Table of Contents

- How do APIs Work in FinTech?

- Use Cases of API Integration in FinTech

- Benefits of API Integration in FinTech

- Conclusion

- Why Partner with TestingXperts for API Testing?

The financial industry is witnessing a rapid digital revolution with the fusion of technology and finance, also known as FinTech. It is restructuring how financial services are delivered and digitally transforming traditional banking practices. API integration is one such technology trend that’s addressing the rising demand for interconnected and efficient financial services. APIs are becoming the backbone of modern FinTech practices, allowing the seamless integration of multiple financial services, leading to an agile, customer-friendly business environment.

The rise in API integration into the FinTech industry depends on various factors, such as the shift towards digital banking, which necessitates implementing interconnected systems into financial services. APIs make it possible by enabling multiple services and software to communicate effectively, filling the gap between traditional banking practices and FinTech innovations. APIs also facilitate the implementation of electronic payment systems, enabling secure and seamless transactions across multiple platforms. According to a report, in Europe, API marketplace growth will grow at a CAGR of 17.4% till 2030. This trend is supported by digital payments becoming more common, and the API platforms supporting this transition are in high demand. But for a successful API integration, businesses need a robust and scalable testing strategy that could provide them with better ROI.

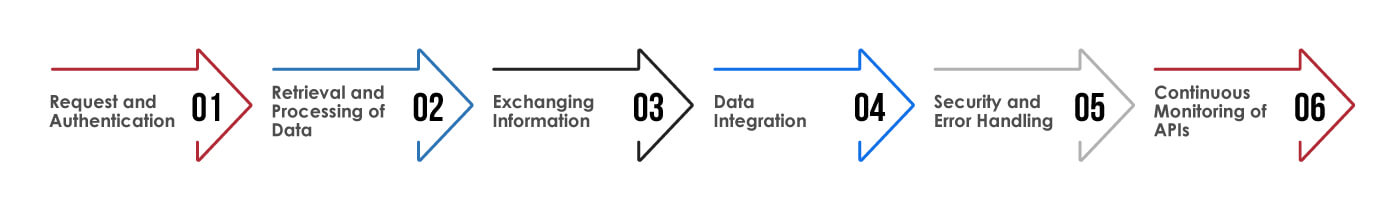

Before knowing how FinTech APIs work, let’s understand what these are and why they exist. FinTech or banking APIs are the standardized protocols that enable secure communication between mobile devices and bank servers. They allow users to connect with banking personnel through a mobile app and a stable internet connection. Let’s take an example of a finance application. It uses Open Banking API to connect with the bank and fetch the user account balance in real-time. The complex process that allows such procedures to work seamlessly depends on APIs’ advanced functionalities. Now let us look into how APIs work in FinTech:

Step-1 Request and Authentication:

When a user performs an online transaction or uses a FinTech application, a request is generated. Then the banking API asks for authentication to ensure security, which includes passwords, tokens, keys, fingerprints, or other credentials to verify the user’s permission and identity.

Step-2 Retrieval and Processing of Data:

APIs forward the authentication request to the FinTech server or system, and the data processing starts. It involves accessing databases, calculations, and interacting with third-party services such as payment processors or banks.

Step-3 Exchanging Information:

After the completion of processing and obtaining necessary data, the FinTech application responds back via API. The response includes user information, transaction details and confirmation, financial information, etc.

Step-4 Data Integration:

On the receiving end, the mobile application integrates data into the user interface to display the details on the screen. The user can verify the details or perform other additional actions such as viewing the remaining balance, checking for transaction details, etc.

Step-5 Security and Error Handling:

API integration requires the implementation of robust security measures like encryption protocols to protect sensitive financial data. Additionally, FinTech APIs have robust error-handling mechanisms to handle incorrect request errors, validation errors, and server failures.

Step-6 Continuous Monitoring of APIs:

The last step in the working of APIs is the continuous monitoring of API-based banking usage. This step is necessary to ensure APIs’ optimal performance and that the integration process adheres to security standards and regulatory requirements.

