It is a fact that the banking sector is on cybercriminals’ top hit list because of its sensitive nature. It holds a vast amount of money and other valuable assets in the form of data. As users shift towards the digital economy, cyber security in the banking sector has become a major concern for financial institutes globally. The traditional security measures are no longer effective to safeguard against sophisticated hacking attacks. According to statistics, cyberattacks in the financial sector reached 238% globally. It shows the rising need for advanced cyber security solutions to identify and neutralize threats early and effectively. Its effectiveness will directly influence the safety of PII in case of an unintentional breach or during a well-planned cyberattack. That’s where artificial intelligence (AI) comes in.

Business owners realize that the stakes are high in the banking and financial sectors, as money and other valuable assets are at risk. A security fault can compromise banking systems and lead to significant upheaval. AI steps in as an ally of the banking sector to implement cyber security practices. But how can AI transform cyber security capabilities for banking and financial data security? Today, in this blog, we will look into how AI is transforming cybersecurity in the banking sector to ensure it is more secure than ever.

Cyber Security in Banking

The connection of methods, protocols, and technologies that build up cyber security is the set of procedures to guard against damage, hacking, attacks, malware, viruses, and unauthorized access to data, networks, programs, and devices. In the banking sector, securing user’s assets is the primary responsibility. People are becoming cashless as they adopt online transactions, which will rise in the future. As more people conduct digital payments via credit/debit cards, mobile payment apps, etc., it becomes a necessity for banking institutes to protect these methods by cyber security. However, the traditional methods alone are not enough. Cybercriminals use complex methods like advanced persistent threats (APTs), dynamic ransomware that evolves with every breach, and phishing to penetrate security defenses.

Current State of Cyber Security

Generally, banks secure their networks using a combination of IDS, manual monitoring, and firewalls. Although these methods have been effective in the past, they can’t handle the rapidly evolving cyber threat landscape, which can easily penetrate these defenses. Talking about the market for IT security in banking, it has maintained its rapid growth in 2024. As the finance sector is always a primary target of cybercriminals, investments in maintaining security protocols are growing steadily. Also, its market value is projected to reach $195.5 billion by 2029. But, as we know, hackers will continuously develop and deploy new techniques to exploit vulnerabilities, which makes it necessary for banking and financial institutes to invest and work on advanced cyber security approaches.

How is AI Changing the Cyber Security Landscape in Banking?

According to statistics, AI-powered fraud detection could save banks $10 billion annually. Businesses know that AI can transform banking operations by analyzing large datasets, identifying patterns, and making accurate predictions. According to a survey by The Economist Intelligent Unit, 77% of bankers believe that unlocking value from AI will differentiate between winning and losing banks. It has the potential to enhance risk management and optimize cyber security measures. AI capabilities to introduce smarter, faster, and more adaptive security measures are crucial in the era where cyber threats are always evolving, becoming more sophisticated and frequent.

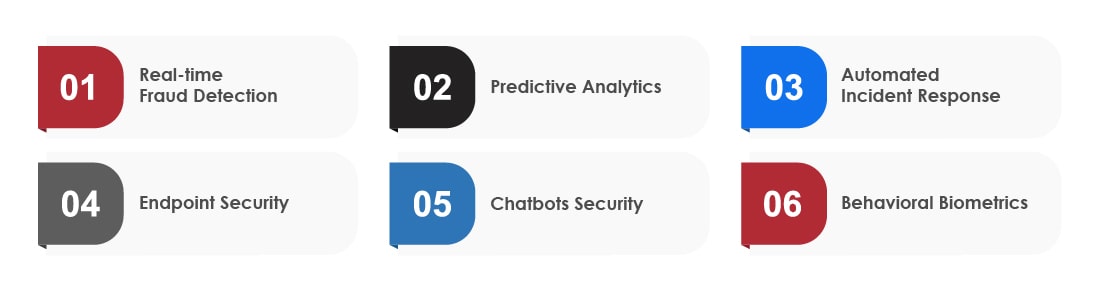

By leveraging ML and data analysis, AI predicts, identifies, and responds to threats faster and more accurately. AI enhances cybersecurity in several ways, which are given below:

Real-time Fraud Detection:

In cyber security, AI tools help identify and prevent cyber fraud in real time and protect sensitive information from breaches. AI-enabled systems learn from each attack and continuously improve their defense protocols. According to a survey, 69% of organizations cannot respond to critical threats without AI. It also allows banking institutes to stay ahead of potential threats by:

• Detecting abnormalities

• Processing data quickly and accurately

• Analyzing and learning from past data to improve continuously

• Identifying potential threats

• Automating alerts regarding new threats before they become unmanageable

Predictive Analytics:

AI utilizes predictive analysis to improve cyber security measures. In this, AI analyses historical data to anticipate and prevent potential hacking incidents before they actually occur. AI identifies anomalies that might lead to a planned attack by analyzing trends and patterns from past incidents, allowing banks to deploy security protocols to improve their defenses.

