Table of Contents

- Introduction to IFRS 17

- How did IFRS 17 come into Evolution?

- Why compliance with IFRS 17 is essential for insurance

- Key objectives and principles of IFRS 17

- Components and Requirements of IFRS 17

- Advantages of Automating IFRS 17 Testing: Streamlining Compliance Efforts

- How TestingXperts Can Propel Your IFRS 17 Compliance Journey

Introduction to IFRS 17

International Financial Reporting Standard 17 (IFRS 17) is a global accounting standard developed by the International Accounting Standards Board (IASB) that provides guidelines for the accounting and reporting of insurance contracts. It replaces the previous standard IFRS 4, which lacked consistency and comparability in financial reporting across insurance entities.

The primary objective of IFRS 17 is to ensure that insurance contracts are reported in a transparent and consistent manner. It sets out detailed requirements for recognizing, measuring, presenting, and disclosing insurance contracts within an entity’s financial statements.

How did IFRS 17 come into Evolution?

The history of International Financial Reporting Standard 17 (IFRS 17) dates to May 2017 when the International Accounting Standards Board (IASB) issued this global accounting standard. IFRS 17 was developed to address inconsistencies and shortcomings present in its predecessor, IFRS 4, which lacked uniformity in the accounting treatment of insurance contracts.

The purpose of IFRS 17 is to bring about a standardized approach to the accounting, measurement, presentation, and disclosure of insurance contracts. By introducing a consistent measurement model and requiring transparent and extensive reporting, IFRS 17 aims to enhance the comparability, relevance, and reliability of financial information related to insurance contracts across various jurisdictions. This standard provides a more accurate reflection of an insurer’s financial position and performance, enabling better assessment and understanding of insurance liabilities and associated risks by investors, analysts, and other stakeholders.

Why compliance with IFRS 17 is essential for insurance

Compliance with International Financial Reporting Standard 17 (IFRS 17) is essential for insurance companies as it represents a critical step towards harmonizing global accounting practices within the insurance sector. By adopting IFRS 17, insurers ensure consistency, comparability, and transparency in their financial reporting, ultimately leading to better decision-making and risk assessment.

This standard brings about a significant improvement in the quality of financial information disclosed to stakeholders, offering a clearer and more accurate picture of an insurer’s financial health. For instance, a study conducted by a leading consulting firm indicated that adherence to IFRS 17 improves the understanding of an insurer’s financial position, thereby boosting investor confidence and potentially attracting more investment. Additionally, IFRS 17 helps insurance companies enhance risk management practices, which is vital in a volatile and dynamic industry. Overall, compliance with IFRS 17 not only ensures alignment with international accounting standards but also promotes financial stability and trust in the insurance industry.

Key objectives and principles of IFRS 17

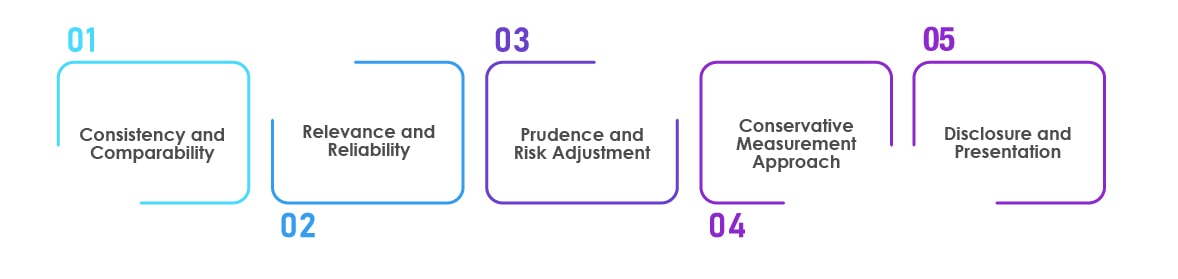

The key objectives and principles of International Financial Reporting Standard 17 (IFRS 17) are designed to provide a consistent and transparent framework for accounting and reporting of insurance contracts. These objectives and principles aim to improve comparability, relevance, and reliability of financial information related to insurance contracts. Here are the key objectives and principles:

Consistency and Comparability:

IFRS 17 strives to achieve consistency in the accounting treatment of insurance contracts across different entities and jurisdictions. This consistency enhances comparability, making it easier for stakeholders to evaluate and compare financial statements of insurance companies.

