Table of Contents

- Generative AI in Banking Systems

- Top Use Cases of Generative AI in Banking Systems

- Challenges and Ethical Considerations

- Integration Strategies for AI in Banking

- Conclusion

- Why Partner with TestingXperts for Gen-AI Testing?

Implementing generative AI in banking systems is necessary in today’s digital business environment and the rapidly evolving financial industry. According to McKinsey Global Institute, gen-AI adds $2.6 trillion to $4.4 trillion annually across various use cases. The banking sector had the largest opportunities, i.e., $200 billion to $340 billion, due to increased productivity. Deloitte’s predictive analysis states that integrating gen-AI applications can boost the productivity of investment banking. By 2026, the top global investment banks can witness front-office productivity by 27% to 35%.

The influence of Gen-AI technology can be seen in various banking aspects such as risk management, trading, investment research, user engagement, etc. This technology is being adopted for its potential to upgrade the banking processes.

Generative AI in Banking Systems

Integrating gen-AI in banking systems offers various benefits, such as improvement in customer service, enhancing operational efficiency, and upscaling financial performance. Although banks are in the early stages of gen-AI adoption, some leading institutes are still exploring its potential. The current focus is on low-risk, internally used applications that can offer productivity benefits. Also, various tech companies are investing in research and development to refine AI models and features. This rapid development is the reason for the adoption of generative AI technology in the banking industry.

Another factor influencing Gen-AI adoption is the rising demand for a seamless 24/7 customer engagement experience. According to a survey, various users who interacted with AI in recent months have expressed their trust in it. Also, as specific regulatory compliance has been created for AI, it is helping to establish a framework for ethical and safe usage of this technology.

Impact of Gen-AI Technology on Banking Operations

• With Gen-AI, Virtual agents can give unique and human-like replies for user queries. This allows for smooth and dynamic chats.

• Gen-AI can look at tons of data and give perfect and custom replies.

• Chatbots with Gen-AI offer various benefits: less wait times, better responses, and unique chats.

•It helps automate regulatory analyses and provide real-time alerts, thus improving the accuracy and efficiency of compliance processes.

• Generative AI models forecast and anticipate cybersecurity threats by analyzing past data and threats, allowing for proactive risk reduction.

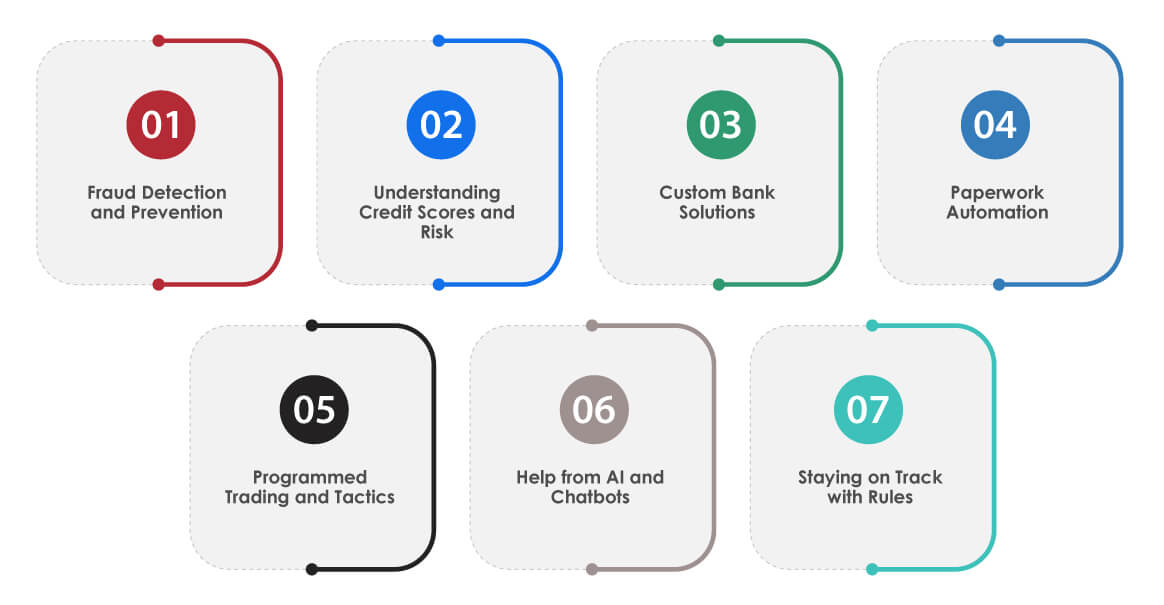

Top Use Cases of Generative AI in Banking Systems

Gen-AI doesn’t just automate tasks as RPA does. It looks at past data, finds trends, and adapts to fast-changing situations. With AI-run chatbots for client services, tailored banking, underwriting, lead generation, and improved fraud spotting, banks are moving towards digitization because of generative AI technology. Here’s how Generative-AI is used in banking:

Fraud Detection and Prevention:

With generative AI’s power to read tons of data instantly, banks have a new ally in spotting fraud. First, the AI learns from old transactions. Next, it spots unusual patterns that might show fraud, often missed by traditional methods. This includes finding new kinds of fraud as they occur. It can check each transaction for signs of stolen identity, transaction scams, or washing money by comparing them to normal patterns. Plus, these AI models keep learning and getting better. They can sort through data in real time, spotting and responding to cyber fraud quickly. So, the bank’s losses are cut down.

Understanding Credit Scores and Risk:

Generative AI improves credit scores by considering more than usual factors. It even examines non-traditional data, such as rent payment records or utility bills. This helps, especially when checking someone’s credit with a bit of history. AI technologies can analyze complex information, like financial market changes and economic trends, resulting in a better understanding of credit risk. This provides banks with the knowledge needed to make lending calls. It also gives them the opportunity to provide credit to often overlooked individuals, encouraging everyone to have access to financial services.

Custom Bank Solutions:

AI plays a big part in making the banking experience personal. A deep dive into customer data – including spending habits, investment history, and communication choices helps AI personalize bank services to the individual. AI could suggest unique investment possibilities, saving plans, or even hand out financial tips based on a person’s financial behavior and targets. This personal touch boosts customer engagement and happiness, forging stronger relationships and customer loyalty.

Paperwork Automation:

AI cuts time and resources needed for bank paperwork. It streamlines the pulling out, sorting, and checking of data from a string of documents, like loan requests, IDs, and transaction logs. This not only speeds things up but also improves correctness by cutting down human mistakes. Automation of paperwork is especially beneficial during busy times and enhances the overall productivity of banking jobs.

Programmed Trading and Tactics:

AI is changing trading and investment processes. AI algorithms filter through market details, financial updates, and economy signs for trading chances and to tweak investment tactics. They crunch a mountain of data faster than humans, allowing swift action as the market moves. These AI-powered strategies keep learning from market results to refine their predictions and game plans over time.

Help from AI and Chatbots:

Banking is changing with AI and chatbots. They helps customers all day, 24/7, by answering their questions, managing accounts, and processing transactions quickly. Lots of questions? Not a problem for these AI tools! Plus, they get smarter the more they’re used. They can even help with the tough stuff, giving lots of details about banking products and services.

Staying on Track with Rules:

Compliance is a big issue for banks, with the challenging and rapidly changing rules. AI helps by automating how compliance and reporting are done. AI looks at regulations and policies to ensure banks follow the law. It watches for problems and red flags, keeping the bank safe from penalties and a bad reputation.

Challenges and Ethical Considerations

Generative AI in banking has pros and cons, including ethical issues. Incorporating this complex tech into bank systems involves handling difficulties, from privacy worries to the risk of unfair results. Careful thinking and management are needed to use AI’s advantages responsibly and ethically. Let’s discusses the main problems and ethical issues banks deal with when using Generative AI, stressing the need to match innovation with accountability.

Protecting Data and Security:

Generative AI is heavily data-dependent, which causes considerable distress over data protection and security. Banks must make their customers’ data used for training AI models safe and comply with privacy laws like the GDPR. The threat of data leaks or unauthorized access is a serious worry because it could reveal private personal and financial details. Utilizing strong data encryption and safe data handling methods is vital for maintaining customer confidence and dodging legal problems.

Prejudice and Fair Treatment:

AI models might unintentionally continue biases found in their training data, resulting in unjust or prejudiced outcomes. This is a significant worry in fields such as credit scoring or fraud detection, where biased AI choices could have major effects on people. Banks have to put in place steps to spot and lessen biases in AI models, making their AI-based decisions evenhanded and just.

Being Clear and Concise:

Sometimes, it’s hard to figure out how AI makes decisions because it’s intricate. This is tricky, especially if AI is used to make key choices, like approving loans. Banks have to work to make their AI models clearer and give reasons for their actions. This makes sure fairness and follows the law.