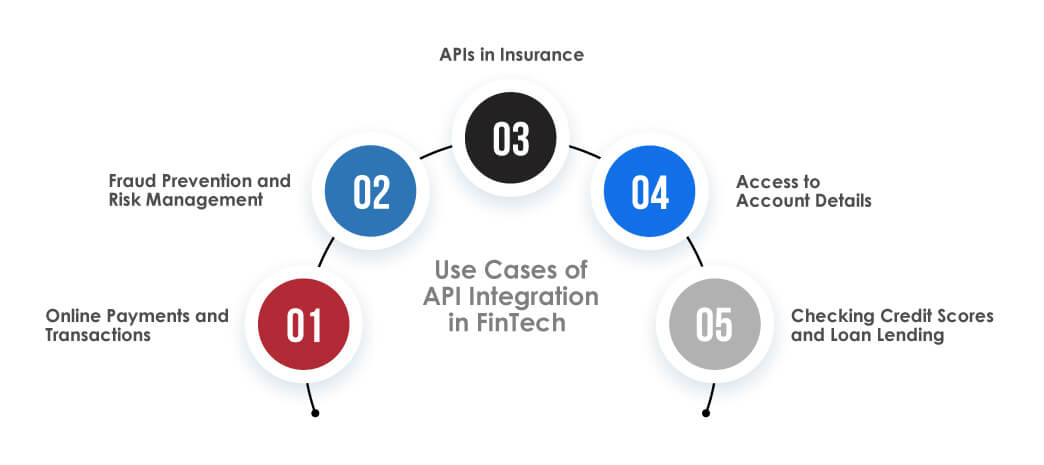

Use Cases of API Integration in FinTech

APIs in FinTech offer numerous benefits to app developers and customers and serve as a crucial aspect in various applications, from ensuring regulatory compliance to enhancing customer experience. Following are some of the use cases of APIs in transforming the financial sector:

Online Payments and Transactions:

APIs in FinTech facilitate online payments and transactions. They enable peer-to-peer money transfers, real-time payments, and various financial transactions in a secure and convenient environment, enabling users to transfer money anywhere in the world seamlessly. For example, PayPal, one of the leading online payment platforms, offers a set of APIs allowing engineers and merchants to accept customer payments.

Fraud Prevention and Risk Management:

One of the important use cases of APIs is that they can integrate with multiple data sources and analytics tools, prevent fraud, and allow businesses to manage and monitor risks more efficiently. FICO, one of the leading credit scoring and analytics software providers, develops APIs that allow businesses to integrate with fraud detection and prevention tools, facilitating real-time monitoring and analytics.

APIs in Insurance:

APIs in the insurance industry help streamline processes and improve customer experience. They also improve the underwriting and claims processing by making them faster and more accurate. For example, Lemonade, one of the leading digital insurance providers, uses APIs to access various data sources (public records and social media data), assess risk, and underwrite policies.

Access to Account Details:

APIs offer real-time access to account details such as balance, transaction history, account statement, and other financial data, allowing businesses and customers to manage their finances and make informed decisions carefully. For instance, Mint, a finance management app, uses APIs to connect with customer’s bank accounts to provide real-time details of their balances and transactions.

Checking Credit Scores and Loan Lending:

APIs can automate loan lending and underwriting processes by allowing financial institutes to check credit scores accurately and quickly in real time and make lending decisions. LendingClub, for instance, is a peer-to-peer lending platform that uses APIs to connect borrowers with investors directly through the platform.

Benefits of API Integration in FinTech

Integrating APIs with the FinTech industry brings various benefits, transforming how financial services operate and improving user experience. They easily cater to the evolving digital transformation needs, providing more agile, user-friendly, and efficient financial services. Following are some of the benefits of API integration into the FinTech industry:

• Integrating APIs with finance processes allows the creation of personalized and seamless financial services. They support real-time account updates, personalized customer support, and much more.

• API Automation and seamless data exchange reduce manual efforts and errors, improving operational efficiency, cost savings, and faster service delivery.

• API integration facilitates the implementation of security measures such as advanced authentication and encryption mechanisms, thus ensuring the privacy and safety of users’ personal and financial data.

• FinTech businesses can develop and deploy new services much faster and facilitate scalability and flexibility in their new business model and offerings.

• APIs automate and streamline the compliance process by allowing finance companies to easily adhere to regulatory requirements and securely handle data reporting and compliance activities.

• APIs allow collaboration between FinTech startups, financial institutions, and other stakeholders, leading to market expansion as they leverage each other’s services to offer advanced services to customers.

Conclusion

The digital transformation of the finance industry, led by FinTech, is changing the delivery process of financial services. API integration is playing a vital role in this transformation by facilitating the rising demand for efficient and interconnected services. APIs enable the integration of various financial services, thus promoting an agile, customer-centric business infrastructure. They are also playing a key role in bridging the gap between the traditional banking and FinTech industry. But in order to successfully integrate APIs within FinTech infrastructure, businesses need a robust and scalable API testing solution. In the modern technological age, it becomes crucial for finance businesses to partner with a reliable QA partner who can help them seamlessly integrate API within their operations.

Why Partner with TestingXperts for API Testing?

For organizations that want to adopt modern architecture including Mobile and Cloud services, investing in API integration is a crucial step. With the architecture following certain protocols, such as XML, SOAP, REST, and others, the big question is, “How do you validate the finance applications?” TestingXperts offers a wide range of API testing services for the FinTech sector, which includes the following:

• Our QA experts check the functionality of individual APIs and test the end-to-end functionality of the API layer.

• Our security testing involves various security checks like authentication, access control, penetration testing, and encryption.

• Our web UI testing offers end-to-end testing of the entire system using the APIs.

• Expertise in a wide range of API protocols like XML, SOAP, JSON, REST, Gdata, YAML, ATOM, RSS, RDF, etc.

• End-to-end application validation experience at various layers of the application.

• Expertise in leading industry tools for API testing for functional, load, and security testing.

• Automation of API test cases.

To know more, contact our QA experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info