- Why ISO 20022 Adoption is Necessary?

- 7 ISO 20022 Business Benefits Banks Can Leverage

- How will ISO 20022 Impact Banks and Payment Industry?

- Why Partner with TestingXperts (Tx) for ISO 20022 Adoption?

- Summary

- FAQs

ISO 20022 migration is a big step for financial institutes towards the transformation of global payments. Its rich and structured data is enabling the banking and payment sector to achieve instant and frictionless payments. This also facilitates a new era of interoperability and automation, leading to improved innovation, customer insights, and efficiency. We all have heard, “Data is the new oil, and like oil, data needs to be refined to know its exact value.”

Financial institutes deal with a lot of sensitive data of payment details, whose current presentation is not up to mark. ISO 20022 standard offers a better approach for banks and payment companies to frame the data in a structured way. Although migrating payment message format is complex, banks can adopt various approaches from a tactical view for enabling compliance to a longer-term view for addressing changes across the entire payment infrastructure.

Why ISO 20022 Adoption is Necessary?

Regulations and standardization are critical in running financial transactions and reporting activity in the banking industry. A global standard helps streamline interoperability between clients and banks and enables a secure and efficient exchange of information. The ISO 20022 financial messaging standard offers flexibility and a globally recognized payment message syntax where financial institutes will use the same message format (MX format) to exchange cross-border transaction details across all currencies.

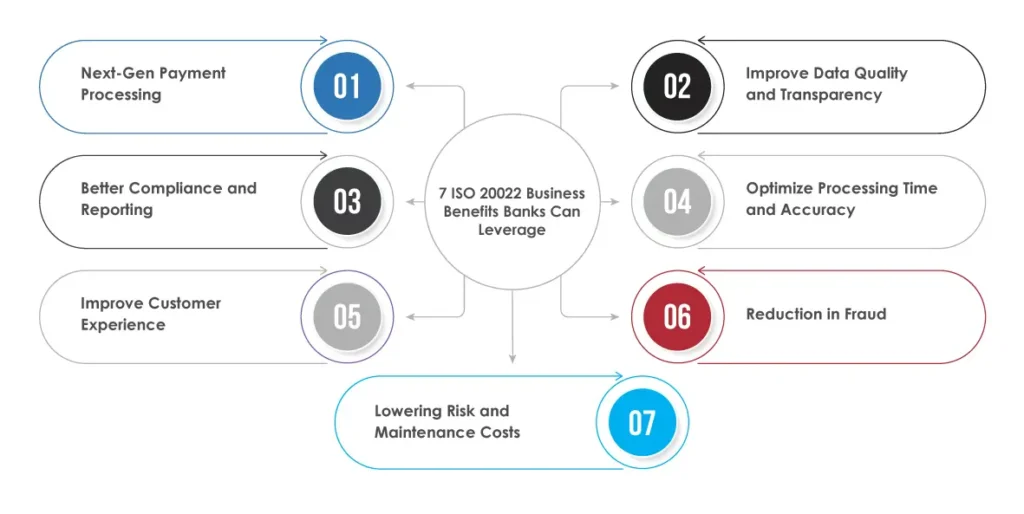

7 ISO 20022 Business Benefits Banks Can Leverage

Despite the different elements contributing to ISO 20022 transformation, it offers many business benefits. The quicker banks and payment companies implement this standard, the faster they realize its benefits. Let’s take a quick look at some of the key benefits that financial institutes can achieve by implementing ISO 20022 standards across the payment infrastructure:

Next-Gen Payment Processing

The ISO 20022 standard opens new opportunities for banks to offer services such as digital asset management, smart contract-enabled transactions, and cross-border payments. It would allow banks and payment companies to leverage cutting-edge technologies like cryptocurrencies and blockchain. The detailed messaging format and standardization perfectly align with blockchain-based systems’ traceability and transparency requirements. ISO 20022 is compatible with decentralized finance (DeFi) platforms, allowing banks to bridge the gap between conventional and emerging financial systems.

Improve Data Quality and Transparency

The new ISO 20022 standard supports a rich and structured MX data format, allowing banks and payment processing companies to enhance transaction quality and clarity. The improved data quality will ensure a better understanding of payment flows (especially for cross-border payments), accurate reporting, detailed delivery of transaction messages, and compliance with regulations. This will also promote trust among stakeholders (banks, sender, receiver, and upper management) and help streamline cross-border transactions.

