- Why does your Financial System need an Automation Strategy?

- Designing an Effective Automation Strategy

- Implementing Automation for Financial Organizations

- Challenges and Considerations of Implementing an Automation Strategy

- Conclusion

- How can TestingXperts help you with Automation Testing of your Financial System?

When your financial organization launches a fresh application, your aspirations include smooth sailing. Your goal is to ensure a user experience that’s incredibly intuitive and as effortless as a routine. Your aim is to witness a surge in customer engagement with the app.

Moreover, you aspire for amplified social media appreciation, heightened five-star online evaluations, and a flurry of favourable media coverage, all showcasing your brand in a positive light across diverse platforms.

Above all, it’s crucial to uphold your customers’ trust, ensuring the safeguarding of their Personally Identifiable Information (PII) against cyber threats and data breaches, all the while delivering a product that remains consistently dependable.

The testing phase for your application holds equal significance to the development of your banking software. Notably, automation testing yields more informative outcomes within a compressed timeframe, ensuring a launch devoid of unpleasant surprises.

This blog elucidates the significance of automation testing in maintaining the reliability, security, and stability of financial systems.

Why does your Financial System need an Automation Strategy?

For those overseeing a financial system, the paramount importance of reliability and stability is evident. Downtime comes at a high cost, impacting both financial aspects and the reputation of your enterprise. Automated systems play a pivotal role in enhancing reliability and stability. They diminish the reliance on manual intervention and ensure a consistent user experience.

Though automation presents numerous advantages, it’s imperative to understand that an automation strategy isn’t a one-time fix. To maximize your returns on investment, meticulous consideration is required regarding the selection of processes to automate, the implementation of automation, and ongoing monitoring and upkeep.

Crafting a well-executed automation strategy can significantly enhance the reliability and stability of your financial system, all while streamlining operations and saving valuable resources.

Ensuring reliability, security, and stability of financial systems

Automation testing plays a pivotal role in ensuring the unwavering reliability, robust security, and unshakeable stability of financial systems. In the intricate realm of financial management, where precision and accuracy are paramount, automation testing offers the advantage of systematically detecting and rectifying vulnerabilities and glitches. By subjecting complex financial applications to automated testing processes, organizations can pinpoint potential risks before they manifest as operational disruptions or compromise sensitive data.

This proactive approach not only minimizes the chances of costly downtime but also safeguards the trust and confidence of stakeholders. In the dynamically evolving landscape of financial technology, where the stakes are high, embracing automation testing is essential to fortify the foundation on which financial systems operate, elevating them to levels of performance that instill unwavering trust and satisfaction among users and clients alike.

Cost and reputation implications of system downtime

Automation testing serves as a formidable defense against the considerable cost and reputation implications stemming from system downtime in the realm of financial systems. In an industry where even, a brief interruption can lead to substantial financial losses and erode the trust of clients, automation testing acts as a proactive measure to identify potential issues before they escalate into critical failures. By simulating real-world scenarios and executing comprehensive tests, automation not only detects vulnerabilities that could lead to downtime but also expedites the remediation process.

This timely intervention not only saves precious financial resources that would otherwise be drained by system outages but also shields the organization’s reputation from the negative fallout associated with service disruptions. The result is a more resilient financial infrastructure that not only safeguards financial interests but also preserves the brand’s credibility and goodwill in a competitive and demanding marketplace.

Advantages of automation in enhancing system performance

Automation testing emerges as a catalyst for enhancing system performance within the domain of financial management systems. The intricate nature of financial operations demands seamless and optimized software functioning, and automation testing plays a critical role in achieving this goal. By subjecting various components and functionalities to rigorous testing scenarios, automation identifies bottlenecks, inefficiencies, and potential resource constraints that might otherwise hamper system performance.

This meticulous scrutiny allows for timely fine-tuning and optimization, resulting in a financial management system that operates at peak efficiency. As automation testing continuously monitors the system’s performance under different conditions, it not only ensures consistent operation but also contributes to identifying areas for further enhancement. Ultimately, the symbiotic relationship between automation testing and system performance cultivates an environment where financial operations unfold with precision, reliability, and the agility required to excel in the dynamic financial landscape.

Designing an Effective Automation Strategy

An effective automation strategy serves as the cornerstone of successful automation testing within the context of financial management systems. To orchestrate a strategy that maximizes benefits and aligns seamlessly with organizational goals, several crucial components warrant careful consideration.

Selection of Processes Suitable for Automation:

Determining which processes to automate is a critical initial step. Not all processes are equally well-suited for automation, and selecting the right ones is crucial. Complex, repetitive, and time-consuming tasks are prime candidates for automation. This might include tasks related to transaction processing, data reconciliation, regulatory compliance checks, and more. Prioritizing these processes ensures that automation efforts yield the highest returns by optimizing efficiency and reducing human error.

Identifying Key Metrics for Measuring Success:

Clear success metrics are essential for quantifying the impact of automation. These metrics should align with the organization’s objectives, whether they pertain to reduced operational costs, increased system reliability, faster time-to-market, or enhanced customer satisfaction. By establishing benchmarks and tracking progress, organizations can objectively evaluate the impact of automation on their financial management systems.

Integration with Existing Testing Methodologies:

An effective automation strategy seamlessly integrates with existing testing methodologies. This involves assessing the current testing framework, tools, and practices in place and determining how automation fits within this ecosystem. Integration ensures that automated testing becomes a cohesive part of the testing lifecycle, streamlining processes and fostering collaboration between development and testing teams.

