technology like AI, which includes cyber criminals exploiting these systems.

The rise in mobile app usage and associated cybersecurity challenges is also significant in the digital insurance industry. The growing market share of mobile devices, which is expected to reach 3.6 billion units by the end of 2024, makes them prime targets for cyber threats. Additionally, the expanding influence of the Internet of Things (IoT) introduces new vulnerabilities, as each interconnected device can potentially offer an entry point for cyberattacks.

Furthermore, the transition to cloud-based solutions brings new cybersecurity challenges. As data moves to the cloud, ensuring its security becomes important. This has led to a transformation in compliance, with a notable increase in compliance automation platforms for enterprises. These trends emphasise the critical nature of cybersecurity in the digital insurance industry, highlighting the need for robust and proactive measures to protect sensitive data and maintain customer trust in an increasingly digital world.

The Rise of the Digital Insurance Industry

The insurance industry’s digital transformation is reshaping how services are delivered and consumed. Key factors contributing to this growth include:

Increasing Use of Smartphones and the Internet

The widespread adoption of smartphones and the Internet has changed consumer behaviour. Users now rely on their mobile devices for various services, including insurance. In return, insurers have responded by developing mobile-friendly platforms and applications that allow customers to purchase policies, file claims, and access support services with ease. This mobile-first approach caters to the convenience and accessibility demanded by modern consumers.

Rising Demand for Convenience

Today’s consumers value convenience and efficiency. They prefer services that are accessible, easy to use, and quick to respond. The digital insurance industry meets these demands by offering streamlined online processes, quick policy comparisons, and faster claim settlements. This shift towards digital platforms enables consumers to manage their insurance needs without face-to-face interactions, making the process more efficient and user-friendly.

Advancements in Data Analytics and Artificial Intelligence

Integrating data analytics and AI in the insurance industry has improved risk assessment, policy personalisation, and fraud detection. Insurers can now analyse vast amounts of data to tailor policies to individual needs, predict risks more accurately, and identify fraudulent activities more effectively. AI-driven tools, such as chatbots and automated processing systems, enhance customer service by providing instant responses and assistance.

Emergence of Insurtech Startups

The rise of Insurtech startups has increased innovation and competition in the insurance industry. These startups leverage technology to offer seamless insurance products, efficient service delivery, and customer-centric solutions. Their approach utilises big data, IoT, and blockchain technology to create more transparent, secure, and customer-friendly insurance experiences.

Increased Focus on Personalisation and Customer Experience

Digital insurance companies are focusing on personalisation and enhancing the customer experience. By using technologies like AI, cloud, and big data, insurers can offer customised insurance products based on individual risk profiles and preferences. They also use customer data to provide proactive service, personalised communication, and tailored advice, and helps in building long-term relationships.

Common Cyber Threats in the Digital Insurance Industry

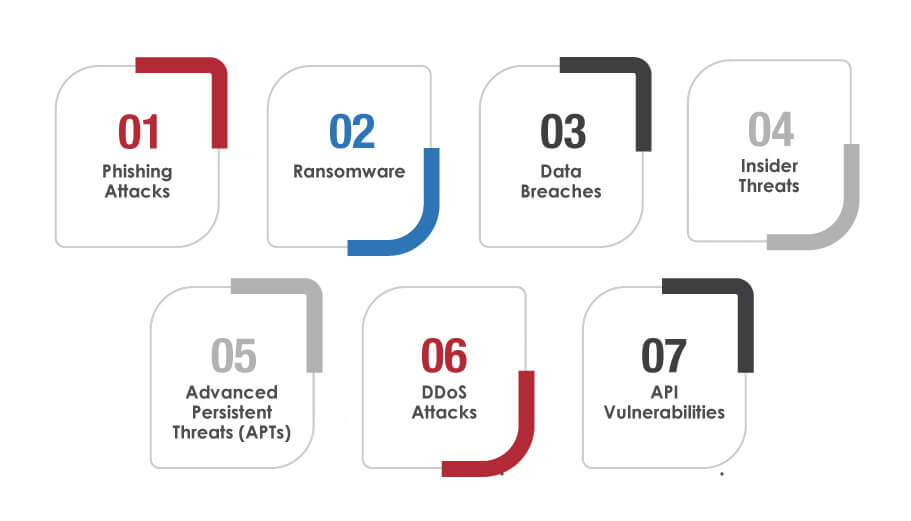

As the digital insurance industry grows, so does its exposure to various cyber threats. These threats pose significant risks to both, insurers and clients whose sensitive data is at stake. Understanding these threats is crucial for implementing effective cybersecurity measures. Here are some of the most common cyber threats faced by the digital insurance industry

Phishing Attacks

These are misleading attempts to obtain sensitive information by impersonating someone trustworthy. Insurers are often targeted with emails or messages that appear genuine, asking for confidential data like login credentials. Users clicking on these links or attachments unintentionally give hackers access to internal systems.

Ransomware

In ransomware attacks, malware encrypts an organisation’s data, demanding payment for its release. Insurance firms with confidential data are easy targets as these attacks can turn off operations and result in significant data loss if backups are not in place.

Data Breaches

Data breaches involve unauthorised access to customer data, including personal, health, and financial information. Such incidents can occur through hacking, inadequate security measures, or accidental exposure. They can lead to identity theft, financial fraud, and severe reputational damage to the insurer.