Automated Incident Response:

AI detects and responds to the identified threats. Its automated incident response system isolates the infected devices, blocks malicious IP addresses, and implements mitigation measures without manual support. This level of automation speeds up response times and reduces the workload on security teams as they focus on priority and complex tasks.

Endpoint Security:

AI-powered endpoint security systems protect individual devices like computers, smartphones, etc. They identify and thwart fraud activities at the device level, which is important for banking employees accessing sensitive data from different devices and locations.

Chatbots Security:

Banks nowadays utilize chatbots for customer support. So, ensuring chatbot security is necessary to prevent cyber threats. The AI-enabled chatbot would allow banks to monitor and analyze conversions and identify security threats that might arise during the process.

Behavioral Biometrics:

It records and analyzes user behavior (the way and manner of handling devices and body movements). AI-powered behavioral biometrics considers the keystroke dynamics, navigation patterns, and mouse movements. If it detects any deviation from usual behavior, it will trigger an alert, giving early warning regarding insider threats or account hacks.

Challenges and Solutions in AI Deployment

Despite the significant role of AI in enhancing banking cyber security, it comes with a set of challenges. AI predictions depend on the quality and quantity of data available, and banks need to ensure their AI systems are trained with up-to-date and comprehensive datasets to avoid false positives, bugs, and errors. As AI becomes widely accepted by financial institutes, cybercriminals are too beginning to utilize AI to create more sophisticated hacking attempts. This is a significant challenge for security professionals, keeping banks on their toes to continuously upscale their AI systems. Let’s take a look at some of the significant challenges in AI deployment:

Data Privacy and Security:

AI implementation requires access to data, which raises concerns about privacy and security breaches. To mitigate this challenge, banks should develop robust data encryption and anonymization techniques that protect their integrity while deploying AI. Also, having a zero-trust security framework would ensure all users (inside-out) must verify their identity and have access to particular information based on their role. Security audit of AI implementations, especially in the case of LLMs, should be conducted at all phases, from design till implementation and continuous operations to ensure AI models are configured correctly and do not, inadvertently, disclose or expose sensitive data or information.

Integration with Old Systems:

Most banks still operate on legacy systems incompatible with the latest AI technologies. This makes it difficult to upgrade the existing systems, which might make them a potential target for hackers. Banks can deploy phased integration strategies for implementing AI solutions alongside legacy systems. It will facilitate a smooth transition to AI-based systems with minimal disruption. They should also invest in middleware to support old and new systems integration.

Skill Issues:

The workforce skill gap is one of the significant challenges in AI deployment and its application in cybersecurity. Banks should focus on upskilling their workforce knowledge by investing in training and development programs. Collaborating with third-party AI professionals like Tx to enhance cybersecurity auditing and testing is also recommended.

High Costs:

The high upfront costs of implementing AI in cyber security would prevent some banks from adopting this technology. To mitigate this challenge, they should opt for scalable AI solutions to start small and expand as they experience its benefits. Partner with cybersecurity auditing and testing service providers that utilize AI solutions to manage finances and share expertise.

How can Tx Help with AI Integration with Cyber Security?

As banking organizations strive to upscale their cyber security measures, they will look for innovative solutions like AI/ML. Tx, a leading AI and cyber security testing company, implements comprehensive QA strategies to ensure the robustness of your security measures. By partnering with Tx, you can expect:

• A talented pool of Highly Skilled and Globally Certified Cyber Security Professionals with years of expertise delivering security auditing and testing services. Other certifications that our team has include CISSP, CISM, CAP etc.

• In-house security testing accelerator Tx-Secure makes security testing quicker, result-oriented, and seamless.

• Our security advisory assists in providing appropriate solutions to your AI Security and general cybersecurity needs.

• 30+ years of collective experience in utilizing various tools to provide intelligent automation solutions to handle AI testing complexities.

• Ability to harness AI for cyber security testing using in-house accelerators, enabling the delivery of advanced security measures tailored to your banking needs.

Summary

The banking sector, increasingly targeted by cybercriminals due to its sensitive data and financial assets, is urgently upgrading its cybersecurity measures. Traditional security strategies need to be revised against sophisticated cyberattacks. AI addresses cyber security challenges by providing essential solutions like real-time fraud detection, predictive analytics, automated incident responses, and endpoint security. It enhances the efficiency and accuracy of cyber security measures and helps regulate compliance and gain customer trust. However, integrating AI poses challenges such as data privacy, system compatibility, workforce skills, and high initial costs. Tx offers comprehensive solutions to these challenges, aiding banks in seamlessly integrating AI to fortify their cybersecurity defenses, thus ensuring a safer banking environment.

Discover more

Get in Touch

Stay Updated

Subscribe for more info