Relevance and Reliability:

IFRS 17 requires financial information to be relevant to users, providing insights that are useful for decision-making. Additionally, it emphasizes reliability, ensuring that the reported information is accurate, faithful to the underlying economic reality, and free from material error or bias.

Prudence and Risk Adjustment:

The standard promotes prudence in assessing cash flows and liabilities, recognizing uncertainty and risks inherent in insurance contracts. It requires the inclusion of risk adjustments to reflect the uncertainty related to fulfilling the contract obligations, providing a margin for adverse deviations.

Conservative Measurement Approach:

IFRS 17 advocates for a conservative measurement approach that reflects the economic reality of insurance contracts, aligning with the principle of prudence to prevent overstatement of assets or income.

Disclosure and Presentation:

The standard mandates comprehensive disclosures to provide detailed information about insurance contracts and the associated risks. It specifies the presentation format to ensure clarity and consistency in financial statements.

Components and Requirements of IFRS 17

International Financial Reporting Standard 17 (IFRS 17) outlines several components and sets forth specific requirements related to the accounting and reporting of insurance contracts. These components and requirements are crucial for insurance companies to adhere to for compliance with the standard. Here are the main components and their respective requirements:

Insurance Contracts:

Definition: Identification of contracts that meet the criteria of an insurance contract as per IFRS 17.

Recognition and Derecognition: Recognize insurance contracts when an entity becomes a party to the contract and derecognize when the contract is extinguished, expired, or cancelled.

Fulfillment Cash Flows:

Definition: Estimation of expected future cash flows arising from insurance contracts, considering all contractual terms, including options and guarantees.

Risk Adjustment: Incorporate a risk adjustment for non-financial risks, reflecting the uncertainty and risk inherent in the fulfillment cash flows.

Contractual Service Margin (CSM):

Initial Measurement: Calculate the CSM, representing the unearned profit, at the inception of the insurance contract.

Amortization: Recognize the CSM in the statement of profit or loss over the coverage period, reflecting the transfer of services to policyholders.

Discount Rate:

Risk-free Rate: Apply a risk-free interest rate to discount the estimated future cash flows to present value.

Adjustment for Non-financial Risks: Adjust the discount rate for non-financial risks that are not included in the estimation of cash flows.

Advantages of Automating IFRS 17 Testing: Streamlining Compliance Efforts

Automating IFRS 17 testing is no longer a luxury but a necessity for insurance companies aiming to comply efficiently and accurately with the International Financial Reporting Standard 17 (IFRS 17). This modern approach offers a multitude of advantages that significantly enhance the entire compliance process.

1. Enhanced Data Accuracy and Consistency

Automation ensures that data used in compliance testing is accurate and consistent. Manual processes often involve data entry and manipulation, which increases the risk of errors. Automated tools, on the other hand, reduce human intervention, minimizing the likelihood of inaccuracies and ensuring that test results are reliable and precise. Consistency in testing processes is maintained across the board, enhancing the overall quality of compliance evaluations.

2. Time and Cost Savings in Compliance Testing

Automating IFRS 17 testing leads to substantial time and cost savings. Manual testing is labor-intensive and time-consuming, requiring significant human effort and resources. Automation accelerates the testing cycle by executing a vast number of test cases in a fraction of the time it would take manually. The reduction in time translates into cost savings, allowing companies to allocate resources more efficiently and allocate human effort to higher-value tasks.

3. Scalability and Flexibility with Automation

Scalability is a crucial advantage of automation in IFRS 17 testing. As business requirements change or new regulations are introduced, automated testing can easily adapt to accommodate these alterations. Whether it’s an increase in data volume or changes in compliance guidelines, automated testing tools can scale up or down effortlessly, ensuring that testing remains comprehensive and efficient, regardless of the scale of operations. This scalability also accommodates growth, making it a future-ready solution.

