- Rising Popularity of the AI Chatbots

- Effective Use Cases of AI Chatbots in the Insurance Industry

- Future of AI Chatbots in the Insurance Industry

- Human Agents and the Chatbots – Where is the Future Leading?

- Why is it Important to Harness the Power of AI Continuous Testing in AI Chatbots?

- Conclusion

- How TestingXperts Can help you with the AI Chatbot Solutions?

Gartner predicts that by 2027, Chatbots are predicted to become the primary customer service channel for a quarter of organizations.The global chatbot market size is expected to reach $9.4 billion by 2024, growing at a CAGR of 29.7% from 2019 to 2024. Navigated by advancement in Natural Language Understanding (NLU), chatbots have become the main principal of digital transformation in customer service, financial services, healthcare by offering intelligent interactions between people and a digital interface.

Moreover, with the rising competition in the insurance sector, customers have a lot many options to choose from. Therefore, if a provider fails to meet their expectations, they will swiftly shift to a competitor. They expect on-demand services and a more personalized experience.

It will be very difficult to imagine having these expectations met with old, complex processes. To foster the gap, insurers across the globe are investing in AI-powered insurance chatbots to better the customer experience. In this blog, we’ll have a look at how chatbots are making a difference in the insurance sector and essential considerations to test AI chatbots for the industry.

Rising Popularity of the AI Chatbots

AI chatbots are becoming increasingly popular globally because they offer a convenient and efficient way for businesses to communicate with their customers. With the rise of messaging apps and social media, customers now expect to be able to interact with companies quickly and easily through these channels. AI chatbots enable companies to provide round-the-clock customer service, handle large volumes of inquiries simultaneously, and provide personalized responses to customers.

AI chatbots are also becoming more advanced and sophisticated, using natural language processing and machine learning algorithms to understand and respond to customer queries in a more human-like manner. This makes them more effective at resolving customer issues and providing a positive customer experience.

In addition, AI chatbots are relatively easy to implement and can be integrated with existing communication channels such as websites, social media, and messaging apps. This makes them an attractive option for businesses of all sizes, from small startups to large enterprises.

Effective Use Cases of AI Chatbots in the Insurance Industry

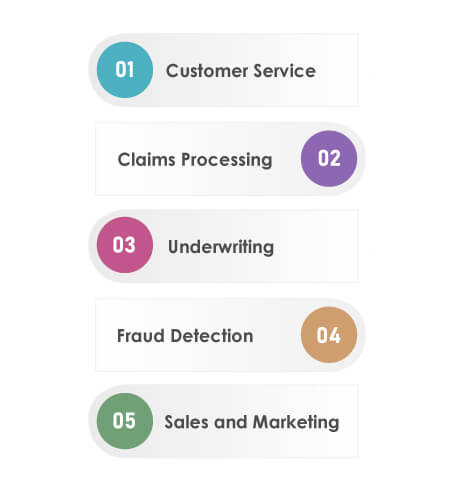

AI-powered chatbots can be used in the insurance industry to improve customer service, automate claims processing, and reduce operational costs. Here are some effective use cases of AI-powered chatbots in the insurance industry:

Customer Service:

AI-powered chatbots can be used to assist customers with policy-related inquiries, such as coverage details, premium payments, and claims processing. Chatbots can provide instant responses to customer queries and can handle multiple conversations simultaneously, thereby reducing wait times and improving customer satisfaction.

Claims Processing:

AI-powered chatbots can be used to automate the claims processing process, from initial claim submission to final settlement. Chatbots can gather information from claimants, process claims, and provide updates on claim status, all without the need for human intervention. This can help insurance companies to reduce processing times, improve accuracy, and lower operational costs.

Underwriting:

AI-powered chatbots can be used to assist underwriters with risk assessment and policy pricing. Chatbots can gather and analyze data from various sources, such as social media, credit reports, and public records, to identify potential risks and calculate policy premiums. This can help insurance companies to improve risk assessment accuracy and reduce underwriting costs.

Fraud Detection:

AI-powered chatbots can be used to detect and prevent insurance fraud by monitoring claims and identifying patterns of suspicious activity. Chatbots can flag potentially fraudulent claims and alert investigators for further review. This can help insurance companies to reduce losses due to fraudulent claims and improve overall profitability.

Sales and Marketing:

AI-powered chatbots can be used to assist with sales and marketing efforts by providing personalized policy recommendations to customers based on their needs and preferences. Chatbots can also be used to generate leads and provide information on new products and services.

Future of AI Chatbots in the Insurance Industry

The future of AI chatbots in the insurance industry is very promising. As the use of AI technology continues to expand across all industries, the insurance industry is no exception. AI chatbots have the potential to revolutionize the insurance industry by providing more efficient and personalized customer service, reducing costs, and improving customer satisfaction.

One area where AI chatbots are already being utilized is in claims processing. By using natural language processing and machine learning algorithms, AI chatbots can understand and process claims faster and more accurately than humans. This can reduce processing time and costs, resulting in more efficient and faster claim settlements for customers.

