- Understanding Cybersecurity Threats for Black Friday

- Payment Gateway Vulnerabilities: What’s at Stake

- Essential Cybersecurity Services for Payment Gateways

- Cybersecurity Acts in the US, UK, and Canada

- Key Tips for Strengthening Black Friday Cybersecurity

- How Prepared Companies Benefited Last Black Friday

- Conclusion: Cybersecurity as a Long-Term Investment

As Black Friday approaches, businesses look forward to massive sales and unprecedented traffic, however, there’s a darker side to this digital gold rush: cyber threats. In 2022 alone, retail cybercrime surged by 30% during Black Friday weekend with 62% of businesses reporting cybersecurity incidents related to payment gateways. This peak in cyber activity has made Black Friday a profitable hunting ground for hackers.

With more customers shopping online, payment gateways have become the prime targets. One breach can result in millions of dollars in lost revenue and also erode customer trust, potentially wiping out business. It is more important than ever to ensure that your payment systems are fortified against cyber threats, making robust cybersecurity a non-negotiable investment.

Understanding Cybersecurity Threats for Black Friday

The sheer volume of online transactions during Black Friday increases the risk of cyberattacks. Businesses face threats ranging from DDoS attacks (leading the system to crash) to phishing schemes designed to forge customer credentials. Payment gateways are primarily vulnerable because of the sensitive data they process – the credit card details, personal information, and transaction histories serve as goldmines for criminals.

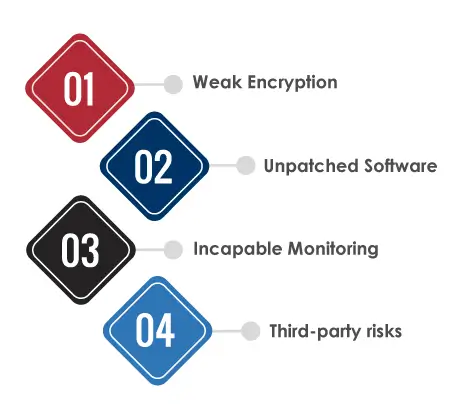

Payment Gateway Vulnerabilities: What’s at Stake

Payment gateways are digital channels for sensitive data during transactions. Here’s the reason they are at risk:

- Weak Encryption – If sensitive data is not encrypted properly, it becomes easy for attackers to intercept.

- Unpatched Software – Older software versions have the possibilities of vulnerabilities that hackers exploit.

- Incapable Monitoring – Without real-time monitoring, attacks may go unnoticed until it is too late.

- Third-party risks: Gateways that are highly dependent on third-party services may inherit security flaws from those partners.

In the case of a breach, businesses encounter penalties, compliance issues, and lose trust.

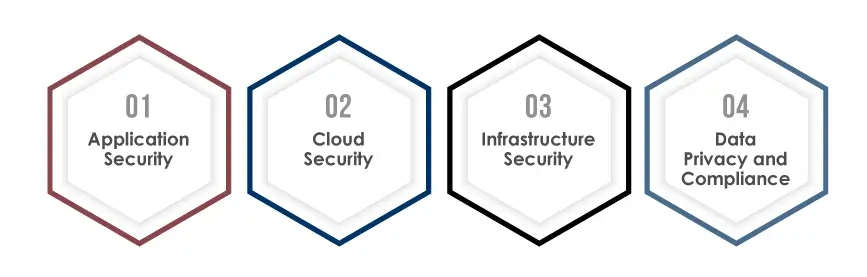

Essential Cybersecurity Services for Payment Gateways

In order to safeguard payment systems, it is important for businesses to invest in key cybersecurity services covering all the layers of their digital infrastructure:

Application Security

The applications driving your payment gateway need to consistently be scanned for vulnerabilities like cross-site scripting, SQL injections, and insecure configurations. Security testing tools powered by AI can enhance the process, recognizing weaknesses faster and more accurately than manual methods.

Cloud Security

A lot of modern payment systems heavily rely on cloud-based infrastructure. Make sure your cloud environments are configured securely to avoid unauthorized access and data leaks. Using multi-factor authentication (MFA) and encryption is a must to safeguard the cloud-based payment data.

Infrastructure Security

Your business’s network infrastructure serves as the foundation of all operations. Implement firewalls, network segmentation, and intrusion detection systems to limit access to the sensitive areas of your system.

Data Privacy and Compliance

With data privacy laws such as GDPR in the UK and EU and CCPA in the US, businesses are compelled to protect customer information. Maintaining data encryption and securing consent before gathering data ensures compliance. AI-driven data privacy monitoring tools can identify the policy violations in real-time.

