- What is PCI DSS Compliance?

- Why is PCI Compliance Important?

- PCI DSS Compliance Challenges in Digital Retail

- Best Practices for Maintaining PCI DSS Compliance

- Conclusion

- How can TestingXperts help with PCI DSS Compliance?

Every retail business owner must know two things about the PCI DSS environment: It’s easy to achieve this compliance but hard to maintain in the long run. This is because security is the top-most priority in the digital retail business as it handles. The reason? It involves various types of online payments, such as Visa, Mastercard, credit cards, etc.

In 2022 alone, payment fraud led to $41 billion in losses globally, which reached $48 billion by the end of 2023. To protect against such frauds, PCI compliance standards were introduced to help businesses build a better strategy that safeguards brand reputation, customers, and revenue.

A thorough understanding of PCI DSS compliance is important in digital retail. In 2023 alone, 60% of data breaches happened due to weak or stolen credentials, highlighting the necessity for robust security protocols. As digital retail continues to evolve with the involvement of technologies like AI and cloud, maintaining compliance will be essential for the growth of the business.

What is PCI DSS Compliance?

Payment Card Industry Data Security Standards (PCI DSS) are practices necessary to protect cardholder information and mitigate the chances of fraud. Any retailers who accept card payments must adhere to and maintain these practices. The PCI standards greatly impact how retailers can accept and process payments. PCI DSS applies to every digital retail business that handles, stores, and transmits payment or personal information for a debit or credit card.

They also have to assess their compliance on an annual basis. For example, smaller retailers with fewer transactions may assess their compliance internally. On the other hand, larger retailers with more than six million transactions per year would likely partner with a Qualified Security Assessor (QSA) to assess their compliance. Following are the 12 PCI DSS compliance requirements that every digital retailer should know about:

• Install and maintain firewall configuration to safeguard cardholder information

• Avoid using vendor-supplied defaults for system passwords and other security parameters

• Ensure the protection of cardholder-stored data

• Proper encryption methods for transmission of cardholder data across public and open networks

• Regularly use and update antivirus software

• Develop and maintain secure applications and systems

• Restrict access to cardholder data by business need to know basis

• Assign a unique ID to everyone having computer access

• Restrict physical access to cardholder data

• Track and monitor all access to network resources and cardholder data

• Regularly test security systems and processes

• Create and maintain policies to address information security for all personnel

Why is PCI Compliance Important?

Cybercriminals are always looking for new ways to obtain sensitive information. They majorly target online retailers or eCommerce businesses as they deal with large volumes of private data. PCI DSS is a set of security standards by payment card companies to ensure that all businesses that process, transmit, or store payment card data maintain a secure environment. Compliance with these standards protects retailers and their customers from payment fraud and data breaches. Following are some of the reasons why being compliance with PCI is necessary for the digital retail business:

• PCI compliance helps reduce costs associated with data breaches, such as fines, credit monitoring, and forensic investigations.

• It ensures that sensitive customer data (like card numbers) is stored and transmitted securely. Businesses can protect their customers’ details from fraudsters and hackers and prevent data breaches.

• Businesses should comply with PCI DSS, or they will incur hefty fines, lost business opportunities, and legal fees if they do not comply. The chances of data breaches and frauds also increase if businesses remain non-compliant.

PCI DSS Compliance Challenges in Digital Retail

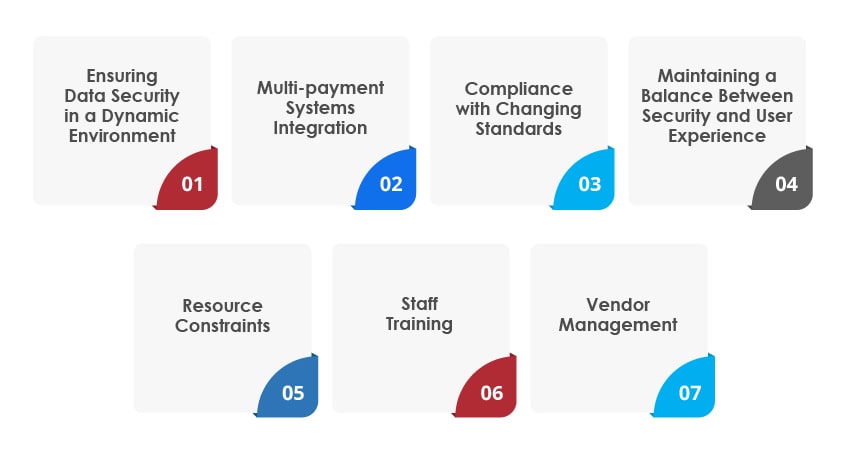

In the dynamic digital environment, retailers must prioritize the safety of customer data and adapt to changing technology and customer expectations. However, the process of complying with PCI DSS comes with certain challenges, which are listed below:

Ensuring Data Security in a Dynamic Environment

Retailers have to deal with huge amounts of transaction data distributed across multiple platforms. And ensuring the security of all the data is a common challenge in the evolving cyber threat environment. Retailers should implement robust security measures that can easily upscale as technologies and threats evolve.

Multi-payment Systems Integration

Digital retail is about integrating multiple payment systems with multiple gateways. Ensuring each system’s compliance with PCI DSS is complex and time-consuming. It becomes more problematic when one must ensure that third-party providers are also compliant.

Compliance with Changing Standards

PCI DSS standards are regularly updated to respond to new security challenges. Retailers must stay informed about the new updates and modify their processes accordingly. It becomes resource-intensive and also requires regular attention and investment.

Maintaining a Balance Between Security and User Experience

Retailers need to ensure a balance between a seamless user experience and stringent security measures. Complex security procedures deter the user experience, and insufficient protocols can cause data breaches and other security issues. It is a critical process that becomes a challenge when technology is involved.