Better Compliance and Reporting

ISO 20022 rich data format for messaging simplifies the compliance and reporting process by providing detailed transaction records. This will allow banks to track, analyze, and report transactions quickly and ensure they adhere to AML, KYC, and other financial standards. Strong data formatting will also support robust audit trails necessary for regulatory reviews and internal audits.

Optimize Processing Time and Accuracy

ISO 20022 possesses multiple structured fields known as “address,” which contain information in a defined format based on specific rules. It allows banks to improve and speed up data validation by looking for discrete information in a specific field. The intermediate fields will contain more information in a structured format so that banks can analyze and understand the complete lifecycle of a particular transaction (from start to end). This will promote higher accuracy in areas like Financial Crime Checks.

Improve Customer Experience

The smart routing capabilities enabled by ISO 20022 will automatically determine the most cost-effective and efficient payment channel for a particular transaction. Let’s take an example of a payment routed through XYZ instead of ABC due to predefined criteria like speed requirements, encryption, or value thresholds. This level of flexibility will help control processing costs and improve customer experience by speeding transaction time and lowering fees.

Reduction in Fraud

ISO 20022 MX message format contains five data points that, when analyzed, could be leveraged to spot fraudulent transactions. The five data points are Purpose Code, Tenure of Account, Type of Account, Age of Account Holder, and Turnover of Account. These fields are categorized under EFD (enhanced fraud data), and businesses are already exploring them at the industry level to reduce APP (Authorized Push Payment) scams.

Lowering Risk and Maintenance Costs

Most banks still work with legacy systems and formats, especially across borders. This increases the chances of risk and high cost, as maintaining those systems and internal formats requires much management and supervision. Migrating to ISO 20022 allows banks and payment companies to standardize internal formatting and lower the cost overhead and risk. It will also simplify data management and reduce the complexity and cost of maintaining multiple systems.

How will ISO 20022 Impact Banks and Payment Industry?

The ISO 20022 message format supports instant payments and modernizes payment processes. It will shift banks from end-to-end batch file processing to real-time payment processing. Also, they will gain enhanced analytics capabilities to offer new levels of payment services to the financial industry clients and customers. Compared to legacy formats, ISO 20022 facilitates processing large data volumes for bank systems and databases at a higher speed by enhancing support over OpenAPI microservices. It also covers fraud detection and prevention, real-time payments, cross-border payments, and daily liquidity management.

An integrated testing process should also ensure that all formatting and syntax are correct and that the concerned authorities accurately mapped data within all payment and clearing systems. Banks must also inform their customers and corporate clients about the new updates and how they will use them.

Why Partner with TestingXperts (Tx) for ISO 20022 Adoption?

ISO 20022 is an upgrade in the compliance initiative for banks to upscale transaction processing and innovate payment infrastructure. It offers a more secure, transparent, and efficient way of processing payments and other financial transactions. However, transitioning to ISO 20022 is a complex process that requires a robust QA process. At Tx, we implement a holistic approach to the testing process that can help you securely migrate your current payment mechanism to ISO 20022 standard. Our QA experts have years of experience in functional and performance testing, allowing you to optimize your system’s functionality according to new payment standards.

We have our AI-powered in-house accelerators, such as Tx-SmarTest, next-gen Tx-Automate, Tx-PEARS, Tx-Secure, etc., which are seamlessly integrated with other testing tools and offer expertise to identify and mitigate vulnerabilities during the QA process. Our QA process also involves testing data validation to ensure the credibility of all data formats. Our deep expertise in QA advisory gives you insights into the best approach to ISO 20022 transformation and the necessary strategy to enhance the QA process.

Summary

The ISO 20022 migration transforms global payment systems with a rich data messaging format. It will help financial institutes enhance interoperability, efficiency, and transparency in cross-border payments. They can achieve better compliance, fraud detection, and fast payment processing and bridge the gap between decentralized and traditional finance systems. However, the transition is a complex process requiring a robust QA strategy to ensure seamless implementation. Partnering with expert QA providers like TestingXperts (Tx) will give you access to AI-powered tools and industry-leading testing methodologies, helping you fully leverage ISO 20022 standards business benefits. To know how Tx can help, contact our experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info