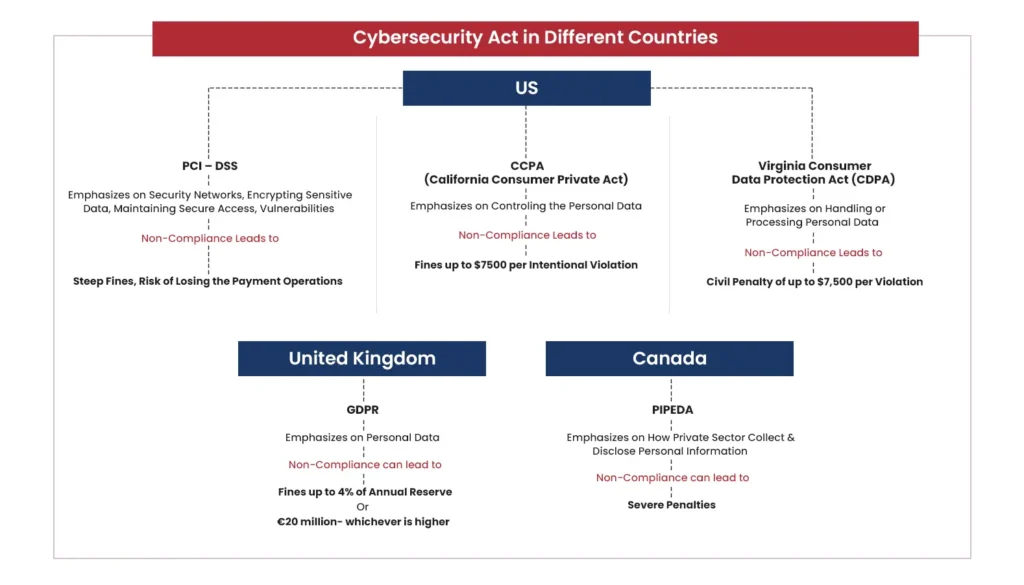

Cybersecurity Acts in the US, UK, and Canada

The Importance of Cybersecurity Compliance

In the digitally growing sphere, adhering to cybersecurity laws is about safeguarding your business from devastating breaches and earning the trust of your customers. A report from IBM’s cost of Data Breach 2023 stated that the average cost of a data breach reached $4.45 million globally, with companies lining huge penalties for non-compliance. With major events like Black Friday driving huge online traffic, businesses in the US, UK, and Canada need to ensure they are aligned with the cybersecurity guidelines to protect both their payment systems and customer data.

Each country enforces different regulations that companies shall follow to secure their operations. Be it preventing data theft or complying with the strict privacy laws, businesses need to be vigilant and proactive in meeting these legal standards.

United States: PCI-DSS & CCPA

In the US, businesses encounter two critical standards and regulations that ensure cybersecurity and data privacy are maintained, specifically for companies handling financial transactions and sensitive customer data.

PCI-DSS (Payment Card Industry Data Security Standard) – This standard outlines specific requirements for securing credit card transactions. It is important for any business that stores, processes, or transmits cardholder data to ensure it is PCI-DSS compliant. Failure to comply may result in steep fines and the risk of losing the ability to process payments, potentially crippling your operations. PCI-DSS emphasizes securing networks, encrypting sensitive data, maintaining secure access, and continuously monitoring systems to detect vulnerabilities.

CCPA (California Consumer Privacy Act) – Though it is focused on businesses dealing with California residents, the CCPA has a broad impact, especially during global sales events like Black Friday. The act offers consumers more control over their personal data, needing businesses to disclose what data is gathered, how it is used, and the audience with whom it is shared. Companies should also provide options for consumers to choose data collection or delete their information completely. Non-compliance with CCPA can lead to fines of up to $7500 per intentional violation, making it important for businesses to comply.

Virginia Consumer Data Protection Act (CDPA) – The Virginia Consumer Data Protection Act (CDPA), which came into effect on January 1, 2023, is a significant cybersecurity and privacy law aimed at protecting the personal data of Virginia residents. The law applies to companies that control or process data of at least 100,000 consumers annually or derive more than 50% of their revenue from selling personal data of at least 25,000 consumers. It emphasizes consumer rights, including the right to access, correct, delete, and opt-out of data processing, especially for targeted advertising purposes. Furthermore, the CDPA mandates that companies implement reasonable data security practices to protect against data breaches, holding them accountable for the unauthorized access or misuse of consumer information.

United Kingdom: GDPR

The General Data Protection Regulation (GDPR) is broadly regarded as one of the harsh data privacy laws in the globe, designed to protect individual’s personal data and give them control over it. For businesses operating in the UK, GDPR is non-negotiable.

Non-compliance can result in fines of up to 4% of annual global revenue or €20 million- whichever is higher.

Key GDPR requirements for businesses include:

- Data Transparency: Businesses need to clearly apprise users of how their data is stored, collected, and used.

- Consent Management: Companies need to gain consent from users before collecting the data.

- Right to Be Forgotten: Users need to be given the authority to request that their personal data can be deleted.

- Data Security: Personal data must be encrypted, and security measures must be in place to prevent breaches. Businesses are also required to report data breaches within 72 hours.