AI chatbots can also assist customers with policy information, premiums, and coverage options. By providing customers with 24/7 access to information, AI chatbots can help reduce the workload of customer service representatives and improve overall customer satisfaction.

Furthermore, AI chatbots can help insurance companies identify potential fraud and reduce risk. By analyzing data and flagging suspicious claims, AI chatbots can help prevent fraudulent claims and improve the accuracy of risk assessments.

Human Agents and the Chatbots – Where is the Future Leading?

The use of human agents and chatbots in the insurance industry can complement each other to provide customers with a better experience. While chatbots can handle simple and routine customer inquiries, human agents can provide more personalized and in-depth assistance for complex issues. Human agents can also handle sensitive and emotional situations that require empathy and understanding, which chatbots may not be able to provide.

However, the use of chatbots can also help reduce the workload of human agents, allowing them to focus on more complex and high-value tasks. Chatbots can handle routine inquiries, such as policy information and billing inquiries, freeing up human agents to handle more challenging and valuable tasks such as claims processing and risk assessments.The integration of chatbots and human agents can also improve the overall customer experience by providing customers with a seamless and efficient service. Customers can start a conversation with a chatbot and seamlessly transition to a human agent if they require further assistance. This can result in faster response times and a more personalized experience for customers.

The use of human agents and chatbots in the insurance industry can work together to provide customers with a better experience. By combining the strengths of both, insurance companies can improve efficiency, reduce costs, and enhance the overall customer experience.

Why is it Important to Harness the Power of AI Continuous Testing in AI Chatbots?

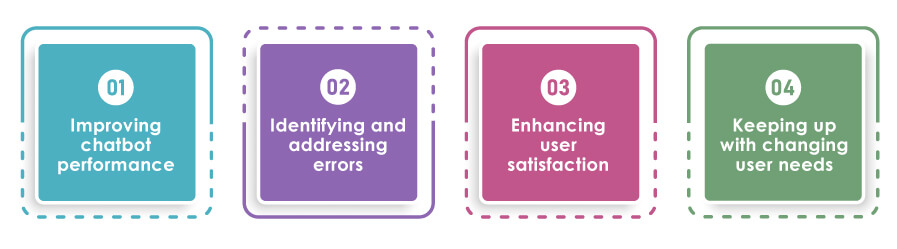

Continuous testing is critical for ensuring the reliability and effectiveness of AI chatbots. AI chatbots use machine learning algorithms to provide automated responses to users, and the accuracy and relevance of these responses depend on the quality of the data and the effectiveness of the algorithm. Here are some reasons why harnessing the power of AI continuous testing is important:

Improving chatbot performance:

AI chatbots need to provide accurate and relevant responses to users to be effective. Continuous testing helps to identify and fix any issues that may impact the accuracy and relevance of the chatbot’s responses. This ensures that the chatbot is performing optimally and providing a positive user experience.

Identifying and addressing errors:

AI chatbots can make errors, and continuous testing helps to identify these errors. By testing the chatbot regularly, you can identify any errors or issues that may impact the chatbot’s performance and address them promptly. This improves the accuracy of the chatbot’s responses and ensures that users receive reliable and relevant information.

Enhancing user satisfaction:

AI chatbots are designed to improve the user experience by providing quick and accurate responses. Continuous testing ensures that the chatbot is meeting the needs of the users and providing the best possible experience. This enhances user satisfaction and increases the likelihood of users returning to the chatbot for future interactions.

Keeping up with changing user needs:

User needs and expectations change over time, and AI chatbots need to adapt to these changes to remain relevant. Continuous testing helps to identify changing user needs and adjust the chatbot’s responses accordingly. This ensures that the chatbot remains useful and relevant to users over time.

Conclusion

The requirement to automate customer experience in the insurance industry is no longer a question. It has become a necessity and an industry standard. AI-based insurance chatbots are one of the most required technological upgrades among the insurers. This helps improve brand engagement, customer loyalty, cut expenses and generate additional income for the company.

For businesses to make this innovation work wonders, you need to deliver a high-end conversational experience which is highly relevant to the customer’s requests.

To know more, how AI solutions are helping insurance companies transform their business and stay relevant, here’s the latest article from our CEO, Manish Gupta, an official member of Forbes Technology Council, detailing how insurers can benefit from AI to improve the processes and stay ahead of the curve.

How TestingXperts Can help you with the AI Chatbot Solutions?

TestingXperts (Tx) is amongst the 5 largest pure-play software testing services providers globally. Tx has been chosen as a trusted QA partner by Fortune clients and ensures superior testing outcomes for its global clientele. Our approach towards AI Chatbot testing makes sure that the major key attributes of the bots work and meet the user expectation as already defined by the organization. Our expertise and real-time customer service helps to achieve the overall operational excellence of the bot as we pay major attention on the key metrics, like NLP score, conversational flow, Bot speed, Bot accuracy, Conversation steps, usability & user experience and more.

Discover more

Get in Touch

Stay Updated

Subscribe for more info