Insider Threats

Insider threats arise from employees or associates who misuse access to harm the organisation. It includes data theft, sabotage of information, or unintentional actions like sharing sensitive data improperly. Such threats are challenging to detect and can cause considerable harm.

Advanced Persistent Threats (APTs)

APTs are sophisticated, long-term cyberattacks aiming to steal data or disrupt operations. Hackers infiltrate networks and remain undetected, often using advanced techniques to avoid getting caught. APTs are concerning due to their persistent nature and potential for extensive damage.

DDoS Attacks

Distributed Denial of Service attacks flood networks with excessive traffic, causing service disruptions. This can mean inaccessible websites or online services for insurers, impacting customer service and trust. These attacks can also be a cover for other malicious activities.

API Vulnerabilities

APIs are critical for integrating various digital services in insurance. However, vulnerabilities in these APIs can be exploited to access sensitive data. Insurers must ensure robust API security to prevent data leaks and unauthorised access.

Implementing Robust Cybersecurity Measures

Implementing robust cybersecurity measures in the digital insurance industry is not just a technical necessity but a critical business strategy. As cyber threats evolve, so must the defences against them. Effective cybersecurity in the insurance sector involves a multifaceted approach, addressing various security aspects, from data protection to employee training. Here are vital measures that can be taken

Regular Security Assessments

Conducting regular security assessments is crucial, which involves vulnerability scanning, penetration testing, and security audits to identify and address potential vulnerabilities in the system. Routine assessments help keep the security posture updated and resilient against new threats. Regular cybersecurity testing, including penetration testing and red team exercises, helps identify and address vulnerabilities. These tests simulate real-world attack scenarios to evaluate the effectiveness of existing security measures.

Employee Training and Awareness

Regular training sessions should focus on recognizing and responding to threats like phishing and social engineering. Employees should know the importance of security protocols and their role in maintaining organizational security.

Data Encryption

Encrypting sensitive data, both stored (at rest) and transmitted (in transit), ensures security even during a breach. Encryption converts data into a code to prevent unauthorized access, making it a critical element of data protection strategies.

Advanced Threat Detection Systems

Implementing sophisticated threat detection systems that utilize AI and machine learning can significantly enhance an organization’s ability to detect and respond to cyber threats promptly. These systems analyse patterns and behaviours to identify potential threats.

Multi-Factor Authentication (MFA)

MFA is a security system that requires more than one authentication method from independent categories of credentials to verify the user’s identity. This adds an extra layer of security, reducing the risk of unauthorized access.

Regular Software Updates

Keeping software and systems updated with the latest security patches is fundamental. Updates often include fixes for security vulnerabilities that attackers could exploit.

Incident Response Planning

An effective incident response plan is essential for quickly and efficiently addressing security breaches. This plan should detail the steps for containment, eradication, and recovery and protocols for communicating with stakeholders during a cyber incident.

Robust Security Architecture

Developing a robust security architecture involves designing networks and systems with security as a core principle. This includes firewalls, intrusion detection systems, and secure network architectures to protect against external and internal threats.

Collaboration with Cybersecurity Experts

Partnering with cybersecurity experts and consultants provides access to specialized expertise and insights. These experts can offer guidance on the latest security trends, threat intelligence, and best practices for maintaining a strong cybersecurity posture.

Conclusion

The rise of the digital insurance industry brings many cybersecurity challenges requiring immediate and ongoing attention. The industry faces various cyber threats, from phishing attacks to sophisticated APTs, each carrying significant risks. Implementing robust cybersecurity measures, including regular security assessments, employee training, advanced threat detection systems, and collaboration with cybersecurity experts, is necessary and a strategic imperative for insurance companies operating in the digital realm. Looking ahead, the digital insurance industry must evolve its cybersecurity strategies to keep pace with the ever-changing threat landscape. This involves investing in technology, infrastructure, and human capital, implementing cybersecurity testing protocols and vigilant against potential threats. Maintaining a solid cybersecurity posture as the industry grows and transforms will protect sensitive data, preserve customer trust, and ensure digital insurance services’ long-term viability and success.

Why Partner with TestingXperts for Cybersecurity Testing Services?

In the rapidly evolving digital insurance industry, cybersecurity is not just a technical requirement but a critical business requirement. TestingXperts is a leading cybersecurity testing service provider. that protects digital insurance companies against cyber threats. Our expertise, innovative approaches, and deep understanding of the unique challenges faced by the industry enable us to ensure that your cybersecurity measures are not only robust but also tailored to the specific needs of the digital insurance sector.

• We have a team of QA professionals with extensive knowledge and experience in cybersecurity and the insurance industry. This dual expertise enables us to offer solutions that are not just technically sound but also aligned with the specific requirements and regulations of the insurance sector.

• We employ state-of-the-art testing methodologies, including penetration testing, vulnerability assessments, and ethical hacking, to uncover and address potential security threats before they can be exploited.

• Recognising that each organisation has unique needs, TestingXperts provides customised cybersecurity solutions. We work closely with our clients to understand their specific challenges and customise our services accordingly.

• We offer continuous monitoring and support to ensure that cybersecurity measures remain effective against evolving threats.

• With ever-changing regulations in the digital insurance industry, TestingXperts stays up-to-date on the latest developments to ensure that our clients’ cybersecurity strategies comply with current laws and standards.

To know more, contact our cybersecurity experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info