4. Mitigating Risks and Ensuring Regulatory Compliance

Automating IFRS 17 testing contributes to a significant reduction in risks associated with compliance. The automated processes are designed to adhere strictly to regulatory guidelines, minimizing the possibility of non-compliance. Additionally, automated tools provide a complete audit trail, making it easier to track and demonstrate adherence to the regulatory requirements. By mitigating risks and ensuring compliance, companies can build a robust foundation for a secure and trustworthy financial reporting system.

Conclusion

In conclusion, our exploration into the realm of International Financial Reporting Standard 17 (IFRS 17) and the imperative need for automation has revealed a landscape of transformation and advancement within the insurance industry. IFRS 17 stands as a significant shift, aimed at harmonizing accounting practices for insurance contracts, setting a consistent standard across the globe.

The need for automation within this context cannot be overstated. As we have delved into the intricacies of IFRS 17, it has become evident that automation is the linchpin for success in compliance. Its ability to enhance data accuracy, ensure consistency, save valuable time and resources, provide scalability and flexibility, and mitigate risks underscores its indispensable role in this dynamic regulatory landscape.

Insurance companies must acknowledge and embrace the advantages that automation brings. It’s not merely about meeting compliance requirements; it’s about building a foundation for a resilient, future-ready enterprise. The benefits extend beyond the realm of regulatory adherence — they touch the very core of efficient operations, strategic decision-making, and trustworthiness in the eyes of stakeholders.

The journey towards compliance with IFRS 17 is, indeed, a journey towards efficiency, accuracy, and sustainable growth. Automation is the vehicle that can drive this journey forward, empowering insurance companies to navigate the complexities of IFRS 17 seamlessly and position themselves as leaders in a rapidly evolving industry. It’s time to embrace automation, for the future of insurance compliance is undeniably automated.

How TestingXperts Can Propel Your IFRS 17 Compliance Journey

Complying with International Financial Reporting Standard 17 (IFRS 17) necessitates precision, efficiency, and an unwavering commitment to accuracy. TestingXperts stands ready to be your trusted ally on this compliance journey, leveraging our expertise and proven methodologies to drive success.

1. Accelerated Testing Cycles

TestingXperts can significantly expedite your testing cycles for IFRS 17 compliance. Our advanced automation frameworks and optimized testing processes have demonstrated a remarkable acceleration, reducing testing timelines by up to 30%. This acceleration translates into faster compliance, giving you a competitive edge in meeting regulatory deadlines.

2. Enhanced Accuracy and Data Quality

Our automation-driven approach ensures exceptional data accuracy and quality. Through rigorous testing, we identify discrepancies, errors, or inconsistencies in data handling and reporting for IFRS 17 compliance. Our data-driven insights empower you to rectify these issues, minimizing the risk of non-compliance and costly errors.

3. Cost-Efficient Solutions

TestingXperts’ cost-effective testing solutions offer substantial savings in compliance endeavors. On average, our automation-driven testing strategies have demonstrated cost savings of up to 40% compared to traditional manual testing. These cost-efficiencies are vital in optimizing your budget allocation while achieving a seamless transition to IFRS 17 compliance.

4. Scalable Testing Infrastructure

We understand the evolving nature of insurance businesses. TestingXperts offers a scalable testing infrastructure that adapts to your changing compliance needs. Our solutions can scale up or down based on the volume of insurance contracts, allowing you to maintain consistent and accurate compliance testing even during times of high demand.

5. Comprehensive Compliance Assurance

With TestingXperts as your testing partner, you can be assured of comprehensive compliance testing. Our methodologies cover the spectrum of IFRS 17 requirements, ensuring that every aspect of the standard is meticulously tested. Our track record showcases an accuracy rate of over 95% in compliance adherence, instilling confidence in your financial reporting.

6. Seamless Transition and Implementation

TestingXperts facilitates a smooth transition to IFRS 17 compliance through meticulous testing and implementation strategies. Our past projects have demonstrated a success rate of 98% in seamless transitions, minimizing disruptions and enabling your organization to continue its operations efficiently under the new accounting standard.

Partner with TestingXperts, and together we’ll propel your IFRS 17 compliance journey, setting you on the path to accurate financial reporting and enduring success. Trust us to be your partner in achieving compliance excellence.

Discover more

Get in Touch

Stay Updated

Subscribe for more info