By addressing these key points within the design of an automation strategy, financial organizations can forge a path towards a more optimized, efficient, and reliable financial management system. This strategic approach not only maximizes the benefits of automation but also ensures a cohesive and sustainable implementation throughout the organization’s testing endeavors.

Implementing Automation for Financial Organizations

The successful implementation of automation testing within financial management systems involves a systematic approach that encompasses various elements critical to its effectiveness. By carefully navigating these components, organizations can ensure a smooth transition to automated testing methodologies that yield improved efficiency and reliability.

Tools and Frameworks for Automation Testing:

Selecting the right tools and frameworks is pivotal to the success of automation testing. There is a multitude of options available, ranging from open-source tools to commercial suites, each tailored to specific testing needs. These tools offer functionalities such as script development, test execution, result reporting, and integration with other testing components. The choice of tools should align with the organization’s technology stack and testing requirements.

Establishing Testing Environments and Data Sets:

Creating and maintaining accurate testing environments and data sets is essential for meaningful automation testing. These environments should closely mirror production setups, ensuring that tests accurately replicate real-world scenarios. Additionally, having realistic and diverse data sets allows for thorough testing of different scenarios and edge cases. This accuracy in environments and data enhances the reliability and relevance of automated tests.

Collaborative Efforts between Development and Testing Teams:

A successful automation implementation hinges on effective collaboration between development and testing teams. Clear communication is vital in defining the scope, objectives, and expectations of automated tests. Collaboration ensures that automated tests align with the system’s evolving features and functionalities. It also fosters an environment where the testing team provides valuable insights for improving test coverage and identifying critical areas for automation.

Challenges and Considerations of Implementing Automation Strategy

While automation testing offers numerous benefits, its successful implementation within financial management systems is not without its challenges and considerations. By proactively addressing these factors, organizations can navigate potential obstacles and make informed decisions that contribute to the seamless integration of automation into their testing processes.

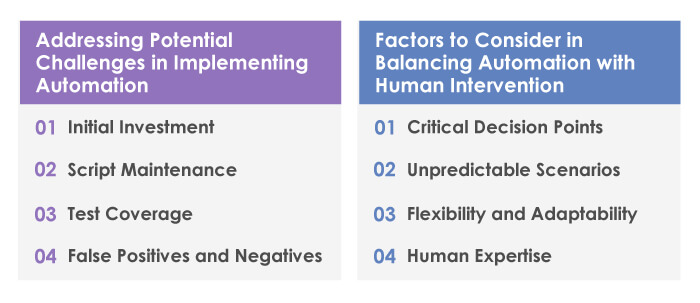

Addressing Potential Challenges in Implementing Automation:

Implementing automation can introduce challenges that need to be addressed. Some of these challenges include:

Initial Investment:

Automation requires an initial investment in terms of time, resources, and training. Organizations must allocate resources for tool selection, training, and developing robust automated test scripts.

Script Maintenance:

Automated tests need regular updates to accommodate changes in the application. As the system evolves, maintaining and updating scripts to reflect new features or functionalities can be resource intensive.

Test Coverage:

Ensuring comprehensive test coverage can be complex, especially in intricate financial systems. Identifying all possible scenarios and edge cases for automation requires careful planning and strategy.

False Positives and Negatives:

Automated tests may produce false positives (incorrectly flagging a valid scenario as an issue) or false negatives (failing to detect an actual issue). Addressing and minimizing such occurrences is crucial to maintain the reliability of automated tests.

Factors to Consider in Balancing Automation with Human Intervention:

Striking the right balance between automation and human intervention is essential for an effective testing strategy. Key considerations include:

Critical Decision Points:

Certain testing scenarios, especially those involving complex business logic or critical decision-making, may necessitate human intervention. Identifying these critical points ensures the preservation of accurate judgment in testing.

Unpredictable Scenarios:

Some scenarios might be unpredictable or require manual exploration due to their unique nature. Determining when to rely on automated tests and when to involve human testers is vital to ensure thorough coverage.

Flexibility and Adaptability:

Balancing automation with human intervention requires a flexible approach that can adapt to evolving system dynamics. Regular reviews and adjustments in the balance are essential to align with changing business requirements.

Human Expertise:

Human testers possess domain expertise, creativity, and critical thinking that can uncover nuanced issues that automated tests might miss. Incorporating this expertise into the testing process ensures a more comprehensive evaluation.

Navigating these challenges and considerations requires a strategic and well-informed approach. By understanding the intricacies involved and making informed decisions, financial organizations can establish a harmonious balance between automation and human intervention, resulting in robust and effective testing methodologies.

Conclusion

In the ever-evolving landscape of financial management, where accuracy, reliability, and security are paramount, the role of automation testing has emerged as a transformative force. This exploration into the realm of automation testing for financial management solutions underscores its indispensable significance. By meticulously designing effective strategies that encompass process selection, key metrics identification, and integration with existing methodologies, organizations can harness the power of automation to elevate their systems’ performance.

How can TestingXperts help you with Automation Testing of your Financial System?

TestingXperts offers a comprehensive suite of services tailored to assist you in the automation testing of your financial system. Our expertise in automation testing, combined with deep insights into the intricacies of financial management, ensures a robust and efficient testing process that aligns seamlessly with your organizational goals.

Incorporating TestingXperts’ automation testing services into your financial management solution ensures a robust, efficient, and reliable testing process. With our dedicated team of experts and a proven track record in automation testing, you can navigate the complexities of financial systems with confidence, ensuring optimal performance and maintaining the trust of your clients and stakeholders.

Discover more

Get in Touch

Stay Updated

Subscribe for more info