- Data Analytics in Insurance

- Data Types Utilized in Insurance Analytics

- Benefits of Implementing Data Analytics

- Challenges in Adopting Data Analytics

- How does Tx ensure the Seamless Adoption of Data Analytics in Insurance?

- Summary

The insurance value chain is becoming digital, and it is becoming essential for insurers to understand and respond to changing user demands if they want to maintain a competitive advantage. However, this also brings the challenges of inaccurate risk assessment, third-class customer service, and increasing fraud. The solution? Leveraging data analytics in insurers enables insurers to access massive datasets for better decision-making.

They understand that data is the future of business, and they must utilize advanced analytics capabilities to enhance risk assessment accuracy, offer personalized CX, and improve fraud detection time. According to a McKinsey report, the top performers in the insurance sector have outperformed their competitors by leveraging advanced data analytics in the underwriting process. This has added significant value to their operations.

Data Analytics in Insurance

Multiple insurance types make it challenging for clients to understand what suits them the best. Similarly, insurers face challenges in understanding user behavior, policy risk, claim security, and fraud risks. All these factors must be understood before recommending a policy to an end user. Insurers took years to establish direct customer sales and issue insurance policies online while competing on price comparison sites. Yet, the majority of insurers still haven’t achieved this milestone.

With data filtration, using advanced mathematics to analyze and understand user behavior and risk costs has supported the insurance domain. This critical factor enables insurers to enjoy continued stability and profitability. There was a time when organizations used descriptive analytics to analyze past data. But now, as the data grows and customer demands change, this industry requires more. It wants to know what will happen in the future and how their actions will change the outcome using predictive data analytics.

Big data plays a critical role in this, making the insurance sector a perfect example of data analytics usage. It enables insurers to develop basic patterns, get insights into the insurance business, and manage client and agent relations.

Data Types Utilized in Insurance Analytics

When using data analytics in insurance, companies leverage various data types to assess risks, improve their decision-making, and better interact with customers. These types of data can be categorized into three groups.

Structured Data

Highly organized and easy-to-search information that’s stored in databases. Structured data in insurance includes

- Policy details covering information about coverage, premiums, and policyholder demographics.

- Claims history regarding past claims, frequencies, and settlement amounts to assess risk.

- Customer profile details such as age, location, date of birth, etc., for policy customization.

Unstructured Data

Qualitative information without a predefined format but offering valuable insights when analyzed with AI and ML. It includes:

- Customer feedback details on emails, chat transcripts, survey responses, etc., after sentiment analysis.

- Social media interactions consisting of public opinions and trends for understanding market demand and customer sentiment.

- Call center transcripts consisting of conversations with clients revealing service gaps and concerns.

External Data Sources

Leveraging external data sources to optimize risk assessment and insurance pricing models. It includes

- Economic indicators showing interest rates, inflation, and employment rates that can affect policy pricing

- Weather patterns related to natural disaster prediction affecting home and auto insurance policies

- Third-party databases consisting of credit scores, industry reports, and public records supporting fraud detection and risk assessment

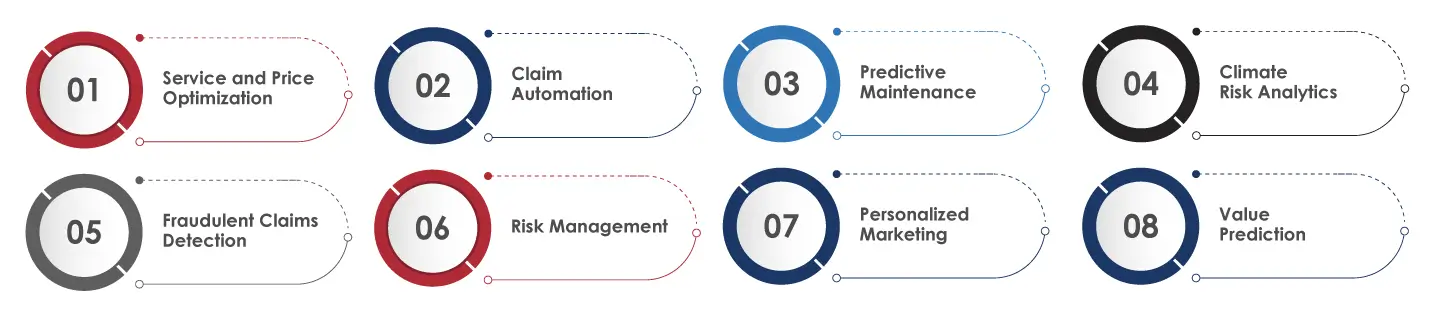

Benefits of Implementing Data Analytics

Insurers are using data to identify and leverage new business opportunities while protecting critical information from risks. Business and customer analytics in insurance is enabling insurers to get insights into user behavior, market trends, competition, risks and regulations, and plans for natural disasters. Following are some of the benefits of leveraging analytics in insurance, showing how companies are adjusting in the digital age to achieve their goals:

Service and Price Optimization

Data analytics helps insurers develop premiums by analyzing market conditions, risk factors, and customer behavior. Insurers can offer more personalized products by knowing user buying preferences and pricing sensitivity. Pay-as-you-go pricing allows dynamic policy adjustments based on real-time behavioral data.