Resource Constraints

For small and medium retailers, resource constraints pose a significant challenge in ensuring PCI DSS compliance. The process requires financial resources and skilled personnel to integrate and maintain security measures. Retailers can counter this challenge by strategically allocating resources and partnering with compliant service providers.

Staff Training

Human error is the most common factor in data breaches. Educating and training staff about the latest security compliance requirements and protocols is crucial, but it becomes challenging. Businesses with high staff turnover or limited resources might face challenges during the staff training process.

Vendor Management

Retailers need to partner with third-party vendors for multiple services, which introduces complexities in maintaining PCI DSS compliance. Ensuring that every vendor fulfills the security standards is a challenging task. Retailers can address this challenge by implementing vendor management practices, conducting assessments of security controls, and integrating cybersecurity best practices.

Best Practices for Maintaining PCI DSS Compliance

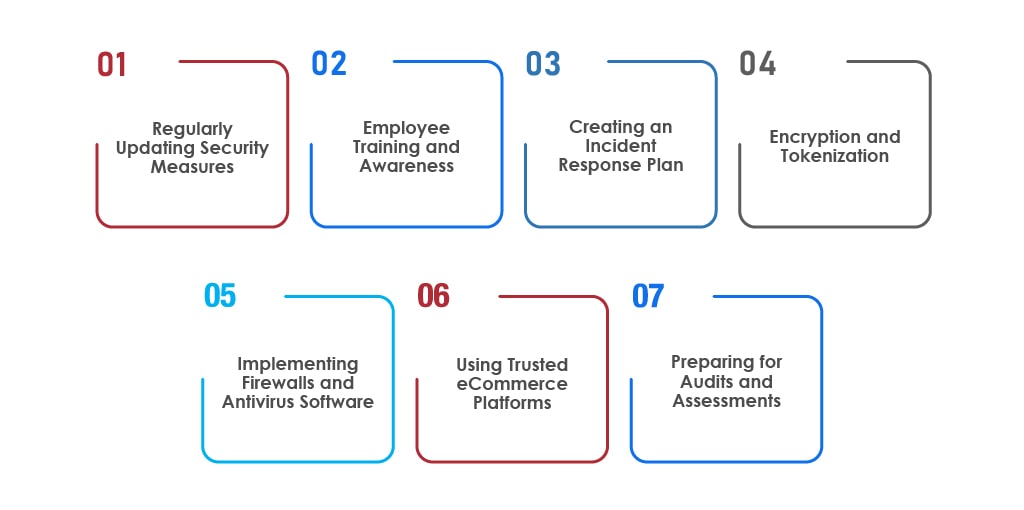

Whatever the challenges that retail businesses encounter during digital transformation, the path to maintaining PCI DSS compliance will depend on the following key practices:

Regularly Updating Security Measures

The cybersecurity threat risk is unavoidable in a digital retail business and is evolving daily. Retailers should regularly update their security by installing new software patches and system upgrades to counter this situation. It will help in defending against cyberattacks and vulnerabilities.

Employee Training and Awareness

Employees are key to maintaining PCI DSS compliance. Conducting regular training and awareness programs on data security and compliance procedures can decrease data breach risks caused by manual errors. It is necessary to keep staff updated regarding the latest security practices.

Creating an Incident Response Plan

Retailers should have an effective incident response plan to counter data breaches quickly and efficiently. The plan must outline the steps against any security incident, such as identifying the type of breach, determining how to contain it, and sending notification to relevant stakeholders.

Encryption and Tokenization

Encrypt sensitive data and use tokenization to ensure that even if data is intercepted, it remains useless to the hacker. Encryption will convert data into a code format, while tokenization will replace sensitive data with unique symbols. It would keep sensitive information out of reach of attackers.

Implementing Firewalls and Antivirus Software

Firewalls act like a barrier between the internal and external (unsecured) networks. Antivirus software protects the systems from malware, bugs, and other cyber threats. Both are crucial components when designing a comprehensive security strategy.

Using Trusted eCommerce Platforms

Opt for eCommerce platforms with robust security features that fulfill PCI DSS compliance requirements. It will lessen the burden of maintaining compliance to a certain level. These platforms come with built-in security measures and updates.

Preparing for Audits and Assessments

Conduct regular internal and external audits to continually ensure PCI DSS compliances are met. Partnering with professional auditors could help maintain documentation and have a concise view of all compliance-related controls and processes.

Conclusion

Maintaining PCI DSS compliance is a dynamic and ongoing process in digital retail. It ensures the security of customer data and business integrity. Deploying effective strategies like regular security updates, comprehensive employee training, and incident response planning could help adapt to the evolving environment of PCI compliance. As the digital retail domain evolves, adjusting to the security trends and continuous improvement in PCI DSS practices is fundamental for retailers’ reputation, sustainable growth, and customer trust. Partnering with professionals such as TestingXperts can help ensure compliance with PCI standards.

How can TestingXperts help with PCI DSS Compliance?

TestingXperts offers customized compliance testing services to protect your digital retail business against evolving cyber threats and regulatory standards. We combine our experience with innovation and expertise to deliver comprehensive results for your digital retail initiative. Here’s what sets us apart:

• Our experts have deep knowledge of PCI DSS standards and understand the complexities of implementing it. We tailor our strategies to align with your business needs.

• From vulnerability scanning and pen testing to data testing, we offer a wide range of testing services to ensure no vulnerability goes unnoticed.

• We leverage the latest tools and our in-house accelerators to upscale auditing and testing processes and provide timely results.

• Our continuous monitoring ensures your eCommerce platform remains compliant and secure against cyber threats.

• Detailed reporting provides actionable insights to help you understand the problems and what countermeasures could be taken.

To know more, contact our QA experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info