Following Rules and Laws:

AI changes quickly, so it’s hard for banks to ensure they’re always following the rules. As AI in banking grows, laws might change. Banks must keep up with these changes to make sure their AI is always lawful.

Using AI Responsibly:

Following laws is important, but one must also have to think about wider ethical issues. This means thinking about how AI decisions affect people and society. Banks must make AI guidelines that meet moral concerns like personal freedom, permission, and how AI might change the decision-making process.

Not Relying Too Much and Learning New Skills:

As banks use more AI, they risk relying on it too much. This could be dangerous if AI stops working or is attacked. Also, it’s hard for people to understand and manage AI. Banks must invest in employee training to ensure proper handling of AI.

Integration Strategies for AI in Banking

The right approach to bringing AI into banking is key to making the most of it and avoiding problems. Plans should aim to match AI skills with the bank’s long-term goals. They should follow the rules and build a culture of AI understanding in the bank. Here are some ways to integrate Generative AI into banking systems that set banks up for success.

Set Clear Goals:

Step one in bringing generative AI into banking is to set clear goals and line up AI aims with the bank’s business goals. Find areas where gen-AI can work, like making customer service better, making data secure, or making work smoother. Banks should make goals they can measure for their AI projects and make sure their plans match their business objectives.

Managing Data and Rules:

Managing data right is vital to successful AI implementation. Banks need good, relevant data to teach their AI models. This also means setting firm data rules to ensure data is correct, safe, and in line with privacy laws. Banks should also think about how they’ll keep data up-to-date and of high quality.

Meeting Rules and Thinking Ethically:

Banks need to make sure their AI systems follow all applicable rules, like ones about privacy, protecting consumers, and financial reports. They also need to think about the impact AI might have ethically, like possible biases in the computer programs or effects on customer privacy and trust. A guide for ethical AI usage is essential for building trust and keeping a good reputation.

Boosting and Adapting AI Usage:

Banks should adopt AI solutions that can grow and change with their business needs. This means choosing AI tools and platforms that can be smoothly integrated with their current systems and adjust to market changes and tech progress.

Focusing on Customers:

Putting customers first is the way to go when integrating AI. Banks should concentrate on how AI can better serve customers by tailoring services, responding quicker, or strengthening security. Knowing customers’ needs and wants is key to creating useful AI applications.

Conclusion

Generative AI is changing banking by offering many new possibilities. But it also comes with its challenges and tough choices about ethics. Banks must be smart when introducing gen-AI into their business processes. This means doing an excellent job of handling their data, following the rules, doing AI ethically, and making sure their services are centered on customers. Whether or not AI works well in banking doesn’t just depend on having a good grasp of tech. It matters how it’s used and adaptable to new trends and rules. It can deal with loads of data and see patterns, make processes run smoother, and make customer service top-notch. Even so, getting to the full potential of AI in banking depends on teamwork.

Why Partner with TestingXperts for Gen-AI Testing?

Partnering with the ideal partner for Generative AI testing is crucial for businesses looking to smartly and securely benefit from artificial intelligence (AI) technology. TestingXperts offers services specially designed to validate that your Gen-AI mechanisms are trustworthy, efficient, and align well with your business aims. Here are the perks of choosing TestingXperts for your Gen-AI tests:

• We have a team of AI testing specialists with over 30+ years of collective experience ensuring your Gen-AI software works as expected. Having researched deeply in testing various AI models, their expertise provides seamless testing resolutions.

• Aware that each business is unique, TestingXperts provides testing strategies exclusively made for your specific Gen-AI applications.

• Using state-of-the-art testing tools and in-house accelerators such as Tx-Reusekit, Tx-IaCT, Tx-PEARS, etc., we make sure that your Gen-AI applications are thoroughly checked for performance, accuracy, and trustworthiness. We use advanced tools to mimic real-world scenarios and stress-test AI models in diverse conditions.

• Our QA experts tests the performance of Gen-AI systems to meet high performance and scalability standards. We test for speed, how quickly they respond, and how they manage large amounts of data.

• We provide in-depth reports and evaluations of testing results, giving valuable insights into your Gen-AI systems’ performance and opportunities for them to get better.

To know more, contact our AI testing experts now.

Discover more

Get in Touch

Stay Updated

Subscribe for more info