Service and Price Optimization

Insurance data analytics streamlines claims processing through automation. This helps improve efficiency and also reduce costs. Predictive models categorize claims by priority, complexity, and cost, allowing straightforward claims to be approved automatically while high-risk cases undergo expert review.

Predictive Maintenance

Property insurers use predictive maintenance to prevent risks. Insurers use IoT and analytics to notify policyholders about necessary maintenance based on real-time conditions.

Climate Risk Analytics

Advanced data modelling enables insurers to assess climate-related risks and predict financial impacts. Geographic information systems (GIS) help evaluate local hazards, allowing insurers to adjust policy pricing and coverage accordingly. According to reports, more than 70% of U.S. insurance companies follow TCFD-recommended climate risk disclosures.

Fraudulent Claims Detection

Predictive analytics helps identify fraudulent claims by analyzing suspicious patterns and past behaviors. When a claim matches known fraud indicators, the system flags it for investigation, preventing financial losses. ML models continuously improve fraud detection mechanisms, improving accuracy over time.

Risk Management

Real-time analytics enable insurers to detect, analyze, and mitigate risks efficiently. Unlike traditional risk evaluation, modern analytics proactively identify risky claims for further analysis.

Personalized Marketing

Data-driven marketing enables insurers to create customized offers based on demographics, lifestyle, and preferences. Insights from digital platforms inform targeted campaigns, loyalty programs, and customized pricing strategies, boosting customer acquisition and retention.

Value Prediction

Customer Lifetime Value (CLV) analytics help insurers measure long-term profitability and optimize marketing efforts. Insurers can predict cross-buying potential, retention rates, and policy lapses by analyzing behavioral data.

Challenges in Adopting Data Analytics in Insurance

- Inconsistent, incomplete, or outdated data can lead to inaccurate insights and poor decision-making.

- Many insurers still rely on legacy systems that struggle to handle modern data analytics tools.

- Strict data privacy laws (like GDPR) make collecting, storing, and analyzing customer data challenging.

- Setting up advanced analytics requires significant investment in technology, infrastructure, and skilled professionals.

- There is a growing demand for data scientists and analysts, but insufficiently trained professionals fill the gap.

- Merging analytics with existing workflows and systems can be complex and time-consuming.

- Handling large volumes of sensitive customer data increases the risk of cyberattacks and data breaches.

- Employees and decision-makers may hesitate to shift from traditional methods to data-driven decision-making.

- Having data isn’t enough; insurers must know how to turn insights into actionable business strategies.

- Poorly trained AI models can result in biased outcomes, unfair pricing, or inaccurate risk assessments.

How does Tx ensure the Seamless Adoption of Data Analytics in Insurance?

Data analytics and visualization are critical for insurance companies as they require relevant data from complex datasets. Tx offers advanced analytics techniques and visualization tools to convert raw data into informative reports and dashboards. Our expertise in data analytics in the insurance industry will help you uncover hidden opportunities to optimize your business strategy.

- Tx ensures clean, accurate, and reliable data by validating sources, removing inconsistencies, and standardizing formats.

- We assist insurers in transitioning from outdated systems to modern data platforms without disrupting operations.

- We implement secure and compliant data analytics frameworks to ensure adherence to industry standards (GDPR, HIPAA, etc.).

- Our experts validate AI-driven analytics models to ensure unbiased, accurate, and actionable insights for underwriting, pricing, and claims processing.

- We conduct rigorous testing to prevent system failures, security breaches, and data leaks in analytics-driven applications.

- Tx implements automated workflows to enhance efficiency in claims processing, fraud detection, and customer insights.

- We ensure that analytics solutions are scalable and adaptable to evolving business needs and technologies.

Summary

Data analytics transforms insurance by improving decision-making, risk assessment, and CX. Insurers leverage various data types to refine policies, optimize pricing, and detect fraud. However, challenges like outdated systems, data privacy concerns, and skill gaps can hinder its adoption.

Partnering with Tx will ensure seamless data analytics integration in insurance processes by validating data, automating workflows, and implementing secure, scalable analytics solutions. You will gain real-time insights, streamline claims processing, and stay competitive in a rapidly changing insurance ecosystem. To know how Tx can assist you, contact our experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info