For businesses handling Black Friday sales, complying with GDPR is critical, especially with the sheer volume of personal data processed during transactions.

Canada: PIPEDA

In Canada, businesses are governed by the Personal Information Protection and Electronic Documents Act (PIPEDA). PIPEDA regulates how private-sector organizations collect, use and disclose personal information during commercial activities. The companies operating in Canada need to comply with this act or risk serious penalties.

Key PIPEDA principles include:

- Accountability: Businesses are responsible for safeguarding the data they collect and need to ensure it is used for the intended purposes.

- Limiting Collection: Organizations can only collect personal information required for the identified purposes and shall obtain meaningful consent before collecting any data.

- Safeguards: Businesses need to implement strong data protection from breaches. This includes encrypting sensitive data and restricting access to the authorized personnel.

The penalties for non-compliance can be severe, and the damage to your reputation if found in breach of PIPEDA can be more detrimental. The act is designed to give consumers control over their personal data, and with the high volume of transactions during Black Friday, ensuring compliance with PIPEDA is important.

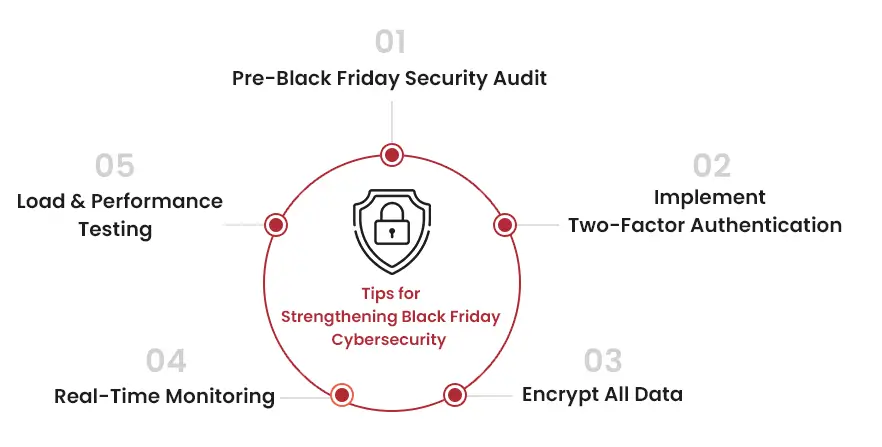

Key Tips for Strengthening Black Friday Cybersecurity

- Perform a Pre-Black Friday Security Audit: Review your payment systems, security practices for vulnerabilities, and network infrastructure.

- Implement Two-Factor Authentication (2FA): Ensure both customers and employees use 2FA to secure their accounts.

- Encrypt Everything: From transaction data to personal information, encryption minimizes the risk of stolen data being misused.

- Monitor Real-Time: Use AI-based tools to monitor transactions and detect unusual behavior in real-time, preventing attacks before they escalate.

- Load & Performance Testing: Ensure your payment systems can handle the traffic surges on Black Friday. Load testing helps prevent system crashes, while performance testing ensures your application operates smoothly during high demand.

How Prepared Companies Benefited Last Black Friday

The businesses that prioritized cybersecurity saw huge returns last Black Friday. They invested in advanced threat monitoring systems and load testing and reported no downtime during peak hours. This led to 20-30% higher sales compared to competitors who face outages or security breaches. Companies with robust encryption and compliance measures enjoyed a boost in customer confidence and repeat sales.

How Tx Can Secure Your Business for Black Friday

At Tx, we specialize in Cybersecurity advisory services tailored for businesses looking forward to securing their operations during critical periods like Black Friday. Our services cover all the aspects of cybersecurity, from application security to data privacy, ensuring your business is secure from threats at every level.

Tx-Secure: Your Accelerator for PCI-DSS Compliance

Tx-Secure, our cybersecurity accelerator, comes with pre-built PCI-DSS compliance capabilities.

By integrating Tx-Secure into your payment system, you’ll be assured that your on-prem or on-cloud infrastructure remains secure and compliant with industry standards. Beyond compliance, Tx-Secure uses AI-driven analytics to regularly monitor your systems, flagging vulnerabilities in real-time and automatically updating compliance measures as new threats emerge.

Conclusion: Cybersecurity as a Long-Term Investment

With the businesses gearing up for Black Friday, securing payment gateways against cyber threats is not just a temporary fix, but a long-term investment in trust, reputation, and revenue. The cost of prevention is always lower than the price of recovery from a breach. By following industry best practices, adhering to cybersecurity acts, and employing robust security testing services, the businesses can ensure a successful Black Friday but also a secure digital future.

Investing in cybersecurity today safeguards your bottom line tomorrow. At Tx, we’re here to help guide you every step of the way, ensuring that your systems remain compliant, fortified, and ready for whatever challenges do come.

Let’s make this Black Friday not just a profitable one—but a secure one.

Discover more

Get in Touch

Stay Updated

Subscribe for more info